The North Ireland-headquartered technology provider that is listed on both AIM and ESM, First Derivatives (FD) PLC, a leading provider of consulting and software services for the capital markets industry, today announced its preliminary results for its year that ended February 29th, 2016.

The results were released in regulatory filings with the London Stock Exchange (LSE) earlier today and highlight that the company realized a 41% increase in revenues for its 2016 year with £117 million reported (roughly $169 million at today's rates) – compared to £83.2 million for its prior year that ended February 28th 2015.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Top-line improvements

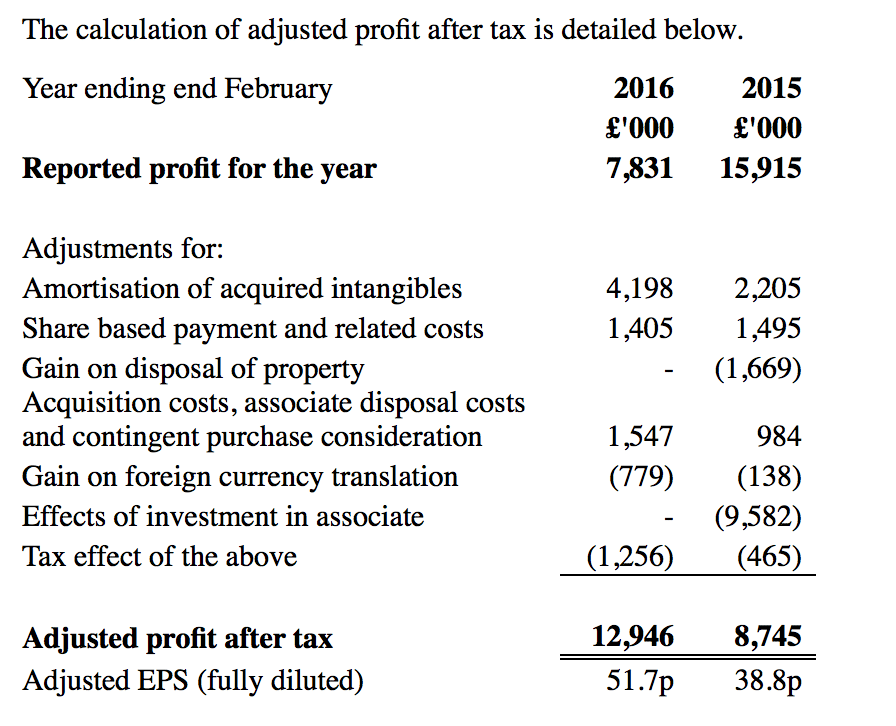

FD reported a full year dividend of 17 pence per share, up 26% from 13.5 pence reported for the prior year, and its adjusted earnings per share (EPS) was up 33% on a diluted basis to 51.7 pence per share from 38.8 pence over the same period.

The company saw mostly broad improvements to its top-line numbers for the reported year, which should trickle into the current year in terms of momentum from key business drivers.

Adjusted profit before tax also rose 56%, £16.8 million up from £10.8 million Year-over-Year (YoY), while on a non-adjusted basis profit before tax was down 41% to £10.8 million from £17.5 million over the same period, and reflecting various adjustments related to disposal related gains, finance translations of income/charges, acquisition costs, and exceptional tax items on EPS, and other expenses.

The company acquired Affinity Systems and ActivateClients as it set to extend its software revenues beyond just capital markets.

Excerpt for First Derivatives preliminary results for year-ending February 29th 2016.

Record new software wins

FD said its consulting revenue was higher by 29% and reached £75.0 million compared to £58.3 million for 2015, and was driven by mostly recurrent revenues as well as multi-year contracts with large investment bank clients.

The amount of revenue from the company’s software segment was also higher by 69%, and up 27% organically, after it reached £42 million for 2016, and up from £24.9 million year-over-year.

This increase was cited on a record number of new software wins during the year across the company’s capital markets products, and which are also expected to benefit the current financial year, according to the update. The company spent £6.8 million on research and development (R&D), up from £6.6 million in the prior year.

Compliance in focus for clients

FD Chairman Seamus Keating commented in the report: "This was another successful period for FD, with progress across the Group resulting in record results and positioning us strongly for future years. In consulting we are becomingly involved in client projects earlier and in a more strategic way, leading to deeper relationships and enabling us to maintain our high level of revenue visibility as we scale up. In software, technology trends continue to move in favour of our Kx technology platform, which is world leading in its big fast data capabilities.”

Mr. Keating added: “Software contract wins in capital markets accelerated through the year, driven by strong feedback from reference clients and our ability to assist our clients to address issues such as compliance and Regulation . We are also pleased with developments in other markets for our software and in particular utilities and digital marketing, where we are already generating revenue. We expect another year of strong growth, at least in line with market forecasts, while continuing to invest for growth in the future."

Shares of FD were up half of a percent following the news, and traded near the 1800 pence mark just 20 pence shy of last week's all-time high in London.