Divisa Capital, one of the most rapidly developing prime brokerage service providers in the industry, is continuing to roll out new products that are aimed at capturing more market share. The firm, which earlier this year secured a significant investment in the Middle East, is rolling out a proprietary Trading Platform .

Commenting on the launch, the CEO of Divisa Capital, Mushegh Tovmasyan, said: “The launch of the new trading platform brings significant improvements to Divisa Capital’s offering. We are very pleased to provide our clients with a new generation technology platform that provides a more efficient, highly secure and customised trading experience. It will also strengthen reliability, performance and execution quality demanded by users.”

New Markets

Divisa Vault is developed with the needs of institutional traders in mind. While the company is already successfully delivering its services via MetaTrader 4, the new solution is aimed at professional clients like asset managers, banks, pension funds, hedge funds, etc.

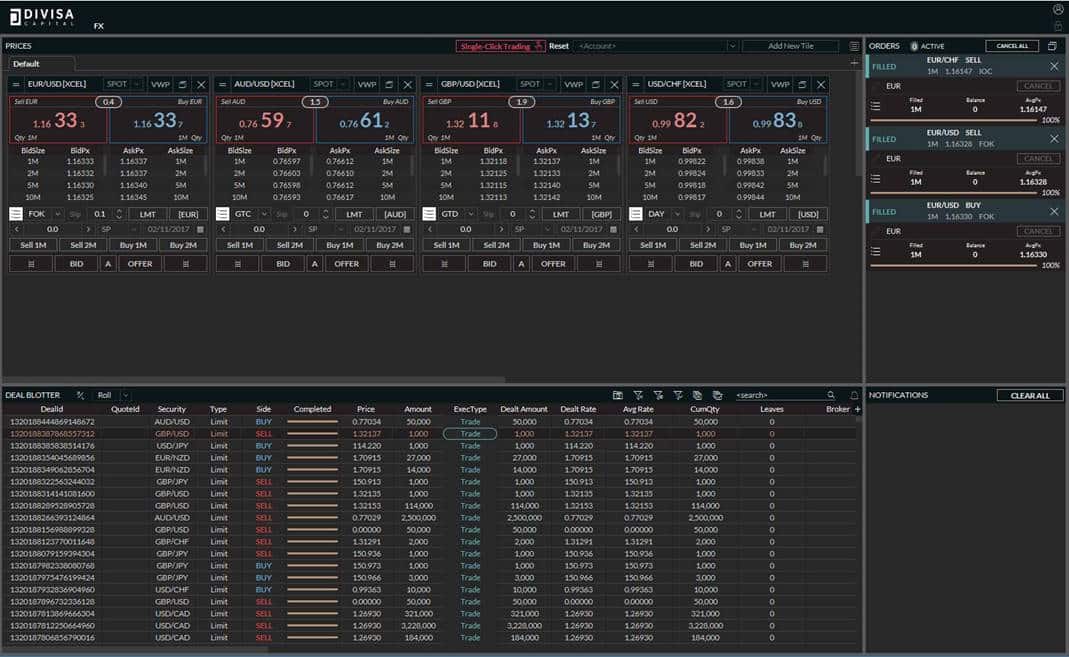

A look at the new proprietary trading platform from Divisa Capital

Hormoz Faryar

Commenting to Finance Magnates, the Head of Institutional Business at Divisa Capital, Hormoz Faryar, said: “Our new trading platform gives traders access via API through the desktop application or HTML5 via the web-based solution.”

“We are initially deploying the offering to cater to clients that need direct access to a prime broker. The new solution grants our clients faster and deeper access to our Liquidity partner BNP Paribas,” he added.

The company’s in-house tier-1 prime brokerage partnership with BNP Paribas enables clients using Divisa Vault to directly access liquidity across multiple global server locations in New York, London and Tokyo.

The integration of multiple products enables clients to access margin credit across FX, Precious Metals, NDFs, and CFDs. Divisa Vault also has an internal FIX engine that makes the trading platform one of the fastest, most powerful and modern in the market and differentiates it from open-source based FIX integrations.

Divisa Vault is available to clients that are using both principal and agency setup.

Retail Rollout Planned for Coming Quarters

The service is for the type of clients that the company hasn't been able to onboard with its MT4 offering. The firm has signed up several large institutional clients that are already using the platform.

“The next phase of our Divisa Vault roadmap is the deployment of a more retail-friendly solution which will also include a mobile app. For the time being our focus on HTML5 enables us to cater to the mobile needs of institutional clients. The functionality of the web-based solution includes 99 percent of the desktop platform’s features,” explained Mr Faryar.