Singapore Exchange (SGX) has released its market statistics for September, highlighting a record trading activity in commodities and forex. Besides that, SGX announced the launch of Singapore's largest equity ETF focusing on climate action.

SGX's FX market recorded substantial growth in September. Its total FX futures trading volume increased 20% year-on-year (YoY) to 4.1 million contracts. According to the company, the concerns about prolonged high-interest rates in the US caused an increase in trading activity. The SGX USD/CNH Futures contract surged 77% YoY in volume to 2.8 million contracts, with a record average daily notional volume of almost USD $15 billion.

Comparatively, SGX's total FX futures trading volume surged 26% month-on-month (MoM) to 4.2 million contracts in August. The trading volume of SGX USD/CNH Futures was also recorded at 2.8 million in August. Additionally, SGX INR/USD Futures saw an increase of 11% MoM to 1.2 million contracts.

Equity Derivatives and Sustainable Finance

SGX Equity Derivatives experienced increased demand, particularly in the GIFT Nifty 50 Index Futures, which jumped 9% MoM in September. On the sustainable finance front, SGX FTSE Blossom Japan Index Futures attracted global institutions with a record month-end open interest of USD $116 million.

Commodity trading reached unprecedented levels in September, with an increase of 77% YoY to 5.4 million contracts. This surge encompasses various products such as iron ore, freight derivatives, petrochemicals, and rubber futures. Iron ore derivatives experienced a jump of 85% YoY, driven by China's stimulus measures and expanding steel production.

In August, the commodity derivatives trading volume increased 52% YoY to 5 million contracts. Notable growth was observed in iron ore, rubber, and dairy derivatives, with benchmark iron ore volume increasing 54% YoY. SGX SICOM rubber futures saw an increase of 51% YoY, while the dairy derivatives set a record with 78,504 lots due to heightened volatility.

SGX: Screen Trading on the Rise

A notable trend is the growing adoption of screen trading among traders, contributing to almost 60% of the total futures activity. Forward Freight Agreement volume increased by 15% YoY.

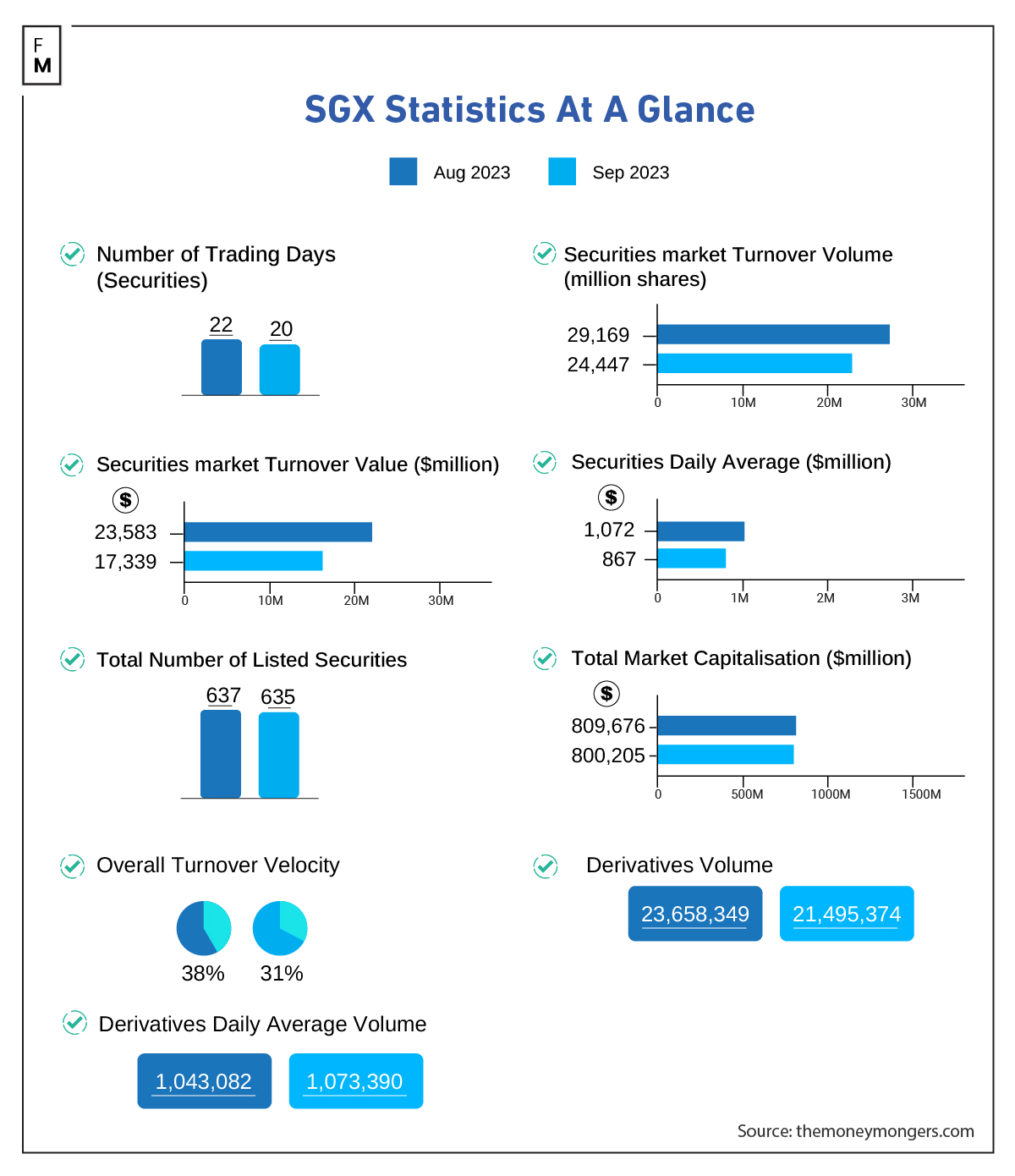

Singapore's securities market saw a decline in daily average value and market turnover value in September. The benchmark Straits Times Index experienced a drop of 0.5% MoM. However, structured warrants and Daily Leverage Certificates market turnover value increased 4% between July and September.

In the fixed income sector, SGX Fixed Income surged 28% MoM in the amount issued from 39 new bond listings in September. Highlights included multi-billion-dollar offerings from financial institutions like The Export-Import Bank of Korea, Sumitomo Mitsui Trust Bank Ltd., Nippon Life Insurance Co., and Bayfront Infrastructure.