The agreement for calculating data for the USD Interest Rate Swap ISDAFIX benchmark between the International Swaps and Derivatives Association (ISDA) and ICAP Plc has come to an end, Forex Magnates confirms.

ISDAFIX publishes daily fixings for Interest Rate (IR) swaps across six different currencies via data submitted from banks to 3rd parties such as ICAP and Reuters (who would in turn provide ISDA the compiled data or provide a third-party to publish- such as on Bloomberg, Telekurs and Thomson Reuters' terminals).

Until now, ICAP had provided the USD-based calculations (which were sent to Thomson Reuters), whereas the non-USD-based fixings were handled by Thomson Reuters entirely.

Tri-Party Agreement between ICAP, ISDA and Thomson Reuters

Under the new change, Thomson Reuters will handle all currencies covered from the total of six, including all USD and non-USD ISDAFIX benchmarks (four of which remain operational). Banks supply the same rate that would be provided by them as dealer (in a bid/ask price) on a trade with a notional value $50 million, or whatever rate is deemed market size in a given currency, based on ISDA fixing guidelines.

Forex Magnates confirms ICAP will no longer provide the daily calculation (compiled from contributing banks) for the USD ISDAFIX, according to an ICAP spokesperson who said,“We appreciate ISDA’s interest in having a consistent polling process across each of the relevant currencies and fixings. ICAP has assisted with the ISDAfix process for more than 15 years, including collecting submissions and providing market-based reference points for US Dollars ISDAfix. As swap market structures evolve, we remain committed to participating in the development and administration of benchmark processes where we can add value to market functioning and transparency.”

Accordingly, the broker will no longer be collating the trade data from banks for the daily ISDAFIX for the US Dollar - the only currency of the four currently operational under the ISDA administered benchmarks, and this change will not have any significant or material impact on ICAP's broking or data revenues, as told to Forex Magnates' reporters by people close to the company.

The process used to calculate the daily benchmark for Interest Rate Swaps across the six currencies is aimed to become more standardized with one provider instead of several, according to people familiar with the matter, as contributing banks are polled for dealing prices for IR swaps.

ISDA looks to Streamline, No Material Impact on ICAP Volumes or Revenue

The ISDAFIX benchmarking service for annual swap rates for swap transactions worldwide is undergoing a more standardized approach, and in accordance with principles on benchmarking standards set out by the international group of regulators made up of the Madrid-based IOSCO organization, as well as in an effort to automate the process via live prices from Multilateral Trading Facilities, as told to Forex Magnates' reporters by people close to the developments.

The news comes days after IOSCO announced its 100th member had signed its Multilateral Memorandum of Understanding (MMoU) as cross-border regulatory cooperation reaches new heights, alongside the increased attention given to IOSCO related research concerning globalized challenges shared by collective market regulators.

![ISDAFIX example [source: ISDA]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/01/ISDAFIX-example.jpg)

ISDAFIX example [source: ISDA]

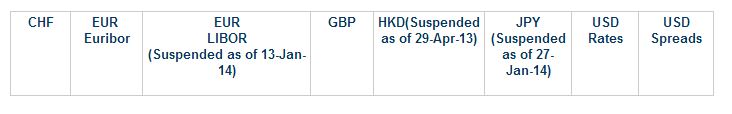

From the seven ISDAFIX benchmarks based on six currencies, three had been previously put on hold by ISDA - including the Japanese yen and Hong Kong dollar and Euro Libor, and the four that remain operational consist of the US dollar, Euro Euribor, Great British pound, and Swiss franc.

From these four, ICAP plc was handling the USD-based one, by colatting prices from banks and then submitting the data to Reuters which then published the information to its systems.What has changed is that ISDA, in an effort to standardize its process, has chosen to use Thomson Reuters to handle the US dollar related USDAFIX calculation instead of ICAP, thereby focusing on one provider and process as outlined above.

Benchmarking Under Scrutiny after Rate Rigging Cases and FX Probe

While ICAP has been compiling the data for some 15 years, according to recent reports by Reuters, its rival competitor on the FX side, the media side of the company reported that recent regulatory actions against ICAP regarding the role of certain of its brokers in Libor-rigging may have put it under the regulators' watch, as covered by Forex Magnates.

ISDA had previously announced the suspension of several key ISDAFIX benchmarks for several currencies currently put on hold, as can be seen in the graphic below:

The rates provided by contributing banks are done via a voluntary polling mechanism, where if not enough providers supply a price, then a detailed contingency plan follows extending time, and in the worst case, will not fix but instead fall back based on 2006 ISDA standard definitions.

Concerns have been voiced by people in this business that if not enough live market rates are polled from contributing banks, then much of the expected benefits of the benchmarks could be lost, especially as data is voluntarily provided as opposed to collected from a MTF, as explained to Forex Magnates' research team. For example, the recent suspension of the ISDA Euro Libor fixing was attributed to a lack of data submitted by contributing banks, in the case of a voluntary submission model.

After the Libor rigging scandals, regulators were said to have considered content from actual trade data as better than just polling contributors for an RFQ-like quote.

Using explanatory data on the ISDA website, it describes that during the polling window panel members may update or amend a rate that they have contributed. Following the window, contributed rates can not be amended or withdrawn and are considered final.

Contributions collected by ICAP and the rate calculated by Thomson Reuters (USD, USD Spread), are described as follows based on information excerpted from the ISDA's website:

ICAP collects spread information from contributors via a secure website that contributors log into every morning. Contributors are asked to indicate the USD swap spread as of 11:00 am, in accordance with the criteria set by ISDA as detailed above. At 10:58 am, ICAP will send an email reminder to each contributor reminding them to contribute. At 11:02 am, ICAP will indicate on the secure website a USD swap spread and USD swap rate to serve as a reference point for contributors. This reference point is generated from two sources of information:

(1) Information contained on Reuters page 19901 at 11:00 am, which reflects the most recent swap spreads from completed trades and executable bids and offers in market size done/posted at ICAP.

(2) Information reflecting executed trades and executable bids and offers at 11 a.m. for US Treasury securities from ICAP’s BrokerTec US Treasury electronic Trading Platform .

By their nature, because both sources of information reflect completed transactions and/or at-risk trading interest, ICAP considers them to be a useful and meaningful reference point for where the market may be at that point in time.

From 11:00 am to 11:15 am, contributors are able to submit their swap spread information and rate to the secure website. In terms of process, contributors may accept the reference swap spread and/or rate indicated on the website, or submit different values. During this time the ICAP swaps desk monitors dealer participation to ensure that the 10-bank minimum is met. As contributors submit spread and rate information, the values are sent to Thomson Reuters on a streaming basis.

At 11:26 am, Thomson Reuters will calculate the USD ISDA FIX rate by eliminating a given number of the highest and lowest rates submitted, and then by calculating a simple average of the remaining rates. A rate will be posted as long as the Minimum Number of Contributions are received (Please see the pdfs attached under “What currencies and rates does ISDAFIX cover?” for the minimum number of contributions required to fix, and the given number of quotes that are topped and tailed.)

The ISDA recently joined two other industry groups in a class action suit against the CFTC, following regulatory changes in the U.S. that is thought to be burdensome surrounding Swap Execution Facility's and related administrative and compliance rulings, as covered by Forex Magnates previously.

Thomson Reuters Announces Suite of Tools for Benchmarking Transparency

The news regarding ISDA today coincides with a parallel announcement by Thomson Reuters regarding a different but related matter, namely a suite of tools it launched to help meet customer needs as well as brokers regulatory obligations with regards to benchmark related pricing and compliance, according to an official press release by Thomson Reuters.

The new solution from Thomson Reuters combines content, Analytics and visualization tools in a managed services environment, as described in the press release, and as part of the solution, financial institutions can use a new capability in Thomson Reuters' Enterprise Platform that embeds a unique identifier (Visual Publishing Identifier) alongside a published price or rate.

This was described as providing detailed insight into publisher information across a firm’s entire workflow.

The tools and data were noted as being able to be integrated into a firm's current auditing and reporting tools, allowing them to perform tasks such as tagging, analysis and setting alerts based on configurable parameters. The expected value of this was explained as providing complete transparency for compliance monitoring, and enabling financial institutions to spot potentially suspicious trading or submission activity.

Brennan Carley, Global Head of Platform, Thomson Reuters

“Thomson Reuters looks to support the financial industry in multiple ways to improve transparency and manage operational risk in today’s evolving markets,” said Brennan Carley, Global Head of Platform, Thomson Reuters. “The new capability gives our customers the detailed level of transparency into contributed data that they need to ensure they can effectively monitor activity and be in a stronger position to satisfy evolving global regulations.”

The announcement from Thomson Reuters today follows a previous announcement the company made surrounding an improved compliance capability in detecting suspicious trading activity, as the subject of Foreign Exchange rate and benchmark rigging investigations have gained global media attention prompting new such measures to be implemented.