Fallout from last month’s Black Thursday Swiss franc volatility has been varied among brokers, banks and trading venues. But one constant has been firms reporting that FX volumes have remained brisk across both the retail and institutional sectors. The trading activity which follows a strong last-four-months of 2014 has been assisted by a continuation of overall increase in FX volatility.

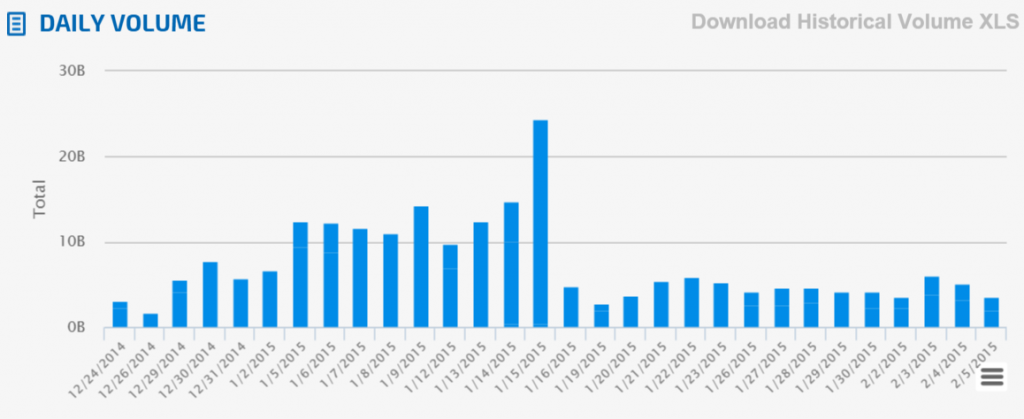

Contrasting the activity in trading volumes viewed across the industry is FastMatch, a provider of tiered Liquidity pools for different client types, with separate matching engines located in New York, Londo and Tokyo to reduce latency and fit needs of traders in different global regions. FastMatch recorded a daily volume record on January 15th, Black Thursday. Since hitting the record $24.349 billion figure on January 15th, daily volumes have been at a fraction of levels pre-Black Thursday, with an average of $4.647 billion, and a high of $5.99 billion that took place this past Tuesday. This activity compares with average daily volume of just above $13 billion for the first half of January.

FXCM Connection

An early investor in the platform, FXCM owns slightly below 40% of FastMatch. In addition, as a large stakeholder, FXCM’s institutional division has been an active reseller of FastMatch’s liquidity to their clients. However, the connection may be hampering FastMatch after the FXCM's revelation that it was on the hook for $225 million in client negative balances and was in need of emergency funding which arrived from Leucadia Financial.

In the day’s following Black Thursday, FastMatch’s CEO Dmitri Galinov publicly stated on social channels that the platform “operated normally” following the SNB’s decision to remove its EURCHF peg. He also directed those that were asking him about FXCM to their press statement of receiving funding from Leucadia. The overall statement from Galinov showed that the platform was being connected to the headline risk from FXCM.

Dmitri Galinov, CEO, FastMatch

Despite their connection to FXCM, answering questions from Forex Magnates, Galinov related that FastMatch continues to operate normally. Most importantly, even as many firms have been affected by prime brokers limiting credit arrangements, Galinov explained that FXPBs remain confident in FastMatch as Citibank remains the platform’s central clearing party to guarantee settlement of trades. In terms of his explanation for the decline in volumes, Galinov answered, “Some banks are staying away as they sort out their issues. However, as you see, volumes are coming back.”

Valuations

The question of whether the current decline in volumes is a longer term issue or simply one that will work itself out quickly may become an important issue for FXCM. As part of its plans to repay Leucadia, FXCM announced to shareholders that it would be looking to sell non-core assets. Among those, the firm’s institutional divisions as well as its stake in FastMatch were being linked as possible asset sales. FastMatch itself has also indicated that it is in the process of separating its operation from FXCM, as the two firms jointly use office space and some marketing services.

In an interview with Forex Magnates yesterday, when asked about what the non-core assets are , FXCM CEO Drew Niv didn’t provide a specific answer of what they are planning to sell, but did refer to the institutional division when he stated, “Over the past few years, the company has spent over $250 million dollars making strategic acquisitions building up our non-core businesses, mainly the institutional side as we tried to diversify the firm.” He added though that they aren’t in a rush to sell assets.

With many assets now possibly up for the sale, how much FastMatch is worth becomes an important question. In terms of a potential valuation for FastMatch, during presentations to analysts in the past, Niv has noted its market share growth compared to major players such as EBS and Reuters, as well as specifically making comparisons to Hotspot FX. Hotspot itself has announced that it is being acquired by BATS for $365 million.

With peak FastMatch volumes being reported at around 33% of Hotspot, it would create a potential valuation of $100 million or higher for FastMatc and around $40 million for FXCM’s stake. However, that figure would be dependent on FastMatch proving that volumes will rebound in the future and that an exit of FXCM ownership will not impede the platform negatively.

Worth noting is that in its current setup, FXCM appears to be benefiting as a large equity holder in FastMatch. The platform reports in its fees schedule: “Clients that own more than 20% of equity interest in FastMatch, Inc and NOT using services of central clearing counterparty" are entitled to free trading and market data. As such, refraining from sending order flow of their institutional clients to FastMatch may not be economically beneficial to FXCM.

What may ultimately occur, though, is that FXCM sells a portion of its stake in FastMatch. This would be similar to the arrangement in 2013 when BNY Mellon acquired a stake in FastMatch. Such a scenario would allow FXCM to retain the longer term economic benefits of being a major stakeholder in FastMatch, while providing some of their short term funding needs. For FastMatch, the possibility of additional minority owners could provide greater exposure for the platform, especially if a strategic buyer emerges that will market the platform to its users.