The International Swaps and Derivatives Association, Inc. (ISDA) today announced the relaunch of its Resolution Stay Protocol that covers securities financing transactions. Twenty-one "Global Systemically Important Banks" or G-SIB have signed the new protocol at launch, with the stated aim of ensuring the orderly resolution of cross-border derivatives transactions.

Statutory resolution regimes have been implemented in a number of countries beforehand, including the US and EU, and from now on will treat domestic and foreign counterparties similarly. Under the protocol, counterparties agree to cross-border enforceability of existing statutory stays on resolution-related early termination and other default rights in Over-the-Counter bilateral derivatives contracts and securities financing agreements.

As a result of the extension of the protocol to securities financing transactions and its adoption by G-SIBs, it is estimated by the Financial Stability Board (FSB) that more than $560 billion of cross-border securities financing activity that could previously have been terminated at the point of resolution will be subject to the stay regimes of their relevant home jurisdictions.

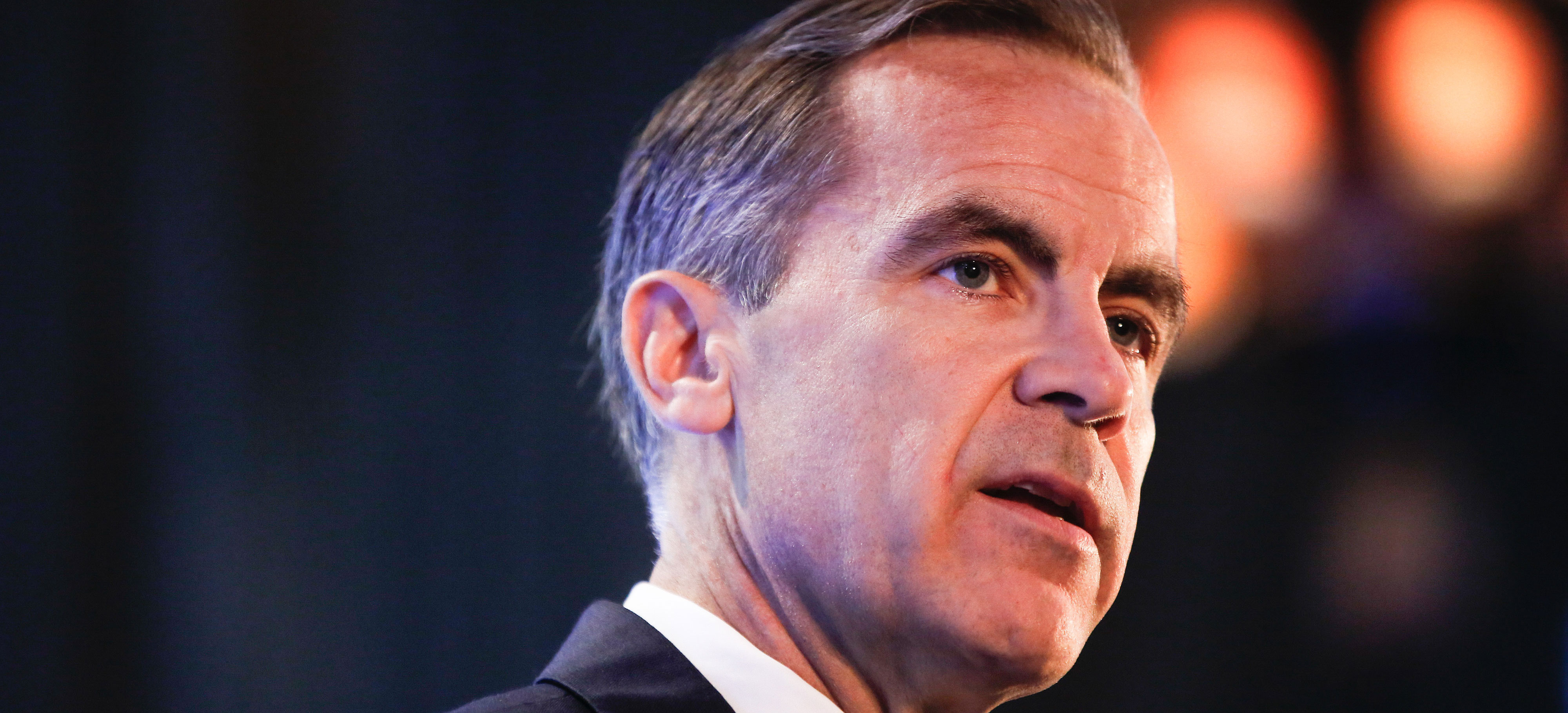

Mark Carney, Governor of the Bank of England and Chair of the FSB, stated: “Since the financial crisis, regulators around the world have improved the resilience of firms but we must ensure that if a firm fails in the future it happens in an orderly way without taxpayers footing the bill and without major disruption to the wider financial system.

The financial crisis exposed critical obstacles to cross-border resolution that complicated authorities’ ability to stem contagion across the global financial system. The Protocol closes off much of the cross-border close-out risk that statutory stays have not been able to eliminate because their reach is limited to national borders. I am particularly pleased to see that all sectors of the industry are working together to find a solution to this issue.”

“The relaunched ISDA Universal Resolution Stay Protocol captures a wider universe of financial contracts, further reducing the risk that a bank resolution triggers a chaotic unwind of financial contracts. ISDA has worked hand in hand with other trade associations and market participants to meet the regulatory objective of broadening contractual stays to support cross-border resolution and strengthen systemic stability,” commented Scott O’Malia, ISDA’s Chief Executive.