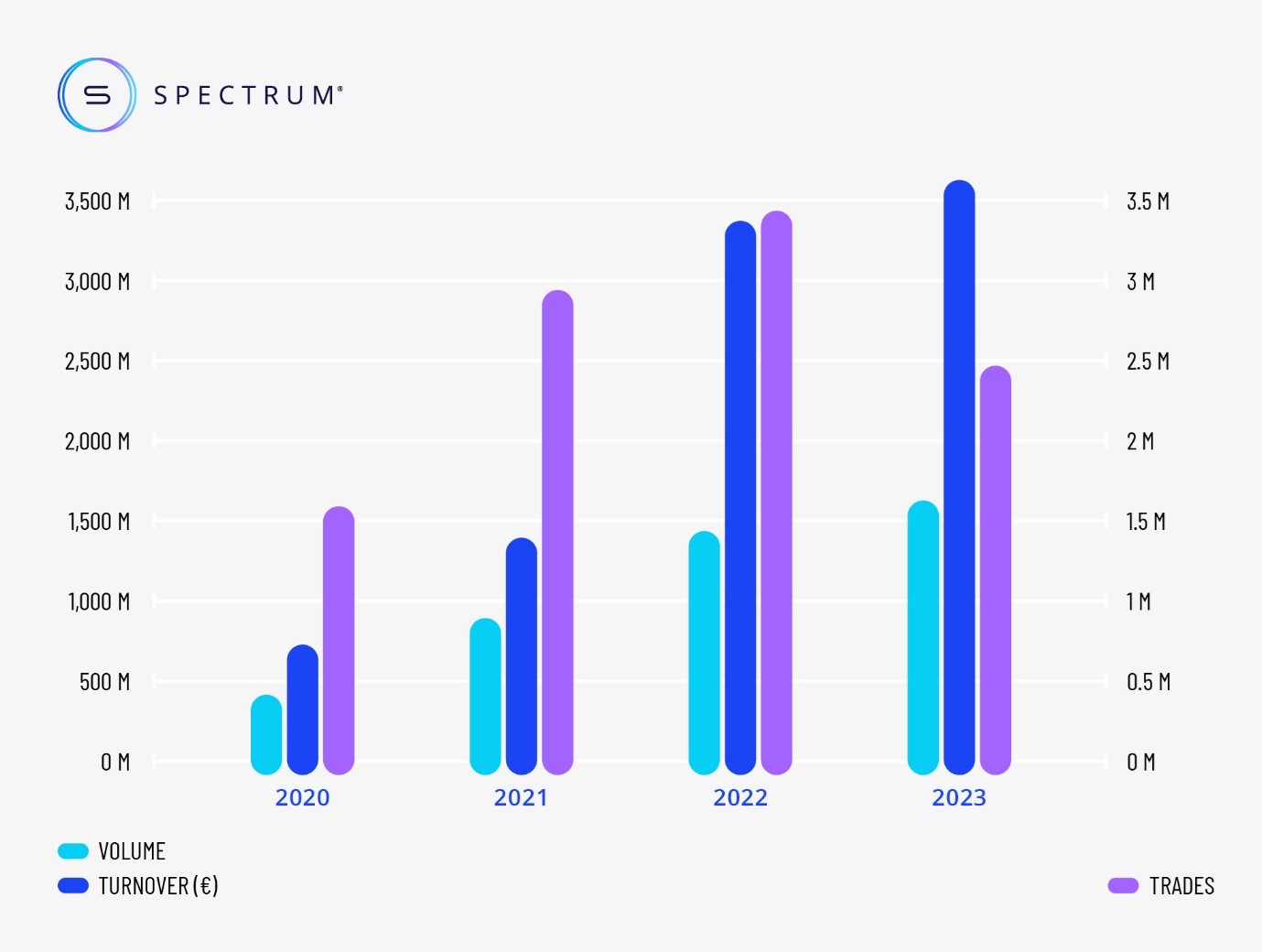

Despite difficult market conditions, the pan-European trading venue for securities, Spectrum Markets, has achieved a new volume record in 2023. According to the company’s latest report, the total order book turnover rose 9% to €3.62 billion last year.

Spectrum Markets Sees Continued Growth in 2023

In 2023, the trading volume increased 14%, reaching 1.62 billion securities, up from 1.42 billion in the previous year. The total volume was carried out through almost 2.5 million trades, of which 33.9% occurred outside of standard trading hours, specifically between 17:30 and 9:00 CET. It confirms the data from the previous report, that one in three trades occurs after hours.

"2023 posed many challenges for the trading and investment space, with declining volumes seen across the industry, so I’m really pleased that Spectrum’s performance remained relatively robust," said Nicky Maan, the CEO of Spectrum Markets.

The company added several new partnerships in 2023, including with Italian retail broker Directa, Intercontinental Exchange's ICE Data Services Italy and the Italian Association of Certificates and Investment Products. The company started 2024 with yet another partnership, becoming the first to join the Frankfurt-based Federal Association of Investment Firms this year.

These deals expand the range of products available to investors on the Spectrum venue and make trading easier through a single pan-European identifier.

Index Products Hold the Crown

The most traded underlying assets on Spectrum in 2023 were the DAX 40 (29.4%), NASDAQ 100 (20.2%), and S&P 500 (18.9%). 84.3% of volume was on index products, with smaller portions in currencies, commodities, equities , and cryptocurrencies.

"Looking ahead to 2024, our focus remains on enhancing and expanding our venue by improving connectivity options and trading infrastructure, as well as welcoming more members," Maan said.

Spectrum Markets, founded in 2017, aims to provide transparency and open access for trading securities beyond regular European trading hours. The company is headquartered in Frankfurt with locations across Europe.