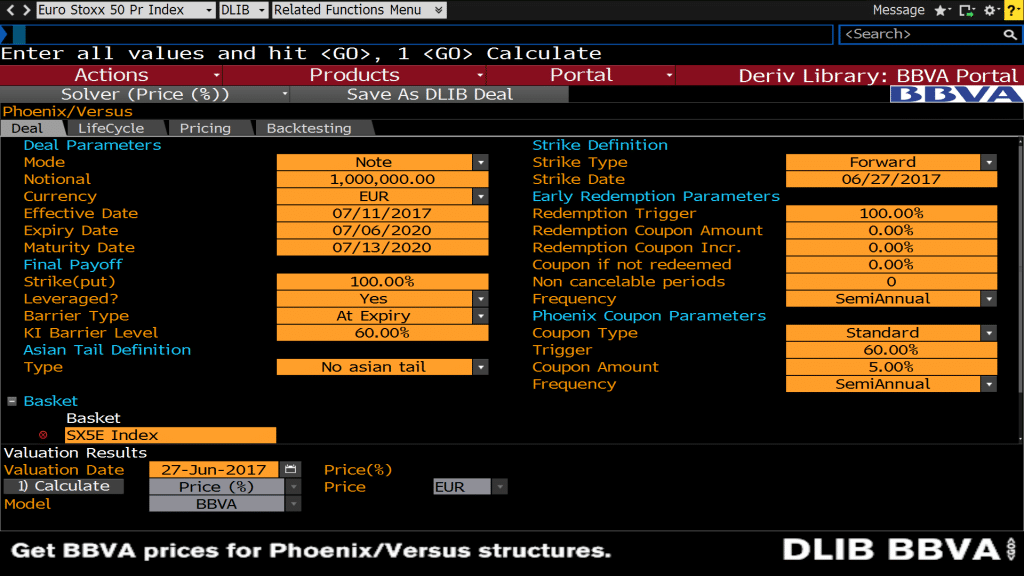

Bloomberg, the global provider of business and financial information, announced today that Banco Bilbao Vizcaya Argentaria, S.A. (BBVA) is the first dealer to offer its institutional clients a new automated way to create bespoke structured products and calculate a tradeable price in real-time, through a new Bloomberg function called the Derivatives Library (DLIB).

The London Summit 2017 is coming, get involved!

“With a clear focus on private banking, this initiative is fully aligned with BBVA’s strategy to position itself as an agile organization and capture fast business from this customer segment,” said Emilio Sainz de Baranda, Global Head of Equity Derivatives Sales at BBVA. “This partnership with Bloomberg helped shorten the time it takes to structure and price deals from hours to a matter of seconds making it easier for our clients to use BBVA as their dealer of choice for structured investments.”

Bloomberg DLIB gives institutional investors access to a library of preexisting and custom deal templates for structuring equity, FX, credit and interest rate derivatives contracts. Users can work up theoretical pricing and analyze the risk of deals, including exotic and hybrid payoffs, right on their Bloomberg Terminal.

“Bloomberg’s wealth of market data and Analytics supports diverse investment strategies and cater to various risk and reward profiles. Our work with BBVA is another example of Bloomberg’s commitment to facilitating the workflow between the sell-side and the buy-side; from idea generation, to pre-trade, Execution and post trade operations,” said Karim Faraj, Global Head of Front Office Derivatives at Bloomberg. “Structured products investors can use Bloomberg for more of their workflow — from structuring deals, to pricing them, to calculating risk on an ongoing basis.”