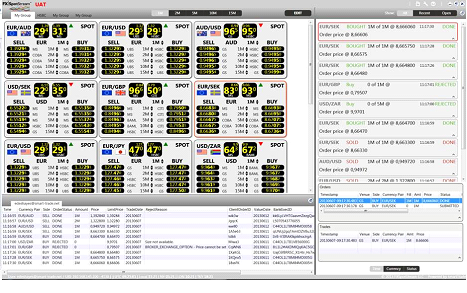

FXSpotStream, a subsidiary of LiquidityMatch, and multi-bank aggregator of FX spot Liquidity , has announced the launch of desktop application. The product adds to their existing API based aggregation feed. The launch comes a year after the firm deployed its aggregated liquidity feed through an API connection, and offers clients the ability to access prices from the existing Liquidity Providers , which include BofA Merrill Lynch, Citi, Commerzbank AG, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley and UBS. The desktop application is supported by multi-asset liquidity and data technology provider, smartTrade Technologies.

According to Alan F. Schwarz, CEO of FXSpotStream, the launch of desktop version of their multi-bank pricing was based on meeting customer demand as well as providing a product that can be deployed faster by clients, as he stated “clients have been asking us to offer access via a Desktop Application to the same value proposition we currently make available on the API. The Desktop Application complements the existing API offering and will allow us to attract additional clients who will benefit from a commission and cost free Service. With the Desktop Application we significantly reduce the time it takes for a client to access in one place up to 8 liquidity providers. As with the API, the Desktop Application offers clients and banks the ability to transact in a transparent, fully disclosed bilateral basis. Additional enhancements to the Service are in process as we continue to listen to our clients and address their needs.”

Also commenting on the launch was liquidity partner, BofA Merrill Lynch, where Liam Hudson, the firm’s Managing Director and Global Head of FX Ecommerce Trading, stated "the aim of the Desktop Application is to replicate for manual traders the successful API price aggregation offering by allowing them to view on one screen prices from FXSpotStream’s liquidity providers. With the addition of the Desktop Application we expect the volumes currently supported by FXSpotStream to continue growing. FXSpotStream continues to address our needs and those of our clients and is able to do so in a cost effective manner.”

FXSpotStream Desktop Application UI