It’s Friday and another round of reviewing some of the important and more interesting stories this past week in the world of virtual currencies on Digital Currency Magnates.

BitLicenses Coming from the NY Department of Financial Services

Perhaps the biggest news of the week, and the one that should have the greatest impact on US businesses was the announcement of proposed guidelines for the issuance of a ‘BitLicense’ from the NYDFS. The guidelines cover client protection, anti-money laundering procedures, transaction reporting, and accounting requirements among details of the proposal. With a large contingent of NY bitcoin firms and Wall Street professionals forming relationships, the licenses are expected to provide the proverbial “regulation” that is spoken about to further integrate the use of bitcoins within the US. Commenting to Digital Currency Magnates about the importance of BitLicenses for their business, Jaron Lukasiewicz, CEO of New York based Coinsetter stated that “The BitLicense is a fundamentally important element to our company’s success. Obtaining regulatory licensing in New York will enable us to offer US banking to our customers and create additional assurances that their funds are safe.” Read More

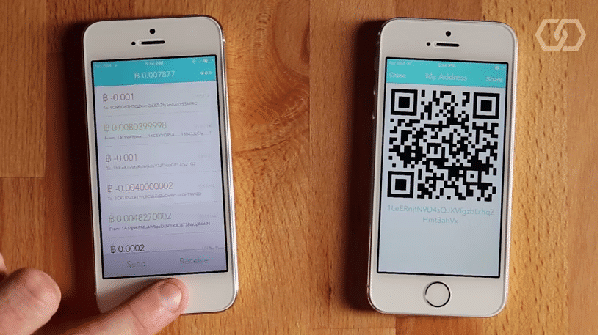

Chain.com Presents The Future of Mobile Payments

Even if you could care less about bitcoins and other digital currencies, mobile payments are a trend that is expected to affect the way we pay for things in the near future. Showing off a glimpse of tomorrow is a new bitcoin wallet by Chain.com that was developed for the still in beta iOS 8. Leveraging the use of Apple’s Touch ID technology which debuted in the iPhone 5S, the product uses fingerprint security to authenticate bitcoin transfers. When Touch ID was launched, Apple was speculated to be soon releasing a payment app that would use the fingerrint technology for its security, Chain.com’s app provides a bit of what we should expect to see soon. Watch the Video

The Dropbox of Bitcoins

Initiating a crowdfunding sale this week was Storj. Aiming to become the Dropbox of bitcoins, Storj has created technology to enable a decentralized network of data storage, which is expected to provide a cheaper and more secure environment for cloud based storage than that of existing centralized products. The product provides incentives for providers of storage space to the network, thus allowing anyone with excess server space to contribute. Overall, while focus has been on decentralized currencies, Storj is among a growing list of firms creating innovative technologies using similar principles as bitcoin and the Blockchain , but applying it to other digital goods. Read More

Digital based crowdfunding was also discussed in a recent with Tal Ron covering some of the developments regulators will be investigating when it comes to raising money using digital currency based offerings. Read More

Regulated Bitcoin Hedge Fund Launched

Last but not least, Global Advisors launched a Jersey regulated commodity hedgefund that will provide investors with exposure to bitcoins. Co-founded by former JPMorgan trader Daniel Masters the fund’s activities holding “concentrated positions in a narrow substrate of commodity markets.” The fund will be based on British pounds and targeted towards UK, European, and Middle Eastern clients. Read More