A key infrastructure provider within the global FX industry, Traiana announced that ICAP Futures and Options (a business of ICAP Plc) has chosen the Traiana Harmony Network for connecting their client connectivity layer. This brings the total number of Futures Commission Merchants (FCMs) on the Harmony Network, as it relates to Exchange Traded Derivatives (ETDs) to 13 and up from the previous announcement.

As the need builds for real-time visibility and transparency of exchange-traded derivatives, the Harmony Network aims to do just that, by bringing a harmonic efficiency to the post-trade workflow via automation processes and reducing operational risk by quickly identifying and reconciling any trade-break between counterparties.

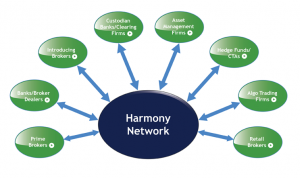

The Harmony Network links over 500 companies including major banks, prime brokers, buy-side firms and technology companies provide financial institutions with services to automate post-trade processing of transactions in listed and OTC markets.

The ICAP Connection

The company is owned in the majority by ICAP Plc which earlier in January 2013, sold a stake of Traiana to several of its leading FX-bank customers in order to align mutual interests, according to information on its corporate website. Triana has been on the forefront of post-trade risk and information services, having launched CLS Aggregation Services LLC (CLSAS), a joint venture between Traiana Inc and CLS Bank, operator of the world’s leading FX settlement system.

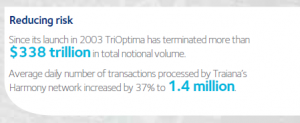

According to the latest ICAP annual report, the average daily number of transactions processed by Traiana's Harmony Network increased by 37% to 1.4 million (for the 2013 year ended March 31, as per the report).

Pre-Trade and Post-Trade Solutions

Traiana's business is well diversified into the pre-trade processing and information business in addition to post-trade, with the latest announcement regarding the CreditLink venue-neutral solution for the newly launched Swap Execution Facility (SEF) segment in the US, in addition to its applicability for designated contracts markets (DCMs) and central counterparty (CCP).

According to people close to the company, with regards to the announcement today, ICAP Futures and Options chose to work with Traiana due to the strength of its execution offering, and it was therefore a business decision taken on merit, as told to Forex Magnates' research team.

Forex Magnates also reached out to ICAP directly with regards to the drivers behind the selection of Traiana and its relationship with ICAP. Gary Pettit, Executive Managing Director of ICAP Futures and Options explained to us how the fit was ideal, he said, "ICAP chose to engage with Traiana as a solution provider for their post trade requirements because they had the best offering. By providing bespoke solutions that were fit for purpose, it made them the ideal STP partner for ICAP Futures and Options. The listed derivatives business has a growing customer base which have specific demands; ICAP understands the need to facilitate these often sophisticated needs and Traiana’s Harmony network is best placed to provide the solution. Having a common ownership framework was a fortunate coincidence. Finally, we are a large user of options but this didn't influence our decision to use the product."

Source: ICAP 2013 Annual Report

Mr. Pettit also commented in the official press release regarding the selection, “As ICAP’s global exchange traded derivative network continues to grow we have selected Traiana to provide STP connectivity direct from our execution platform in order to best facilitate the expanding requirements of our customers. We look forward to developing this relationship into other technology areas in the future.”

Traiana’s Harmony Network enables FCMs to provide real-time visibility of exchange- traded derivatives trades to their clients, enhancing client service and increasing transparency. At the same time, Traiana Harmony reduces operational risk by managing the entire reconciliation and allocation process in real-time and improves operational efficiency, providing STP connectivity to executing and clearing counterparties.

Mr. Nick Solinger, Head of Product Strategy and Chief Marketing Officer of Traiana

Nick Solinger, Head of Product Strategy and Chief Marketing Officer of Traiana, commented in the official corporate press release regarding the announcement, “The addition of ICAP Futures and Options to the Harmony ETD network underlines the flexibility and scale of our offering. Adding connectivity from a wide range of ISV trading platforms to enhance ICAP’s offering is a further step in expanding the Harmony execution and clearing platform.”

Diversification Efficiencies

In addition to some of the advantages noted previously according to the press release, Traiana Harmony also reduces operational risk by managing the entire reconciliation and allocation process in real-time and improves operational efficiency, providing STP connectivity to executing and clearing counterparties.

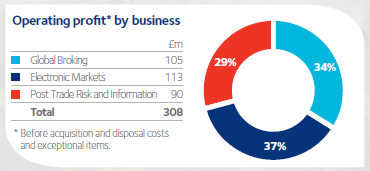

In its most recent annual report, ICAP Plc highlights the intention to develop new initiatives as Traiana expands into new asset classes. Part of the logic behind this intent can be seen in the significance as part of total revenues that are attributable to Traiana's business and its affect on ICAP's bottom-line.

Source: ICAP 2013 Annual Report

The Post Trade Risk and Information business of ICAP comprises a portfolio of risk services businesses including: Reset, ReMatch and TriOptima, the transaction processing business, Traiana, and the information business which together provide services to more than 3,000 customers.