The group of regulatory agencies with authority over various parts of the financial system and markets throughout the EU, under the Joint Committee of the European Supervisory Authorities (EBA, EIOPA, ESMA) known together as the ESAs, have today published their final draft for Regulatory Technical Standards (RTS) which outline framework related to the European Market Infrastructure Regulation (EMIR).

The publications included several documents as part of the update, and are aimed to cover the risk mitigation approaches related to the Exchange of margin collateral to cover exposure that arises from non-centrally cleared derivatives (i.e. traded over-the-counter ) in OTC markets.

The ESAs also detailed the criteria related to intragroup exemptions and outlined the definitions of practical and legal impediments to the prompt transfer of funds between counterparties, according to the press release.

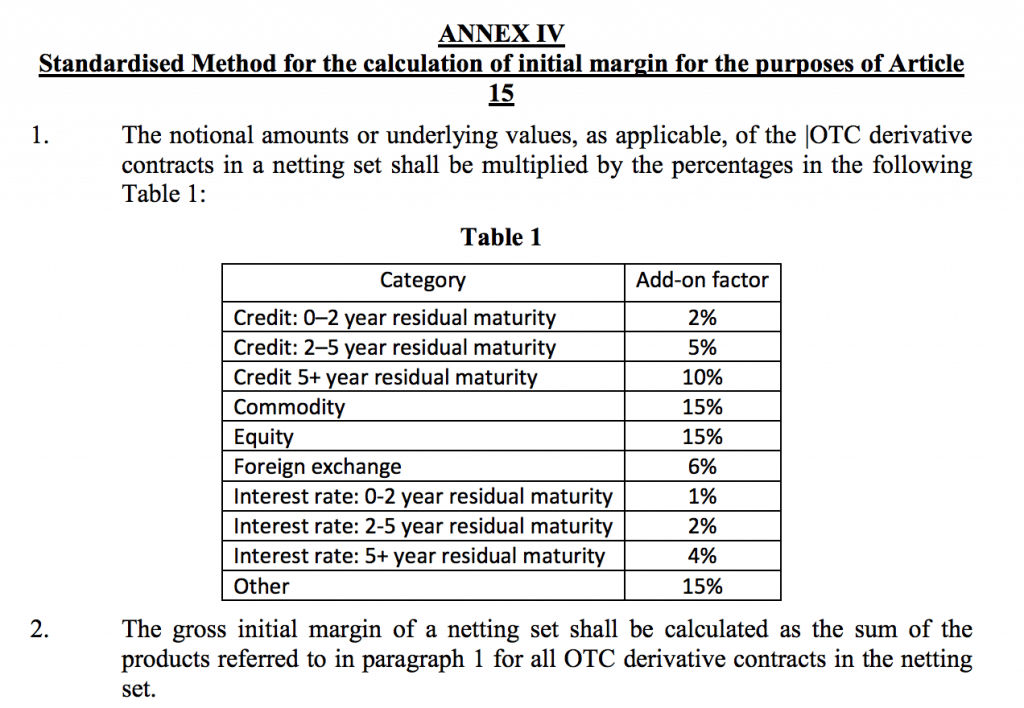

The standards were described to help increase the safety of the OTC derivatives markets in the EU, and provided technical standards across derivatives not centrally cleared by a CCP. Counterparties have to exchange both initial and variation margins, and other regulatory standards were outlined to help reduce counterparty credit risk. Among other instruments FX was noted, and as seen in an excerpt below:

Source: ESAs

Overall the goals of the initiatives are to also mitigate any potential systemic risk and ensure alignment with international standards, from a larger perspective. Eligible collateral for the exchange of margins, the criteria to ensure the collateral is sufficiently diversified and not subject to wrong-way risk, as well as the methods to determine appropriate collateral haircuts.

The many pages of legal jargon and technical details will need to be reviewed and analyzed by firms' compliance, legal, and outside consultants, with regard to requirements and any effect on related businesses.

Some of the major points relate to the diversification of collateral to avoid wrong-way risk, and how to determine collateral haircuts, and an outline of operational procedures and administration including agreement enforce-ability and timeframe for collateral exchanges. Lastly, the RTS draft covers how counterparties and the applicable authorities will handle the treatment of intragroup derivatives contracts. An excerpt from one document referenced in the release can be seen below:

Source: ESAs