New York-based trading technology developer ActTrader Technologies Inc. which has provided trading platforms and related IT services to brokers globally for more than a decade, has announced a synergy with Finstek LLC – a marketing and technology consulting firm – where Finstek will market and sell the Act2020 platform through an exclusive global agreement.

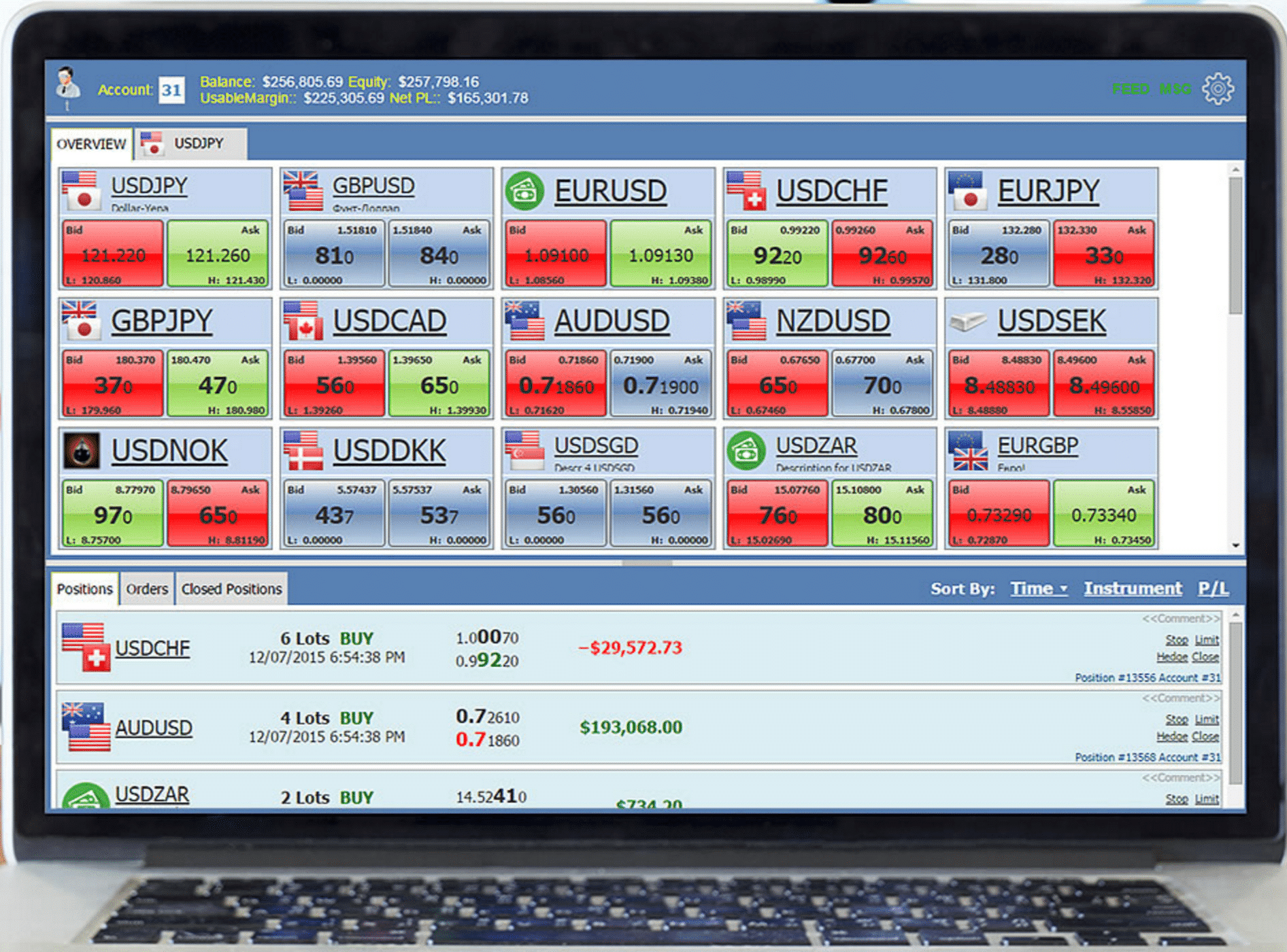

Finstek - founded in 2010 and also based in New York - was described as having contributed to the creation of the Act2020 platform, which provides traders with access to forex, CFD and binary options instruments. The release aims to highlight the commercial side of the offering as a selling point, where a flat-fee model is offered for $3000 per month, rather than variable cost structure that could increase based on usage, users, volumes, and other potentially unpredictable inputs that over time can vary.

Outsourcing sales distribution with partnerships

The choice to outsource the sales efforts of a Trading Platform to brokers seems like a viable distribution channel if the target results can be achieved and for the right terms. Such a structure is reminiscent of when an online broker outsources its sales efforts via IB relationships. That is, the compensation is external rather than in-house, and the producers are paid on the actual results (e.g. rebate versus salary).

Conversely, some pricing structures offer discounts for higher volumes or usage, whereas other deals may charge no upfront fees in return for revenue splits (or commission fees per transaction) if results are achieved. These can also be terms on the negotiating table (or not) during the licensing agreements and when trying to make contracts mutually beneficially yet commercially viable.

From the various fee structures that exist in the market for 3rd party trading platforms (or related sales driven efforts), other factors influence whether one model is superior to another, such as regulatory jurisdictions and any accompanying rules, among other criteria.

ActTrader has been in the business of delivering highly reliable premium multi asset trading platforms to some of the biggest names in the online trading industry for the past 15 years

Flat-fee model part of Act2020 distribution strategy

In the case of the agreement announced, it's not clear what the commercial terms of the partnership are, but the company hopes to reach a target audience with the Act2020 platform and with Finstek's help. A new website - currently set up with a scrolling landing page style- is powered by Finstek under the url Act2020.com and lists the platform's features.

For the new synergy between ActTrader Technologies and Finstek, where Finstek will spearhead the onboarding or offering of the Act2020 to new brokerages, it seems that one of the main drivers to structure the pricing at a flat fee was to target the small to medium size brokers who could be more cost-sensitive with regard to platform and trading operation expenses. ActTrader already caters to a diverse range of brokers and geographies so it will useful to see how this synergy unfolds for the company's future prospects.

Commenting in the official press release, ActTrader Technologies CEO Ilya Sorokin said: “ActTrader has been in the business of delivering highly reliable premium multi asset trading platforms to some of the biggest names in the online trading industry for the past 15 years.”

“This is a great opportunity for small and mid-size brokers to access the high end technology and functionality as the bigger brokers do. Flexible back office and a fully functional dealing desk with good Risk Management capabilities are instrumental in running a profitable brokerage business,” he added