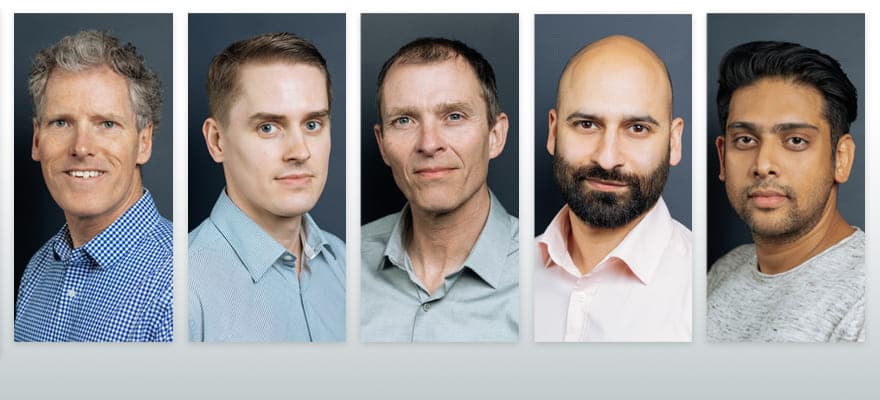

Trading technology provider Cobalt announced on Tuesday that it has hired five new executives.

Most of the company’s new hires have some experience working in the foreign exchange markets.

The exception to that is John Fitzgerald, Cobalt’s new information security manager, who joins from asset manager Rathbone.

Fitzgerald spent 13 years at the asset manager as an information security officer.

Joining him at Cobalt will be Bob Linton. Based in the trading technology provider’s New York office, Linton spent the past 13 years at Traiana.

As Finance Magnates reported last month, Linton, who is going to be working as head of connectivity and onboarding, will become the second Traiana executive to join Cobalt.

Anoushka Rayner, a former FX specialist at Traiana, was appointed global head of sales at Cobalt last November.

New support, new analyst

Also joining the post-trade services firm is Dan Evans. A former director of FX trading at UBS, Evans also has experience running his own consultancy firm.

He joins Cobalt as product Analytics lead and will be responsible for, amongst other things, developing new solutions for the company’s customers.

Alongside Evans will be Nitin Talwar, who has been appointed as head of support by Cobalt.

Previously with Bank of America, Talwar also spent three years as Natwest’s head of currencies production support for the Asia-Pacific region.

The new head of support got his career start at Credit Suisse where he spent almost a decade, including four years in an eFX role.

Last is Kamaldeep Bhachu, who will be working as a senior business analyst at Cobalt.

Bhachu has over a decade of experience in the financial services industry and has worked for some major firms, including Morgan Stanley, UBS and Royal Bank of Canada.

“We are thrilled to welcome Bob, Dan, John, Nitin and Kameldeep to [our] rapidly expanding team,” said Cobalt managing director Darren Coote.

“They bring a breadth of FX experience across the executing broker and Prime Broker space and have an intimate knowledge of the competitive landscape as well as financial institutions’ systems.”