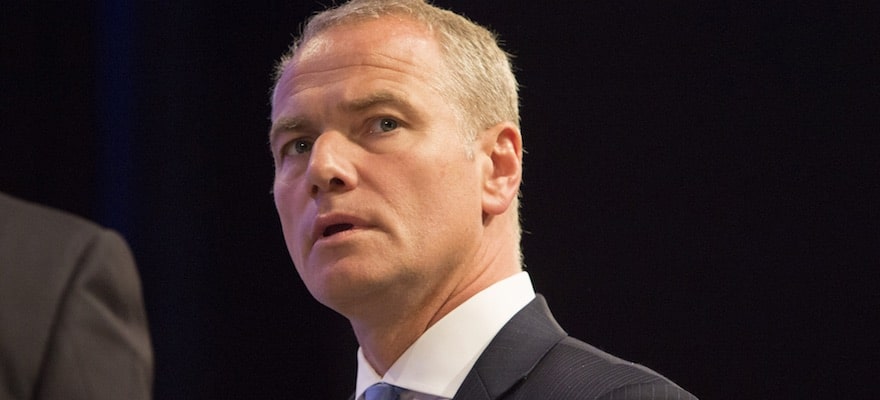

A resolution for Deutsche Börse’s CEO Carsten Kengeter initially appeared to be in sight, but the executive has not been cleared of wrongdoing for his role in questionable share trading. The allegations stem back to a 2015 purchase over $4.85 million of Deutsche Börse shares at the onset of merger talks with the London Stock Exchange (LSE).

The London Summit 2017 is coming, get involved!

An investigation was originally launched back in February 2017 by German prosecutors after Mr. Kengeter was suspected of insider trading of the company’s stock. As he has done all along, Mr. Kengeter firmly shot down any such allegations, reiterating that any insider charges against him would prove totally unfounded and that he had no role or timing in dictating the timing of his share purchases with the announced merger plans with the LSE.

In accordance with his prior stance, the group did reach a deal with a Frankfurt-based prosecutor. More pertinent to Mr. Kengeter was that he would be cleared of any wrongdoing with Deutsche Börse being hit with a $12.1 million (€10.5 million fine). Despite this apparent end however, the investigation is still open and that proceedings were ongoing, according to a Reuters report.

Shadow of doubt?

While prosecutors have reached a deal with Deutsche Börse, it may now be BaFin’s turn to delve into Mr. Kengeter’s share trading. The German market watchdog will now be investigating whether past statements from Deutsche Börse misled the public. The announcement is interesting given that German regulators evidently felt that there were grounds to further probe Mr. Kengeter despite a parallel investigation having just cleared him.

Evidence of misleading statements or any further setbacks facing Deutsche Börse are likely to elicit even stronger fines. Speaking earlier this February, Mr. Kengeter stated: "When I purchased the shares using my own funds, I did not do so at a time of my own choosing. I did so between 1 and 21 December 2015 within a time-frame fixed by the Supervisory board.”

The doomed merger was previously stonewalled by European authorities earlier this year after the European Commission has formally prohibited the deal on the grounds that it would create a monopoly. The Deutsche Börse-LSE merger was feared to have created too strong an entity across the fixed income clearing space, which echoed a tone pursued by other exchanges in the bloc for months.