Foreign exchange trading volumes across Refinitiv Matching and FXall platforms decreased slightly in December 2020 from the previous month, the company said on Friday.

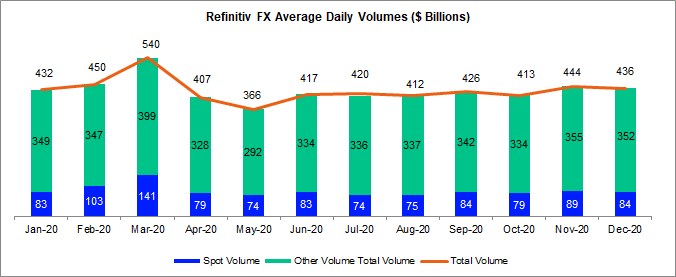

Turnover in all products including cash, forwards, Swaps , options and non-deliverable forwards were reported at $436 billion in December 2020. This figure was down 1.8 percent from $444 billion in November 2020 but reflects a 10 percent increase from $395 billion in December 2019.

The former Financial and Risk business of Thomson Reuters in November reported its best metrics since March when turnover hit an average daily $540 billion, the highest in its volumes data going back to February 2013.

Of the December’s $436 billion figure, $84 billion was FX spot, representing a -6 percent fall over the monthly interval when compared to $89 billion in November 2020. Over a yearly basis, the spot turnover outpaced its counterpart in December 2019, which came at $79 billion.

London Stock Exchange to Close Refinitiv Acquisition

Activity in other transaction types, including forwards, swaps, options and non-deliverable forwards (NDFs), averaged $352 billion daily, which is -0.8 percent lower from $355 billion the previous month.

Refinitiv’s figures reflect the trend observed in the monthly figures from many of the major trading platforms which have seen record-breaking volumes in the first half before turning to suffer lackluster activity. However, given its position as a major trading hub for the wholesale market, the financial data vendor provides one of the most comprehensive snapshots of activity.

The London Stock Exchange said earlier this week it expects to close its proposed $27 billion acquisition of Refinitiv on 29 January 2021. The news comes after the European Commission, which oversees competition policy in the 27-nation bloc, approved the all-stock deal back in December.

Under the terms of the deal, the Blackstone-led Refinitiv will own 37 percent of the combined group while its former owner, Thomson Reuters, will be holding a 15 percent stake. It would become the biggest shareholder in the London exchange, with the right to name three directors.