The past year was marked by high profile, billion-dollar fines imposed on major global banks for manipulating critical FX rates. However, the situation is far from over, American and British authorities keep on investigating, and more regulators worldwide are joining them. Meanwhile, the FCA maintains that UK banks have done little to improve the situation. The time has come for reassessment, and what better place to do it than at the Finance Magnates' London Summit 2015.

Secure your seat at the trading industry’s leading event!

Taking place on November 3rd in the heart of the City of London, the first panel of the event will discuss this pivotal issue with a number of prestigious speakers. Neil Crammond, a respected trader and author, says that among the aspects he will raise at the panel, is just how much market abuse provides Liquidity to the market and that with current liquidity issues, we simply cannot do without it. "It is that BIG," he explains.

Another perspective will be provided by Gil Neihous, founder & CEO of Fluent Trade Technologies, specializing in low latency and pre-trade risk solutions. Prior to Fluent, he founded and led an FX hedge fund and provided consulting services to several banks and hedge funds on execution and Risk Management . His experience will help provide the panel with an inside but unbiased view of the situation.

Providing a hands on perspective on the upcoming regulatory changes as a result of the scandal will be David Woodlock. He is Chair of the Committee for Professionalism at ACI – The Financial Markets Association - as well as Vice-Chair of the ACI FX Committee, in addition he has vast experience in writing Codes of Conduct in Ethical, Fair & Transparent OTC Markets.

Woodlock explains how he sees the issue: “Twenty five years on from the Federal Bureau of Investigation's crack-down on improprieties in the Chicago futures pit the largest OTC market in the world has been caught in a maelstrom of allegations of impropriety and large fines have been levied for currency manipulation, rate rigging and collusion on an unprecedented scale.

In an industry that is self-regulated was this just the participants ignoring the Model Code, which is the blueprint for ethical behaviour and best practice, or indicative of a breakdown in the responsibilities of senior managers in their duties towards training and education. The current push to make sure the FX market displays a higher level of professionalism once again is causing a seismic shift in how it regulates itself.”

Woodlock is also an experienced FX trader with a good knowledge of Fixed Income and related matters gained through a variety of roles in the industry. After working for a number of banks between 1977 and 2003, specializing in e-FX from 1998, he did a stint at FXall leaving when it was sold to Thomson Reuters, taking up his current position as Global Head of Sales and Business Development for Eurobase Banking Solutions.

The Scandal

The FX rigging scandal is the result of investigations by financial watchdogs and regulators from around the world, that focused on chat groups in which institutional dealers sent instant messages over their Bloomberg terminals.

For a period of three years, in chat groups with names such as, ”The Cartel” and “The Bandits’ Club,” bank traders shared information with competitors allowing them to execute their own trades before filling client orders.

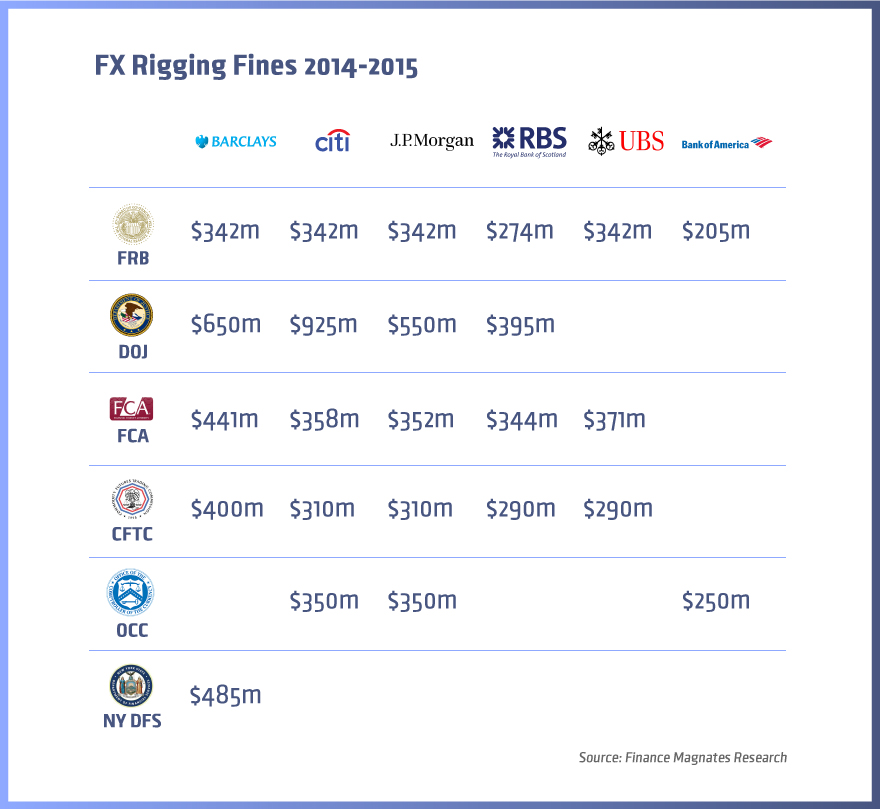

The revelations of the rates manipulation had serious negative effects on the brands of the major international banks as traders were exposed, clients had their confidence shaken and investors worried about the overall impact of the fines crossing over $10 billion.

Beyond the regulatory fines, the banks are also faced with class action lawsuits by their clients, including institutional investors and hedge funds, that have engaged in FX swaps, futures, options and spot transactions.