One of the ways that MiFID II is seeking to improve transparency in the financial markets is to require disclosure of the trading capacity of investment firms and of the person or algorithm responsible for the execution and making of investment decisions.

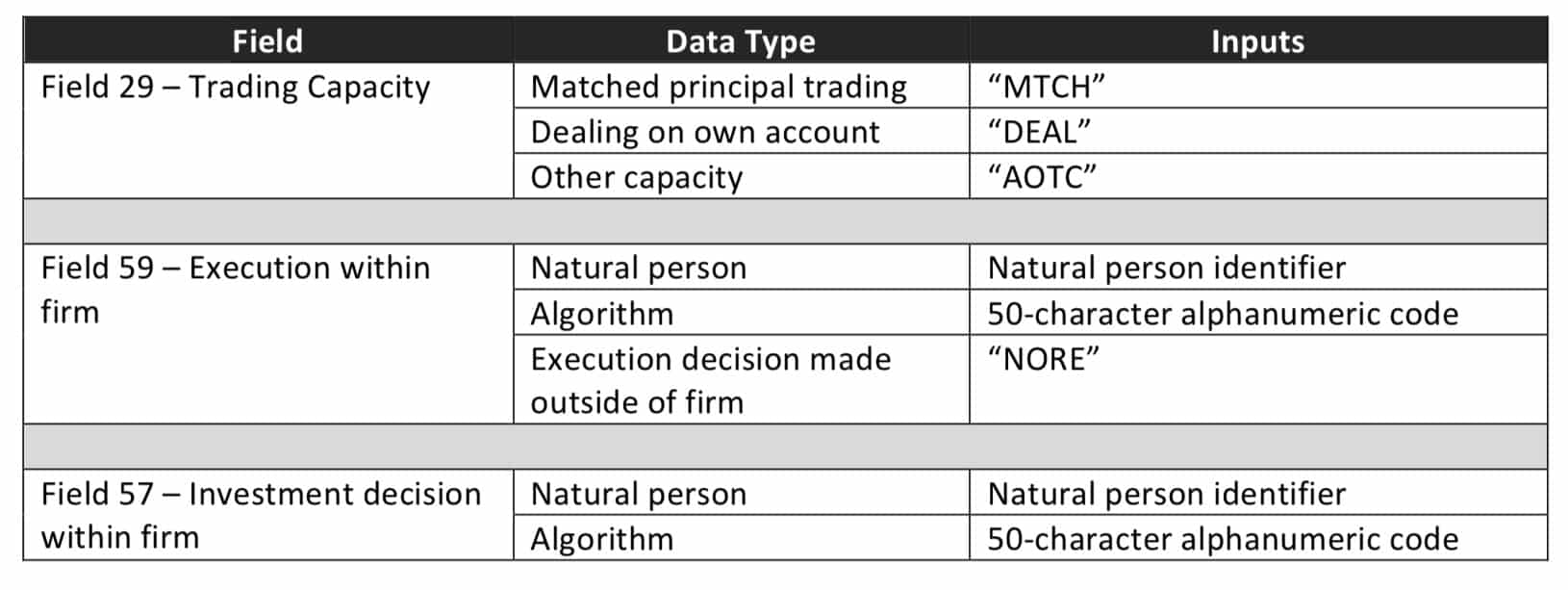

Determining how to make the reports and how to populate these fields is often not a straightforward exercise due to differences in licensing and reporting definitions, as well as certain field criteria being conditional on the input of other fields. The following is a summary of some equivocal fields and potential inputs:

Field 29 - Trading capacity

Many CFD/FX brokers are ‘matched principal’ from a regulatory perspective (e.g. they hold an FCA matched principal broker ‘125K’ limited license) and STP all their trades (back to back) to a third party. However, they may not meet the more stringent criteria in the definition of “Matched Principal Trading” under MiFID II.

The MiFID II definition of “matched principal trading” is a transaction where the facilitator interposes itself between the buyer and the seller to the transaction, and has the following three characteristics:

- The facilitator is never exposed to market risk throughout the execution of the transaction;

- Both sides are executed simultaneously; and

- The transaction is concluded at a price where the facilitator makes no profit or loss, other than a previously disclosed commission, fee or charge for the transaction.

Most CFD/FX brokers processing client orders as a 125K license would not be executing the client- side trade and the Liquidity provider trade at precisely the same time. Because of this, the broker would briefly be exposed to market risk. Further, the broker may enter into gross long and short positions but nonetheless be in the same net position after the completion of both trades.

The fact that the prices can be different (due to the spread mark-up) also raises questions as to whether they are acting within the MiFID II definition of matched principal trading. Therefore, CFD/FX brokers that may be matched principal from a licensing perspective would, in most circumstances, not be engaging in matched principal trading pursuant to the MiFID II definition.

If a transaction is not reported as executed in a matched principal capacity (MTCH) or any other capacity, then that leaves ‘dealing on own account’ (DEAL). The trading capacity for matched principal licensed CFD/FX brokers is ‘Deal on own account’ and the field should be populated with (DEAL).

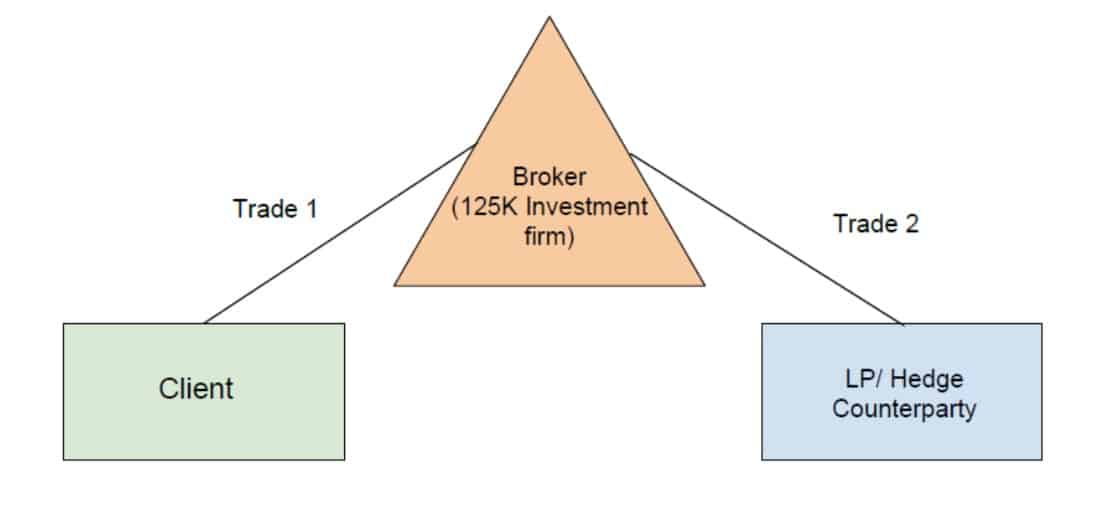

Matched principal trading which does meet the MiFID II definition requires only a single transaction report to be submitted. In contrast, CFD/FX brokers licensed as matched principal firms but having the trading capacity (DEAL) should submit two transaction reports, one for the client transaction and another for the hedge side.

Field 59 - Execution within the firm

Field 59 is mandatory so population will be required for all new transaction reports. In cases where the decision about the execution was made by a client (e.g. the client instructs the details of the trade including the venue of execution) or by another person from outside the investment firm (e.g. an employee of a company within the same group), the value ‘NORE’ should be used in this field.

If the field is filled with a code other than ‘NORE’, the code is - as set out in the Article 9 of the Commission Delegated Regulation (EU) 2017/590 - either the identifier of a person within the investment firm or the identifier of an algorithm within the investment firm, depending on which is primarily responsible for the execution. This is the responsibility of the investment firm to determine in accordance with its governance model.

When considering the previous scenario where the interaction is to be reported as two separate transactions and trading capacity as DEAL, it is likely that the bridge/platform would be identified as responsible for execution as it has undertaken the execution without any further intervention by the investment firm.

Due to the technology-neutral stance of the regulation, the platform should be identified as an ‘algorithm’ – which covers any system that automatically executes transactions without human intervention (NOTE: this is different to algorithmic trading).

Field 57 - Investment decision within the firm

As set out in Article 8(1) of Commission Delegated Regulation (EU) 2017/590, this field should always be populated when the investment firm is dealing on own account (i.e. trading capacity = ‘DEAL’) since it is putting its books at risk and is therefore deemed to be making an investment decision.

The only exception to this is within the context of transmission where the investment firm is reporting as a receiving investment firm and dealing on own account in which case it should populate the client side report with the information provided by the transmitting investment firm.

Where brokers are submitting transaction reports with trading capacity as ‘DEAL’ – it is required to define who within the firm is responsible for the investment decision. This could either be the platform making the decision to accept or refuse trades based on internally set parameters or the person responsible for setting these parameters.

This field is not required to be populated where capacity is ‘AOTC’ or ‘MTCH’.

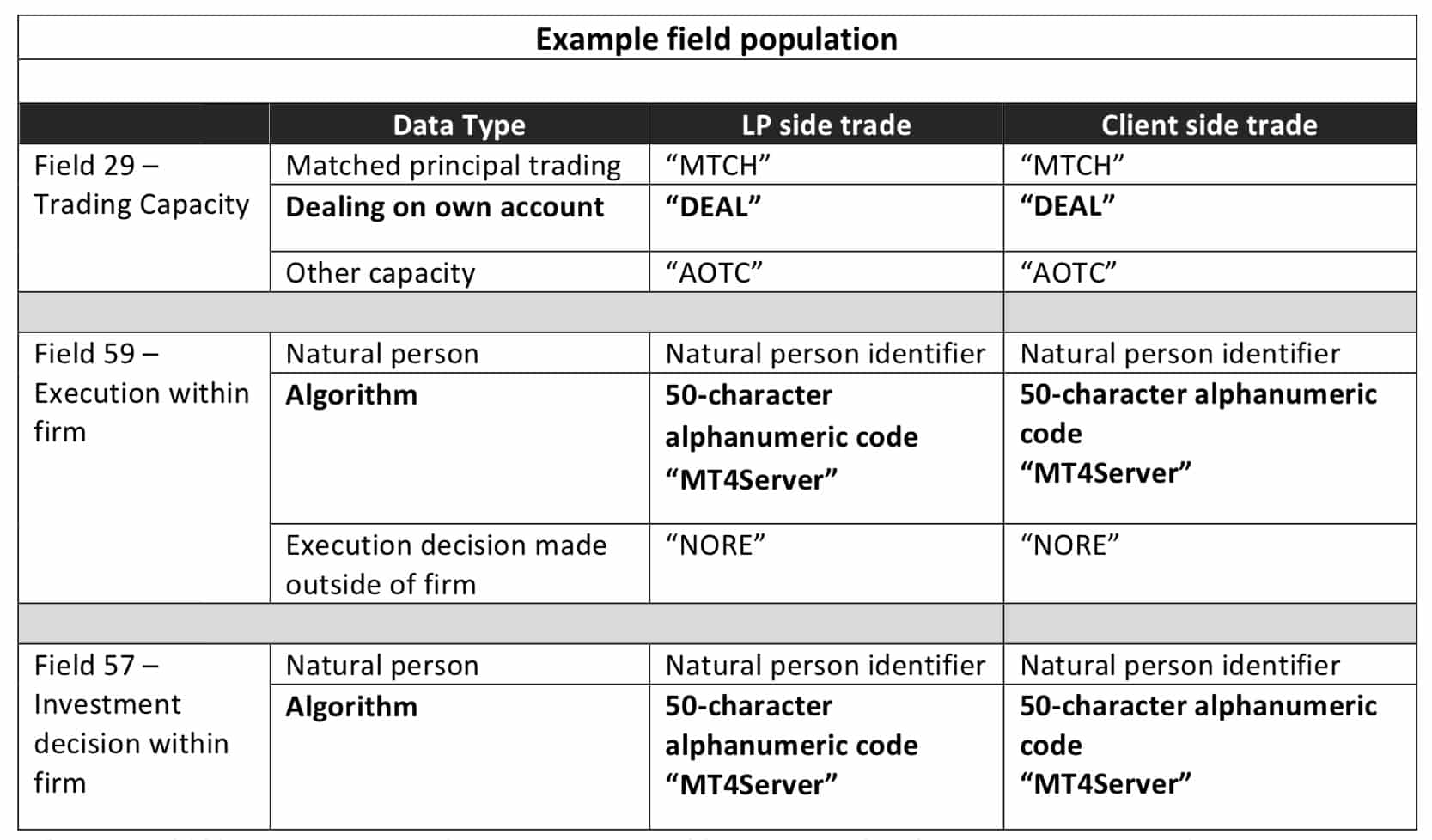

Example

Acme Brokers is a CFD firm with a 125K-matched principal broker license. It operates on an STP model of automatic execution of orders between clients and Liquidity Providers . The transactions are not undertaken simultaneously and therefore Acme Brokers is exposed to very brief market risk and its proprietary capital is used in these trades.

It would be required to submit two transaction reports, with the following field population for both trades.