Foreign exchange trading volumes across Refinitiv Matching and FXall platforms dropped in October 2020 by more than three percent from the previous month, the company said on Monday. This weak monthly turnover was in line with metrics of industry peers as corona-led Volatility that sparked record trading has been losing steam.

Other volumes, which include swaps and options, at Refinitiv, partly owned by Thomson Reuters, held up much better than spot FX volumes.

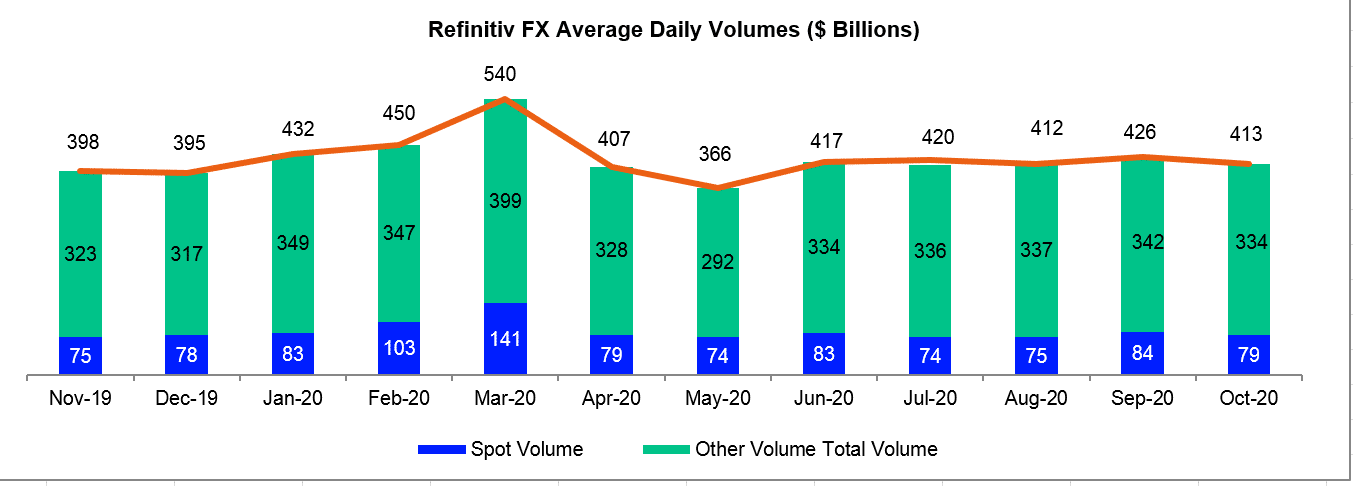

Turnover in all products including cash, forwards, swaps, options and non-deliverable forwards were reported at $413 billion in October 2020. This figure was down from $426 billion in September 2020, and also reflects a four percent drop from $432 billion in October 2019.

The former Financial and Risk business of Thomson Reuters reported in September its best metrics since March, when turnover hit an average daily $540 billion, the highest in its volumes data going back to February 2013.

Of the October’s $413 billion figure, $79 billion was FX spot, representing a -6 percent fall over the monthly interval when compared to $84 billion in September 2020. Over a yearly basis, the spot turnover also failed to outpace its counterpart in October 2019, which came at $81 billion.

Refinitiv Automates Access to FX swaps

Declining activity in other transaction types, including forwards, swaps, options and non-deliverable forwards (NDFs), was also a major force behind the fall, having clocked their worst month since May 2020. The figure averaged $334 billion daily, -2.5 percent lower from $342 billion the previous month.

Refinitiv’s figures reflect the trend observed in the monthly figures from many of the major trading platforms which have seen record-breaking volumes in the first quarter before turning to suffer lacklustre activity. However, given its position as a major trading hub for the wholesale market, the financial data vendor provides one of the most comprehensive snapshots of activity.

Refinitiv has recently enabled automated access to its Forwards Matching MTF venue as the market demand moves to trade more volume in FX Swaps electronically.

The new product enables traders to Leverage a GUI or API connection that replaces the manual processes that exist in the FX Swaps world today, all embedded into a MiFID II compliant offering.