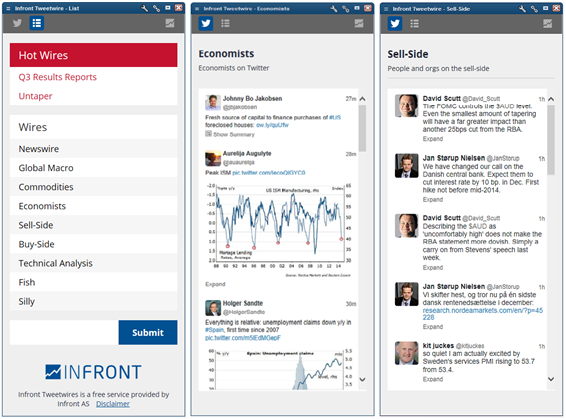

As the challenge of extracting valuable data from within social media becomes increasingly complex, Oslo-based technology provider Infront, that serves real-time market data to Buy-Side and sell-side institutions across Europe and catering to retail and professional users in over 27 countries, today announced Infront Tweetwires, a service aimed at filtering Twitter for relevant finance related news.

The company which was established in 1999, and with offices across Scandinavia, has positioned the new service as a standalone product and is integrated within the company’s platform that is used by banks and brokerages to provide institutional and retail clients with cost-efficient electronic trading solutions. Forex Magantes spoke directly with Infront’s Head of Marketing, Adam Walhout regarding the new Tweetwires and Mr. Walhout said to us,

“Twitter has become important as a serious source of real-time, unfiltered news and sentiment. Those involved in the foreign exchange markets can benefit from a wealth of individuals and organizations sharing and discussing FX-related news, opinions and even research, but filtering relevant content from the noise can be daunting.” Mr. Walhout concluded, “Infront Tweetwires aims to do this hard work, sifting the news from the noise and helping users get the best of Twitter.”

It's all in the Tweets

Source: Infront Platform

According to information on its official blog, Infront Tweetwires aims to continually monitor and curate wires focused on topics of interest to its users, with relevant tweets from opinion leaders and organizations in the know.

When market-moving news breaks, Hot Wires on-the-fly are created that provide infront users the raw news in real-time, and even stay ahead of the media as from time-to-time certain news first breaks on twitter before hitting press wires.

As per the description, Tweetwires is integrated into the Infront platform and available on Infront version 5.6 by clicking the Tweetwires' button in the Infront toolbar for instant access, and clients running an older version of Infront can simply upgrade by selecting Get Latest Version from the tools menu.

Forex Magnates' Scoop

According to Forex Magnates' research, there are only two ways to take data from Twitter, (aside from straight through a twitter login) one is via Twitter's own developers API which has significant limitation on the terms that can be tracked and amount of data that can be pulled. Secondly, is via Twitter's authorised data resellers (i.e. Datasift, Gnip, Topsy or NTT in Japan). Infront appears to be using standard Twitter lists, which are pulled from neither the Developers API or resellers, as told to Forex Magnates by a company spokesperson. Instead, Infront has created the lists manually using standard widgets and covering about 10 subjects that each contain lists of anywhere from 30 to 300 twitter accounts that are deemed worthy curators or sources of news.

While this approach may only represent a fraction of the entire Twitter world, it may still reveal a sufficient sample as to what may be happening on a larger scale. The reminder of the complexities in accessing and processing the entire Twitter 'firehose' is a significant challenge for the latest technology companies aiming to do what products like those from Infront strive to achieve today.

The Deeper Challenge Behind Filtering Twitter for Finance

Even while removing much of the noise from with the twittersphere, financial related results (and sentiment) may still contain that of traders' opinions and chatter which are discussions about underlying assets rather than the news that is actually affecting their prices.

This challenge, of separating the two, is something that Forex Magnates is researching closely with company in the search space - as the often extensive required taxonomy of keywords and library of correlated assets and news that need to be searched for, parallel with finding related news affecting underlying assets is at the heart of the challenge, and a computationally and operationally intensive endeavor (especially when attempting to access the estimated 450 million tweets per day and performing thousands of queries parallel to searching through them from moment-to-moment).

Nonetheless, this is an interesting space and if the Twitterwires' service from Infront can provide extra value to the company's clients and can be used in a meaningful way, then this may complement an already diverse technology offering as the need for making sense of social media feeds as they relate to breaking news affecting the price of securities become more apparent.

Source: Infront Twitterwires

As Infront aims to help its clients stay in-front (pun intended), its ability to provide Foreign Exchange related services continues to be an integral part of its business which is largely focused on catering to securities related brokerages, as can be seen on its official corporate website goinfront.com.

As FX continues to see adoption from companies across other asset classes, such as stock brokerages and broker dealers in the exchange traded securities markets, the ability for firms to maintain a robust Forex offering becomes more important.

Infront strives to achieve this with the Infront Professional Plus, its desktop terminal that provides clients access to the following FX Data, among other asset classes:

- World Forex Plus: A consolidated feed with FX Spots and Forwards from leading global banks and dealers

- Contributed feeds from Nordic banks with FX Spots, Forwards, Deposits and other Money Market data

- Inter-dealer broker data from Tullett Prebon, including FX Spots, Forwards, Deposits and other Money Market data

- FX Futures and Options from CME

- Currency fixings from Nordic Central Banks, including TCW- and KIX-indices

- Currency indices from MSCI

- Dow Jones Global FX and Fixed Income News

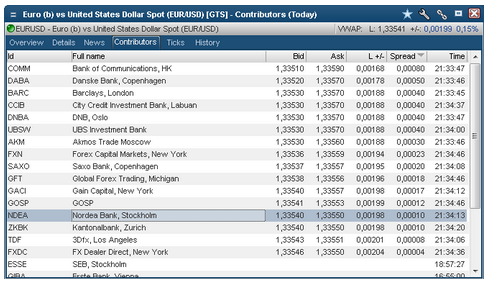

Source: Infront Contributors FX Rate Feeds Window

From with the Infront terminal there is a Symbol Overview window on the World Forex Plus feeds. This provides a view through a contributor's tab, that shows the latest tick from each FX rate contributor. In addition, a ticks tab, a different display, shows each tick in chronological order.

According to information on its corporate website, InFront has been listed in Deloitte Technology Fast 50 for 8 years running, and the firm also has ownership in a Stockholm- based financial news company, News Agency Direkt.

As the Twitter Initial Public Offering (IPO) is set to go live today on the NYSE, the growth of 3rd party services and applications that aim to integrate with Twitter, in addition to the plethora that already exists, may increase as more data becomes available from the soon-to-be publicly traded company -especially as it relates to financial services companies.