QuantHouse, a trading technology provider, has announced on Tuesday its partnership with EliData, a trading and order routing applications developer, to offer QuantFEED market data into the EliData Smart Order Router (SOR).

“In an increasingly fragmented world, financial institutions need access to a wide range of venues and asset classes to execute their orders, and QuantHouse expands our reach beyond our existing set of venues and systematic internalizers,” Marco Connizzoli, CEO, EliData, said in a statement.

Based in Italy, EliData’s applications are focused on the capital markets players and it also offers solutions for data exchange between the front office and the back office systems.

It has already deployed EliData SOR using QuantHouse market data for an unnamed tier-one financial institution in Spain, the announcement added.

“Our SOR was originally developed with MiFID I in mind and over time has been enriched to be MIFID II compliant, ensuring that our customers can meet their best Execution requirements,” Connizzoli added. “We look forward to seeing more clients benefit from our collaboration with QuantHouse.”

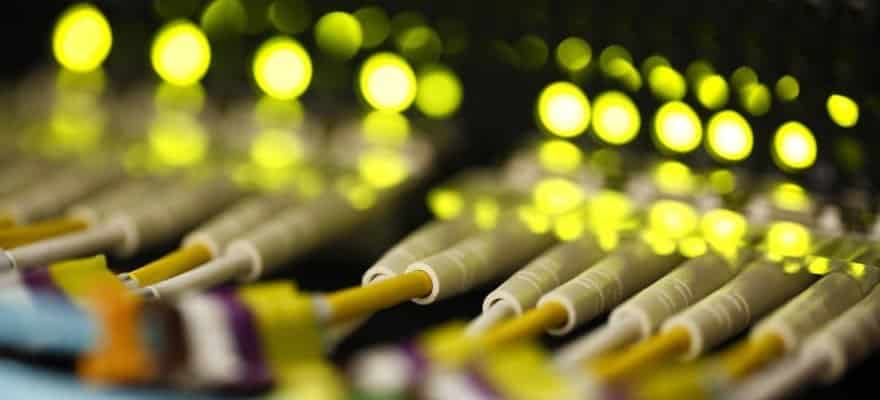

Access to market data always remains in demand

QuantHouse normalizes and disseminates market data from more than 145 Exchange data feed into QuantFEED and offers them with a single API. The company also offers QuantFACTORY, an algo-trading development framework, and QuantLINK, proximity Hosting , and order routing services.

The client of the company also include mammoths like Goldman Sachs.

“We are delighted to see a major financial institution in Spain benefit immediately from the EliData-QuantHouse tie up,” Gilles Antoine, business development director EMEA at QuantHouse. “We consider Spain and Italy key markets and adding EliData as a local partner in Spain, Italy, and wider across into Europe helps bring more choice of order execution to traders in the region.”