Trillium, a proprietary trading technology company, today announced an expansion of its Surveyor product to include options trading data, which now covers the U.S. equity options and options on futures markets.

The London Summit 2017 is coming, get involved!

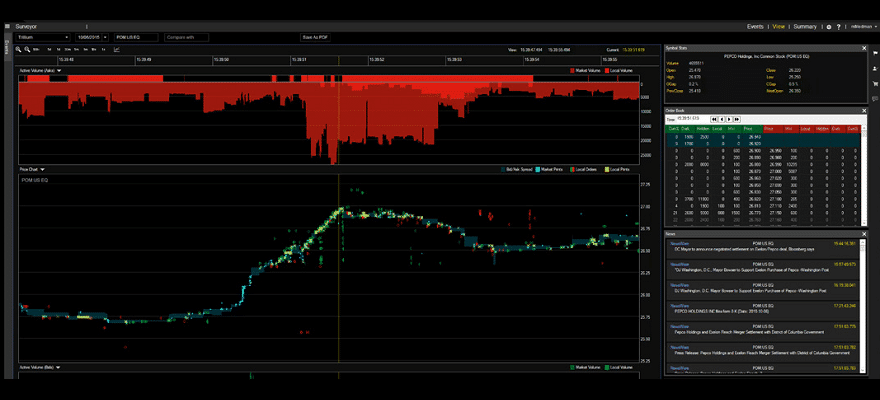

Surveyor is a post-trade surveillance and Analytics platform that uses full depth-of-book direct feed market data to detect spoofing, layering, and other forms of market manipulation. The latest upgrade, which will be rolled out later in March, will review options trading data to identify potentially abusive trading behavior both within a single options instrument, between different options instruments, and between options and their underlying stock or futures contract.

Surveyor is also used by traders and order routing professionals to review and optimize order routing strategies. The solution sources and captures data elements required to conduct a complete review of all trading activity.

A diversified financial services firm, Surveyor is a creation of Trillium’s trading technology development arm, Trillium Labs, which focuses on post trade analytics and market surveillance tools. Surveyor’s expansion into options comes three years after its initial launch, and following an extensive product overhaul completed last year.

Detecting potential cross-product market manipulation is becoming a greater necessity for firms as the US regulators have brought one enforcement case against the practice in recent weeks.

Trillium CEO Barry Schwarz commented: “We found that more and more of our customers aren’t limiting their trading to Equities or any one asset class. We worked to add options because our clients want a unified solution for conducting surveillance across all of their trades.”

“We are excited to be able to offer our next generation trade surveillance platform to the options industry. We look forward to showing options traders how much more accurate and efficient their trade surveillance programs can be with the right tools for the job,” added Trillium Chief Compliance Officer Michael Friedman.