As regulators aim to foster greater market integrity and protect investors, by continually adjusting rules and law-based guidelines from time to time, the latest such changes come from the Central Bank of Cyprus (CBC) which announced a series of revisions aimed to enhance transparency and improve AML compliance from among the financial institutions that it oversees.

Cypriot credit institutions affected by the new rule revisions - which just went into effect as of April 7th 2016 - have a limited amount of time before they must comply with the changes or face ceasing all business transactions with any relevant clients. There are at least 18 cooperative institutions, and 7 leading banks, and nearly 30 foreign authorized institutions, according to data on the CBC website for credit institutions.

Potential game changer

In a memo addressed to all AML officers and credit institutions was a list of new clauses that introduce enhanced requirements for certain financial institutions, such as the need to meet clients in person, and conduct face-to-face meetings, with regard to meeting Know Your Customer (KYC) ) requirements, satisfying related AML and preventing of terrorist financing.

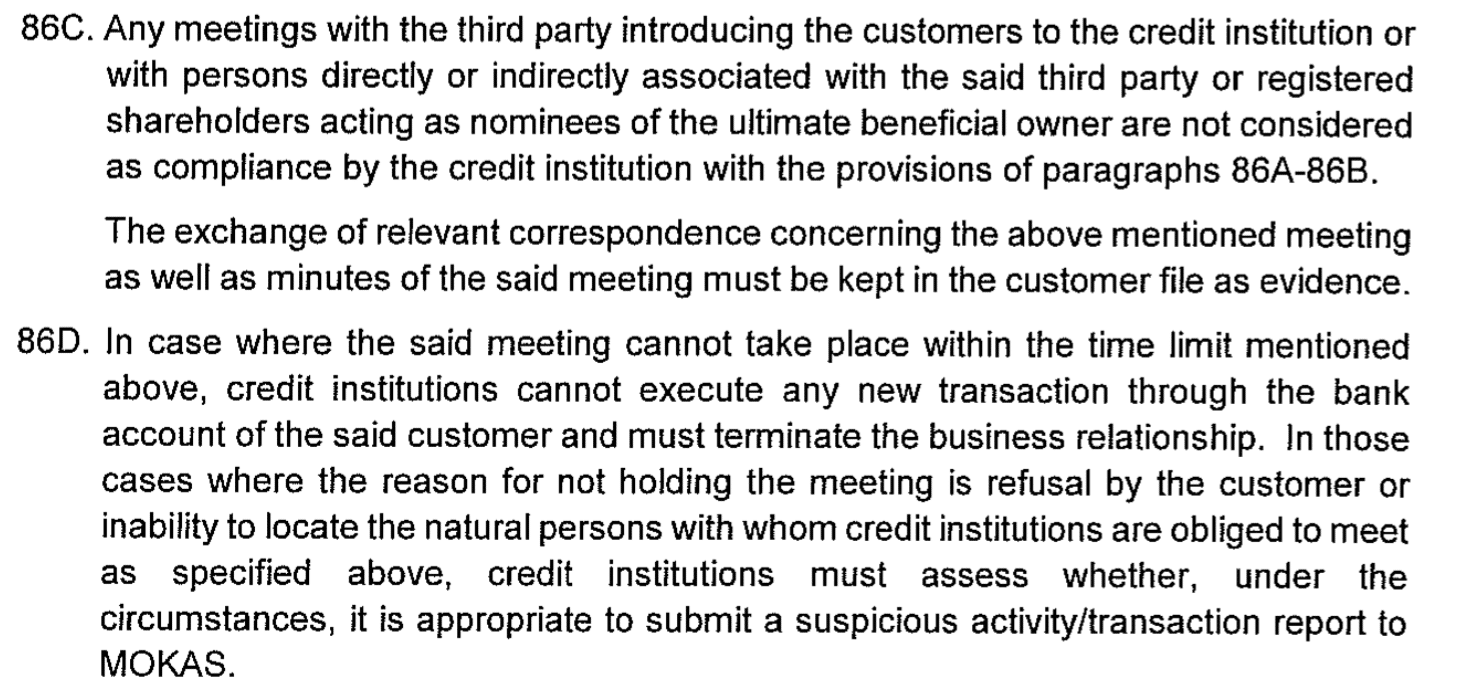

A key part of this news is that the ultimate beneficiary owners of companies that hold accounts at financial institutions in Cyprus will have to come forward in order to comply, as explained below and in the CBC update. This is important because of the way the nominee structure follows for the way Cypriot companies are formed, which may involve 'holding companies' or appointed representatives whilst the real owners remain largely unknown on the surface. An excerpt of the revised provisions shows two of the new several clauses that were introduced by the CBC.

Source: Central Bank of Cyprus (CBC)

Administrative scramble

This update will surely create administrative challenges, and the need for the right technology to be used in addition to a firm’s own changes to its policies, controls, and internal and external documents such as customer agreements and related disclosures.

Nearly all online financial institutions rely on the use of 3rd party systems for verifying clients data, such as Complinet and other solutions that help verify identity and check clients names against lists of known suspicious persons and against blacklisted individuals during the account opening process (i.e. for banks or brokerages where AML is needed for processing deposits/withdrawals).

These approaches may no longer cover all the related KYC and AML compliance checks, although they are still likely to be used for their inherent value, as face to face meetings will be required for certain scenarios that cannot be solved with technology, for the credit institutions in Cyprus. However, one of the clauses noted that online video meetings could be acceptable for the meetings. An excerpt from the CBC memo can be seen below which introduces the required face-to-face meeting related clause under section 86A.

The push towards transparency

This was the fourth time that the CBC amended the AML provisions since the first amendment in its 2013 Directive, and it was in line with its March 2013 agenda outlined with the international monetary fund (IMF), European Central Bank (ECB) and European Commission (EC).

Many Cypriot Investment Firms (CIFs) involved in both Forex or binary options related business may hold funds at some of the affected credit institutions in Cyprus that must comply with the new provisions within the allotted time or face losing their banking relationships with any relevant institutions unless all new compliance checks are met.

A statement from CBC noted: "Today's amendment is part of a continuous effort to further boost the regulatory framework, always with the aim of zero tolerance to deficiencies or weaknesses which could possibly lead to opportunities of money laundering, or terrorist financing,” according to a Reuters article.

The development follows after news earlier this week broke on the leaked Panama Papers that caught global attention as a vast number of international entities could be connected to alleged tax evasion and money laundering.

The news follows on the heels of a senior politician probing CySEC over its handling of its IronFX investigation, as reported by Finance Magnates around the time of when the CBC made its announcement of these new rules that are aimed at bringing greater transparency to Cyprus’ financial and banking system.