The Bank for International Settlements (BIS) today released its quarterly review, covering the dynamics of the entire financial markets' economy worldwide, focusing on two poignant aspects relating to the FX world.

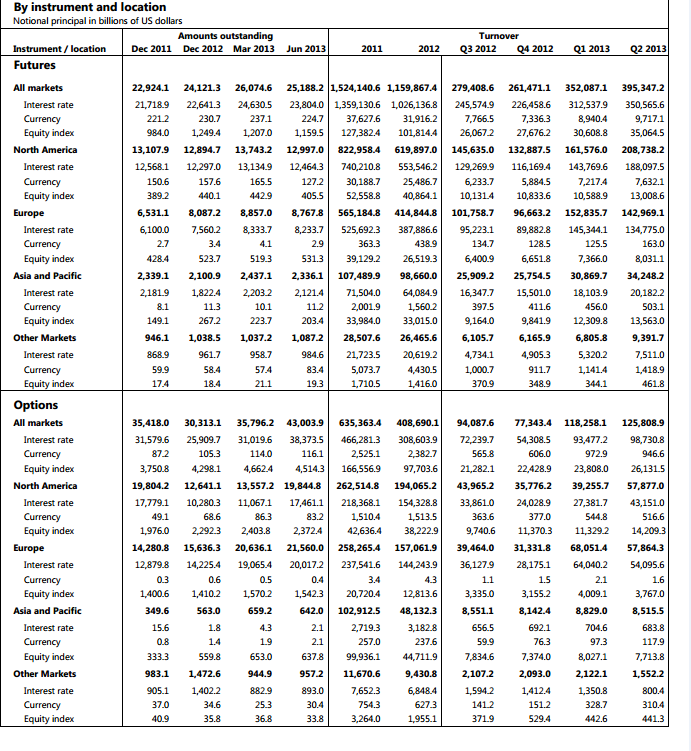

The review details, that cross-border claims of BIS reporting banks, were broadly stable in the first quarter of 2013, and that derivative financial instruments traded on organized exchanges, had risen across all markets from $470,345.2 billion at the end of the first quarter of 2013, to $521,156.1 billion by the end of the second quarter of this year.

FX Transactions Continue Upward Dynamic

In congruence with the increase in trading activity across the world’s venues relating to all financial instruments, FX transactions rose substantially in the second quarter of 2013 to $10,663.7 billion, compared to $9,913.3 billion at the end of the first quarter. Despite the initial stages of this year demonstrating a global recovery of volumes from last year, in which the last quarter’s currency trading activity across all exchanges, was only able to muster $7,942.3 billion.

Despite the retail FX mass divestment from North America, leaving the region's FX industry to focus almost exclusively on the institutional side of the business, during which large numbers of retail FX companies offloaded their US operations due to the cost of operating, reducing the viability of gearing a service toward retail customers, volumes were up substantially from last year. This year’s statistics reflect that the effect of losing a number of retail traders has not impacted overall volumes, the total being $8,148.7 billion in the second quarter of 2013, compared to $7,762.2 billion in the first quarter.

European venues have built steadily on their FX trading volumes over the second quarter, with $164.6 billion in volume, signifying a worthwhile increment over the results of the first quarter, during which $127.6 billion of FX was traded on European exchanges, mostly comprising currency futures contracts, as currency options remain low on the priorities of European traders.

Asia Continues To Generate Large FX Volume

The BIS report further strengthens the announcement which was made last week by the Singapore Monetary Authority, that Asia still represents a profitable location for FX companies, with Japan at the forefront of retail FX trading volumes, and Singapore the largest institutional FX center in Asia, as currency trading in the Asia-Pacific region rose from $553.3 billion at the end of the first quarter of this year, to $621 billion at the end of the second quarter.

It is important to note that the figures cited here encompass a sum total of both currency futures and currency options trading volumes. The separated figures are detailed in the table below.

Derivative Financial Instruments Traded On Organized Exchanges