This article was written by Ron Finberg, Business Development Manager at Cappitech.

It’s January 2nd, which means MiFID II goes into effect tomorrow. Investment firms across Europe have been scrambling in the final months of 2017 to confirm that their systems are in place to comply with the new Regulation .

But what about ESMA and European regulators?

Discover credible partners and premium clients at China’s leading finance event!

While a large portion of MiFID II laws resides around corporate governance, the bulk of the day to day compliance is trade and transaction reporting. Trade reporting is a near real time report of executions of listed products. This information is sent to an Approved Publication Arrangement (APA) facility.

The data is shared with regulators as well as portions of it made public. Submitted information includes executed prices, quotes at the time of the trade, volume and venue.

More in-depth are the T+1 Transaction Reports. Containing 65 fields of reportable data, Transaction Reports also include information of who the underlying buyer/seller is (including personal details), portfolio managers and internal traders that touched the trade. These reports can be sent directly to a national competent authority (NCA/country regulator), or to an Approved Reporting Mechanism (ARM) who sends it to the regulator.

As NCAs are the end destination for these reports, to comply with MiFID II, each country had to build out the capabilities to consume the data.

Data overload

With MiFID II yet to go live, early indications are that ESMA, NCAs and other supervisory organizations are facing an overload of handling the data.

The first indications that regulators may struggle to consume data on time was with their roll out of test environments to handle Transaction Reports. As obligated under ESMA, each NCA was required to provide specifications and a test environment for their underlying licensees to handle Transaction Reporting. The testing period allowed ARMs and investment firms to ensure that their processes created for submitting Transaction Reports were correct.

Despite uniform specifications, regulators rolled out their testing environments at different times. Some like the CBOI and FCA provided connectivity last summer. However, others waited till October and some only opened in December. Latecomers made it difficult for investment firms and ARMs to have enough time to test their connectivity and submissions.

Last minute issues

With only days to going live, the last two weeks saw a spike in test submissions uploaded to NCAs. However, feedback from submitting firms was that several of the larger regulators have had failures consuming data. This caused two of the biggest ARMs to suspend some of their testing capabilities as they were temporarily able to upload reports to some NCAs for feedback on Transaction Reports.

While some of the data consumption issues are expected to be resolved when NCAs move to their more robust production environments, it is unknown how much capacity they can consume at once when things go live. As a result, there is industry expectations from those that were involved with the initial rollout of MiFID I and EMIR, that NCAs will face technical problems that will temporarily shut down submissions.

Site crashes

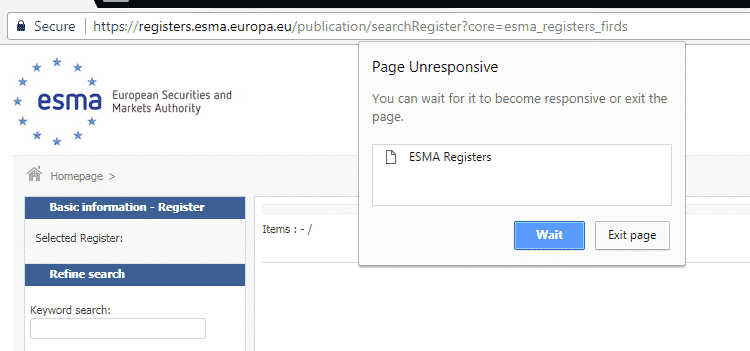

As an early indicator of the increase of load handling, two important MiFID II sites have crashed today. They are ANNA Service and the ESMA Register. Both sites handle identification of ISIN codes needed to properly report transactions under MiFID II.

ANNA website crash

What instruments have to be reported is a big question under MiFID II. As such, investment firms have been relying on the free ANNA Service database and ESMA register to look up products. However, it appears that there has been increased usage today halting both of those sites (as of publishing time, ANNA Service is back up).

While not the entity that receives reports, the site crashes have caused delays for firms seeking last minute identification of new ISINs that were registered late by their trading venues. The late registered ISINs may also prove to be a problem if NCAs don’t properly index them, as this would lead to rejected reports.

Overall, we may see a rocky road over the first few days and weeks ahead as investment firms and regulators adjust to live MiFID II reporting.