After a run of winning streaks in court, investors, former employees and partners alleging wrongdoing at Ebullio hedge fund are pushing to bring a history of questionable business practices to the attention of authorities.

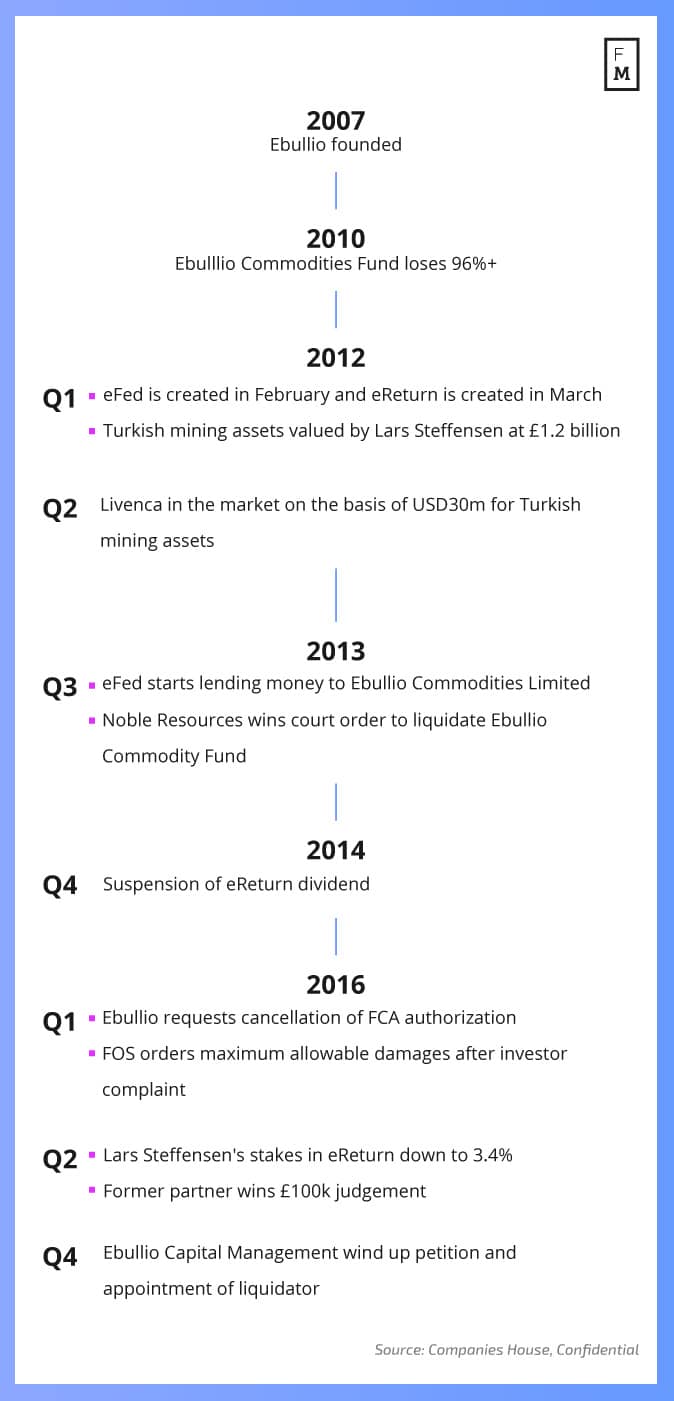

Almost since Ebullio’s founding in the UK some 10 years ago, there were warning flags. In early 2010, the fund suffered a catastrophic loss that ultimately led to a winding up petition in 2013 by raw materials trader Noble Group for the Ebullio Commodity Master Fund (eBull).

Then, some investors who had been promised a 30-day redemption period for the 4-year special purpose vehicle set up in 2012, Ebullio Return (eReturn), didn’t get their money. Employees leaving the company with a severance package saw Payments dry up, or were not paid at all.

And then there were eReturn’s promises of “guaranteed annualized return of 10% per annum on whole investment…backed by assets”. These returns to be paid quarterly were guaranteed “irrespective of performance or Liquidity ”, with full pay outs to be made on 1st October, 2016.

Such claims are considered Ponzi scheme red flags by regulators, who warn investors to “be suspect of an investment that continues to generate regular, positive returns regardless of overall market conditions”.

It is unclear which investors have been paid some, all, or none of eReturn payments, but one source close to the situation confirms that distributions have been uneven, another warning flag for regulators.

Meanwhile, another vehicle set up in the wake of eBull’s collapse, eFed, was billed as highly liquid, using exchange-traded futures and options, and showed promising returns: 33% in 2013, 14% in 2014, and 12% in 2015.

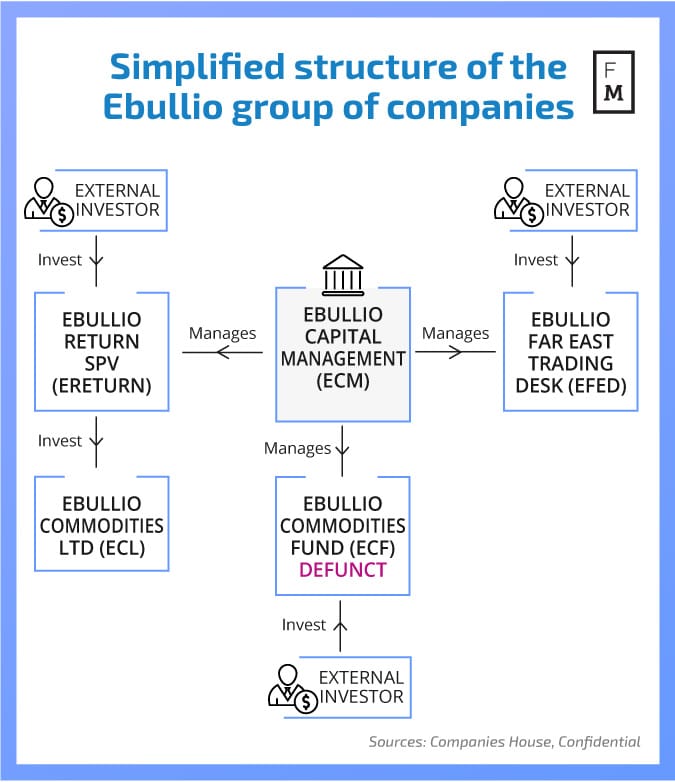

But sources with knowledge of eFed said that 2013 is when things changed, as eFed entered into a loan agreement with Ebullio Commodities Limited (ECL), another entity in Ebullio’s group of companies. Today, the loan to ECL, which was undisclosed to investors, say sources, is the only asset in eFed, a situation that continued even while investor letters from Lars Steffensen stated that eFed was trading commodities futures.

Why the UK regulators – the Financial Conduct Authority (FCA) and Serious Fraud Office (SFO) ⎼ have not stepped in with a heavier hand is one of the big unanswered questions for the people coming forward and reporting wrongdoing. At least five sources claim to have made reports to the FCA over the years starting in 2009, out of which some have repeatedly requested updates on what, if any, actions will be taken. There is at least one report to the SFO.

Some believe the authorities won’t bother with a scheme in which an estimated $20 million to $25 million could have disappeared (one source states it could be considerably more) relying instead on a fund backed by the regulator to compensate investors to the tune of £50,000 – the Financial Services Compensation Scheme (FSCS).

Others believe that it hasn’t yet been impressed upon authorities that the accusations are not about high risk investments gone sour, but fraud, and that FCA personnel tasked with scrutinizing the hedge fund are in over their heads because of the convoluted nature of interlinked companies controlled by Lars Steffensen and his close associates.

At this stage, this is not just about money, this is about righting a wrong done to all the investors and stakeholders as well as preserving the integrity of the asset management industry.

One fund of funds manager from the investment arm of a large institution said that while performing due diligence in 2009, they decided to step aside because the risk was too high, and have since continued to keep tabs on Ebullio: “We’ve dodged a lot of bullets, but this is one of the more outright examples of deception”, he said.

Based on the FoF managers’ understanding at the time, Steffensen was marketing an active strategy, while implementing a different strategy recklessly. “From the outset it was a deception…I don’t expect the FCA to sue Cayman funds on behalf of offshore clients, but they could have withdrawn his authorization easily”.

Successful hedge fund manager?

From L to R: Lars Steffensen, Joseph Crawley, Samantha Cameron, David Cameron Source: Svejo.net

On the surface, Lars Steffensen appears to be an experienced hedge fund manager with connections in the right circles, albeit with a colourful personality: he comes from a Danish shipping background and his sister, Anne Steffensen, is the former Danish Ambassador to the UK and currently the CEO and Director General of the Danish Shipowners’ Association; he has three decades of commodities industry experience; he has won awards, including one from CME Group and BarclayHedge for “2014 Best Emerging CTA”; and he likes to be seen attending functions with high profile personalities, such as the former UK Prime Minister, David Cameron.

For all intents and purposes, Steffensen was running a successful FCA-registered hedge fund and was even taking a lead into the future of electronic trading in the commodities world, announcing the launch of a machine learning quant fund in 2015.

But this image began to unravel as sources familiar with Steffensen’s business practices started to make a public case alleging misappropriation of investor funds and contract breaches.

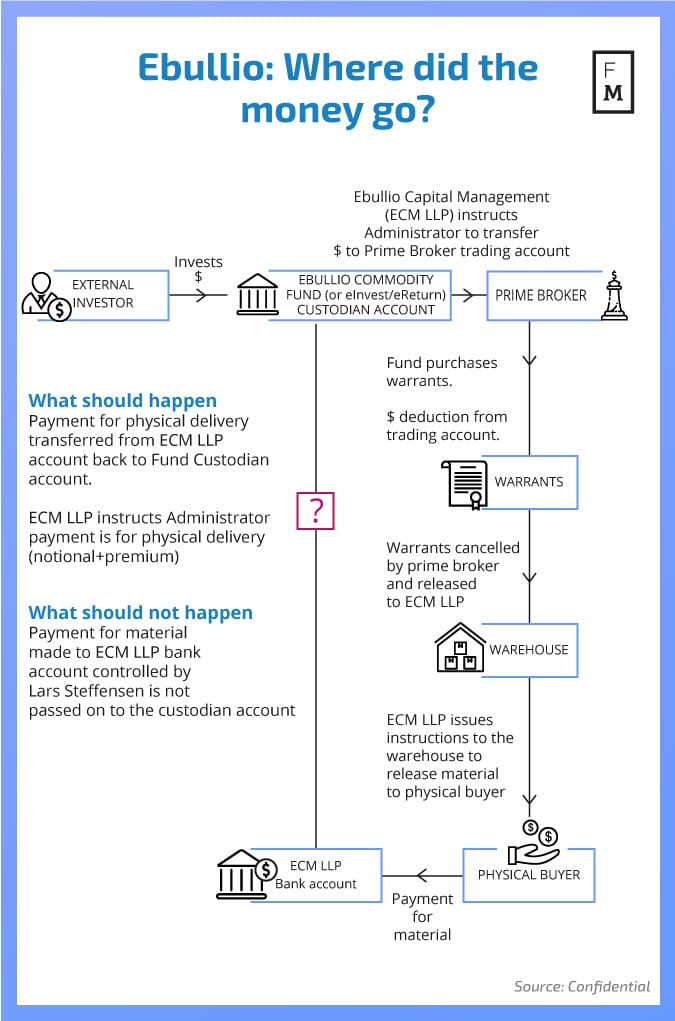

One source, who left the company when he began to question the direction in which Steffensen wanted to take the firm, said instead of running payments for delivered physical material through the administrator and into the custodian bank account, as required, monies ended up in ECM’s bank account, which was controlled by Steffensen.

"A mere glance" at Ebullio’s brokerage trading account should have sparked more curiosity for the fund’s auditors and administrators, as well as the FCA personnel who had investigated the firm, the source added.

“If there have been cash withdrawals from the fund, so when Ebullio bought physical material to deliver, and yet, there’s been no cash returned to the fund, that is where the auditors have a problem, because they have to account for that,” the source said.

The reasons provided for this discrepancy by Lars Steffensen, said the source, were in part hidden amid claims of privacy due to “fiduciary obligations” to investors, as well as cash needs for investments in mining operations located in Turkey and West Africa.

Ebullio’s Mining "Investments"

Steffensen’s claims about the value and status of mining assets in Turkey and Ghana are a major point of contention among people claiming fraud.

Excerpt from April 5 shareholder letter: status of 5 assets.

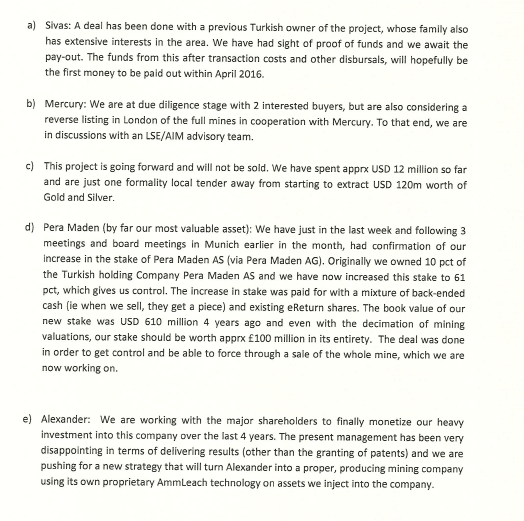

In an investor letter dated April 5, 2016, Steffensen outlines the ongoing investments in mining projects, some of which have been repudiated by sources familiar with them and written about previously by Finance Magnates.

eReturn is the main vehicle used to raise capital to fund Ebullio’s mining projects, and offered to clients investing in the fund some participation to the cash flows generated by the Keban mine in Turkey once in production, according to Laurent Jeanmart, an early eReturn investor.

Jeanmart said that despite substantial inflows into the eReturn fund, estimated at between $5 million and $10 million, Keban had not started production despite numerous promises.

Both he and a source familiar with Ebullio’s Turkish mining assets said that the discounted cash flow and NPV (net present value) valuation given to the Pera Maden project and the Keban mine in excess of £1.3 billion as of 30 April 2015, is based on a potential future valuation provided by respected mining consultants, SRK Consulting, in 2012.

Achievement of this valuation was conditional on spending almost $600 million to fund advanced exploration, with project development and construction involving rehabilitation and reopening of the old mine to access mineral resources.

Ebullio’s auditors, Kinetic Partners, Jeanmart added, should have noticed a competing valuation of $30 million to $35 million by Livenca (eReturn owns a share of Pera Maden indirectly via an investment in Livenca) and were “one obvious, simple phone call away from figuring out the massive gap between Steffensen’s valuation and the actual fair value of the licence”.

“This is all the more surprising as the holding in question is by and large the only asset on eReturn’s balance sheet,” Jeanmart said.

Paul Barnes, a forensic accountant based in the UK, said that auditing firms and administrators are obligated to report the possibility of any potentially fraudulent situation to the FCA: “Were they aware of the potential diversion of the funds? If not, why not? Have they done anything as a result of what has happened, because they should have reported this to the FCA by now, and if they haven’t, why not?”

Barnes also noted that liquidators have the same obligations.

Winding Up Ebullio

It wasn’t until recently, with the court appointment of RSM liquidators to wind up Ebullio Capital Management, that people making allegations have felt a gathering sense of optimism that authorities will finally notice, dig in, and take action.

One source said: “To my knowledge, Lars Steffensen in person doesn’t appear as an owner/shareholder on any of the related structures although certainly behind the scenes he is and has been the ultimate beneficiary and user of these as a slush fund for his lifestyle of fast cars, trips with his buddies to Las Vegas, $25,000 nightclub bills, etc. All of which he bragged about openly on many occasions. He is in my opinion a crook and a charlatan who needs to be exposed and banned from the investment business for life.”

A number of sources have added that some of the alleged fraudulent activities could not be perpetrated without the assistance of close associates, specifically naming: Lars Steffensen’s wife, Gemma Steffensen, currently the office manager for Himsworths Legal, identified as the “On-Shore Counsel” for Ebullio as of February 29, 2016 by Lars Steffensen in an investor letter; and Joseph Crawley and David Sutcliffe, former partners of Ebullio and current members of the executive board of Pera Maden, a company affiliated with the Keban tailings project.

A source close to the situation also noted that directors and portfolio managers have a duty to report any misgivings they had.

If getting regulators to consider taking further action seems like an uphill battle, at least it is not far-fetched, and there’s precedent, especially in the US, in actions taken by the Securities and Exchange Commission against hedge funds like Platinum and auditors like PricewaterhouseCoopers. And size doesn’t matter: commodity pool frauds with investor losses of $550,000 have been investigated and criminally charged by the US Commodity Futures Trading Commission recently.

...fraudsters get away with it and we as taxpayers pick up the bill

As a UK example, the allegations against Ebullio bear some similarities to the Weavering Capital scandal in the fixed income asset class space, which required a civil action lawsuit brought by the administrator to get regulatory attention.

An FCA spokesman declined to comment on the actions taken against commodities firms in recent years, but did point to a list of fines in 2016 and 2015, many of which are in the insurance and retail bank sectors, as well as for manipulative trading practices known as "layering". In 2015, the FCA published a "damning report", said the Financial Times, raising concerns about the poor awareness of market abuse risk and the lack of effective controls among commodity traders and brokers.

Forensic expert Paul Barnes said that with the current FCA policy, "fraudsters get away with it and we as taxpayers pick up the bill" in the form of the FSCS, which is likely to be the case since Ebullio is FCA authorized.

If there have been cash withdrawals from the fund, so when Ebullio bought physical material to deliver, and yet, there’s been no cash returned to the fund, that is where the auditors have a problem, because they have to account for that

Whether or not regulatory scrutiny will be further drawn to Ebullio’s case remains to be seen, but one thing’s for sure: people who feel misled and defrauded intend to continue to push for accountability.

The FoF manager said: “What I can say with confidence is (Lars Steffensen) is a serial deceiver…Whatever he was doing it was completely contrary to what he marketed. I'm sure (the investors) do want to see if he stole from them. It's not the FCA’s job to protect them from themselves. However, if there is evidence of criminal wrongdoing then the FCA should prosecute him.”

Another source said: “(Lars Steffensen) deserves to be in jail…he gives a bad reputation to the commodities space…he’s made life hell for employees and partners, some who are very good, honest people, particularly when they questioned his activities. He threatens people with lawsuits and bullies people financially.”

Jeanmart said: “Sooner or later one has to take responsibility for one’s actions. Mr Steffensen has postponed that for too long. At this stage, this is not just about money, this is about righting a wrong done to all the investors and stakeholders as well as preserving the integrity of the asset management industry. The winding-up petition, which incidentally is yet to be disclosed to investors by Mr Steffensen, is the beginning of this process, not the end.”

Ebullio auditors and administrators - Ifina, GlobeOp (acquired by SS&C in 2012), and Kinetic Partners - did not respond to emailed requests for information; Gemma Steffensen did not respond to an emailed request for an interview; Joseph Crawley responded with a request to see the article before considering a comment, and did not reply to an offer to send related questions; David Sutcliffe did not reply to a phone call and text at his last known contact number; Lars Steffensen did not respond to an emailed request for an interview. If there are any replies we will update the article.