We are approaching the one year anniversary of the release of the FX Global Code of Conduct, which is a business ethics guide aimed at combating the endemic financial crime in the foreign exchange industry.

It was written by the Global Foreign Exchange Committee together with central banks, investors and dealers, and it aims to restore credibility to the 5.3 trillion USD a day FX market.

While signing up to the guide is not compulsory, the understanding is that there will be a trickle down effect driven by peer pressure. For example, the Bank of England signed the document in February 2018 and it expects "regular counterparties to commit to embedding these principles of good practice in their market activities” according to deputy governor Dave Ramsden.

Finance Magnates has covered the evolution of the code as it happened, and hosted a discussion on the subject at the 2017 Finance Magnates London Summit.

Today we discussed with Seth Johnson, CEO of NEX Markets, about how he sees the code progressing.

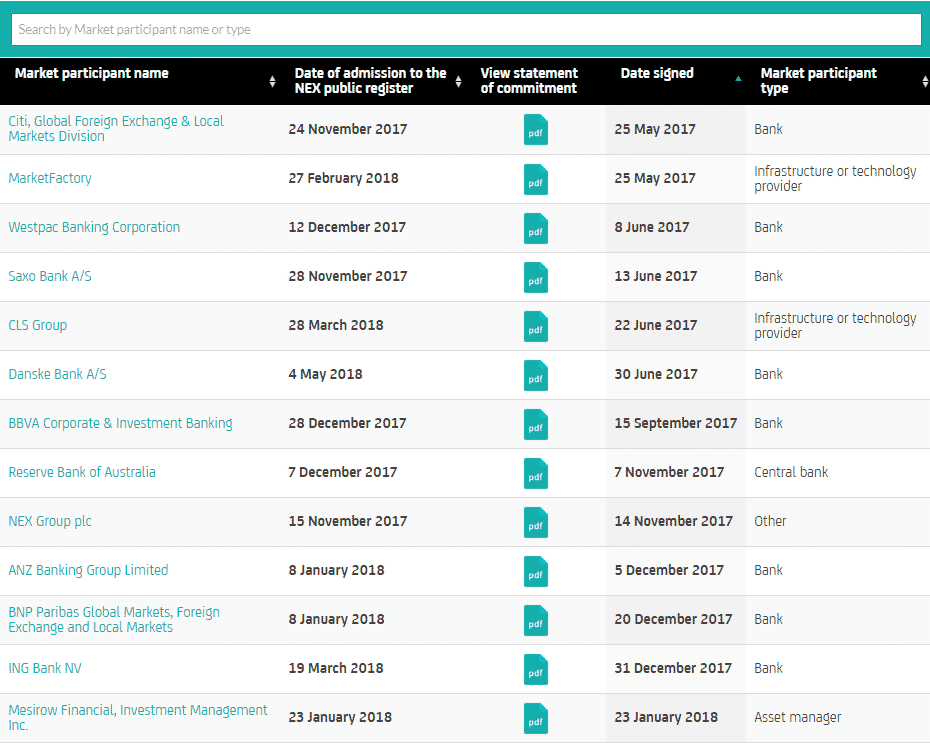

NEX Group, formerly known as ICAP, is a UK-based foreign exchange brokerage which is listed on the London Stock Exchange. It has a market capitalisation of 3.75 billion GBP, and in March 2018 Chicago-based CME Group offered to buy the company for 5.4 billion USD. In the spirit of adopting the code, NEX has published its own registry of compliant entities.

The latest market participants who signed on NEX's register

From your perspective, what is the approximate acceptance rate amongst your industry peers?

We have seen ~65% acceptance rate amongst those we deem peers who carry out similar business to NEX and ~15% across the banking and non-bank Liquidity provider space. This can be quantified by way of them stating that they have signed their statement of commitment (SoC) and publishing on registers such as ours.

To date, the only Corporate to publish their SoC on a public register has been Shell Treasury Centre LTD who chose the NEX Register.

What do you think is making companies hesitate to sign up to the code?

For the main part, market participants will have been bogged down with MiFID II as well as the depth to which FX is integrated in the banking system resulting in a long process before being able to sign.

Banks have also mentioned that they would need to fit the Code in to their Audit schedule before being 100% confident, which at the time of publications of the Code many stated was full with other Audits for the next 12-18 months. Some banks have managed to sign earlier and in some cases have done this by only signing under an entity e.g. capital or global markets.

Seth Johnson, CEO, NEX Markets

For market participants with larger electronic business, the issues they face may be around Principle 17 which saw an amendment towards the end of 2017 (19 December) likely resulted in their holding off signing their SoC. Since the change to the wording was released removing the word “likely” they would need to fully qualify to what extent any information gathered in the last look window effects their behavior be it direct or indirect.

What will happen to the market if the code is widely accepted? Has the code had any impact so far?

Wide acceptance of the code will lead to greater transparency which has already been seen with the publication from some market participants of their disclosures on how they handled foreign exchange transactions. We ourselves at NEX have seen a huge interest in our Quant Analytics program which offers our clients not just a personal, but a holistic view of their executions.

What the code has done is to address behavior at all stages and looks to ensure that not only do those executing the business on behalf of their clients behave in an open and transparent manner, but also that those originating the transactions commit to the same high standards.

What will happen to the market if the code is not widely accepted?

In short: regulation. If we as an industry do not take this opportunity to sign up to a common set of principles written by those respected in our industry, we may end up with regulation that with be lengthy and expensive to implement.