UK corporates are at a crossroads as the pound strengthens. The latest research shows that businesses are divided on whether they are benefiting or struggling. Rising costs and tighter credit conditions are forcing firms to rethink how they manage their foreign exchange (FX) exposures.

The Impact of a Strong Pound

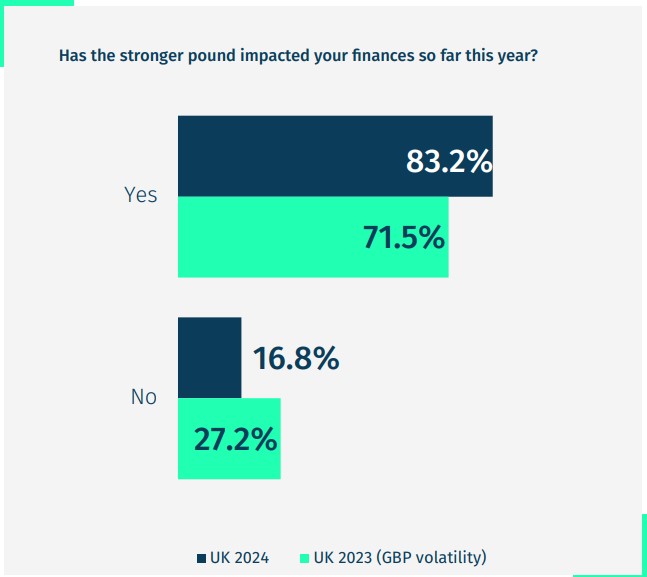

According to the study by MillTechFX, 83% of UK corporates reported that the stronger pound has affected their finances. Interestingly, the effects are evenly split, with 50% seeing positive results and the other half experiencing negative impacts.

As a result, hedging strategies have become a solution for many firms. However, the rising cost of hedging is proving to be a challenge, especially for smaller firms. According to the study, 70% of UK corporates mentioned that FX hedging costs have gone up, with smaller businesses affected the most.

Besides the hedging expenses, businesses are dealing with a challenging credit environment. MillTechFX’s research highlighted that 94% of respondents found it harder to access financing in 2024. The combination of higher interest rates and increased fees from credit providers is adding to the financial strain.

This credit crunch is especially tough on smaller firms. For companies with between 50 and 99 employees, 87% reported facing tougher lending criteria. Even for larger firms, nearly 60% indicated that securing credit had become more difficult.

Despite the hurdles, many companies are sticking with their hedging strategies, and some are even lengthening their hedges. The research further showed that the average hedge length increased by 47% in 2024, reaching 5.55 months.

Global Instability

53% of companies plan to extend their hedge durations due to fears surrounding global instability. Concerns about the upcoming US election, in particular, are driving this move, with CFOs worried about unpredictable market movements and counterparty risks.

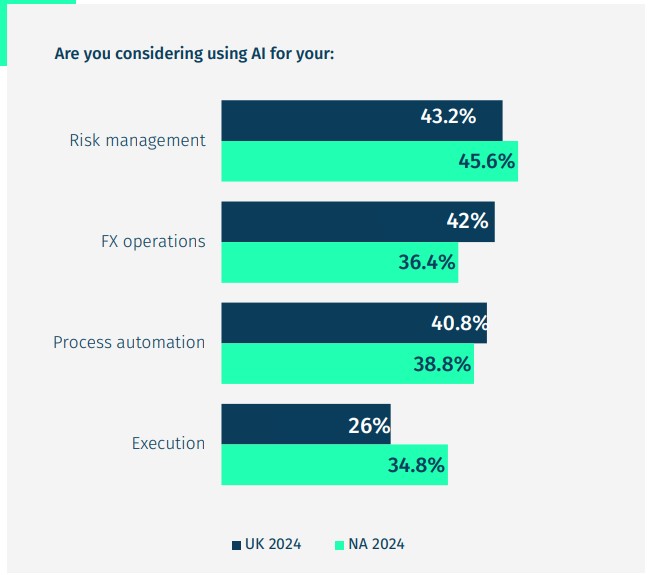

UK corporates are also diversifying their strategies by turning to FX options. The report found that 64% of finance leaders are now using FX options more frequently. At the same time, technology is playing a key role in reshaping FX management. All respondents in the MillTechFX report indicated that they are exploring the potential of artificial intelligence (AI) and automation in their FX operations.

Interestingly, 34% of UK corporates conduct financial transactions by phone, while 32% use email. These legacy processes not only slow down operations but also expose firms to human error.

UK corporates face challenges as they adapt to a stronger pound, rising costs, and a more uncertain geopolitical landscape. However, the rise of AI and automation enables businesses to streamline their FX operations and manage their risks more efficiently.