The debate of man versus machine has been going on for decades.

It was 1929 when an agent for a steam drill company showed up at a tunnel building site with a steam engine powered drill. The agent told the manager there that the steam engine would replace many workers. A man named John Henry took pride is his work and took exception to a machine taking his job and the jobs of other good men. He challenged the agent to race his steam drill against him. As legend has it the race went on all day and night and part of the next day and John Henry defeated the steam drill.

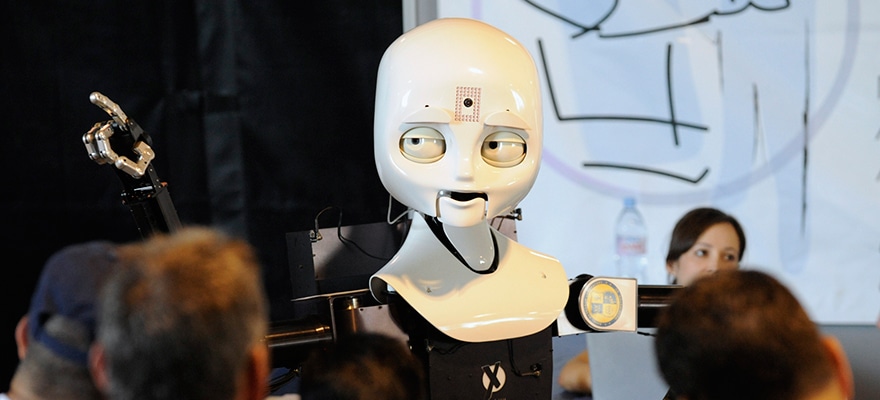

Recently, this debate has crept into the world of financial markets. Perhaps crept into the market is not the right adjective, more like kicked the door in on the financial markets.

In 1971, NASDAQ was the world's first electronic stock market. Though it was originally operated as an electronic bulletin board, it was the onset of what would eventually become a shift in how the world's exchanges conduct business.

Electronic trading is in great contrast to older floor trading and phone trading. It has distinct advantages and disadvantages.

By 2011, investment firms and banks would increase their spending on technology for electronic trading drastically. Many floor traders and brokers were removed from the process- as the firms increasingly started to rely on algorithms to analyze market conditions and execute their orders automatically.

Electronic trading is lauded as having lower transaction costs. By automating dealing with straight through processing (STP), the price of doing a trade becomes less expensive as we eliminate the “John Henrys” who trade, process and monitor trades. Soon enough, after the technology groups that maintain and fix the trading systems, the next level of trading room personnel will be the person stocking the refrigerator.

It is said that electronic trading provides greater Liquidity and greater competition through tighter spreads. Sure. This is true. Until market news and geopolitical events cause market anomalies at which point you are at the mercy of a system with no common sense or logic in its decision-making. Algos and ECNs rush to hit bids or take offers no matter how off the market they are, and the cost is transferred to the investor. I'm sure we all remember the recent debacle in the Swiss franc.

While human traders have been stereotyped as being dishonest, manipulative and greedy, the electronic platforms can be described in the same manner. Electronic front running of trades abounds. The competition between technology firms continues to increase –driving electronic capabilities towards light speed. At some point this speed becomes impossible to maintain and extremely risky. At no point does an electronic system take a step back and use rational thought about where the next bid or offer should be. If by chance it deals at a price well off the market the cost is simply transferred to the investor. If that isn't dishonest, manipulative and greedy –I don't know what is.

So is electronic trading faster? Yes. Is that always an advantage? No. Does it supply greater liquidity? Sure, until markets become chaotic– at which point anything goes and there is no accountability. There is no doubt electronic trading is here to stay; however, a greater balance with human traders needs to be restored.

DO NOT MAKE ME CALL JOHN HENRY! Oh, I forgot to mention, after he beat the steam engine, he collapsed and died.