London based MarketPrizm, a provider of ultra-low latency market data and trading infrastructure services, has announced that it is extending its range of market data products to offer historic data. The firm will offer high quality historic data from major exchanges to financial services firms. The data can be downloaded and used for simulation models to test investment strategies before putting them into the live market.

After extensive research in the market, MarketPrizm has found that the quality of data is a key factor for users when assessing solutions. MarketPrizm will provide full depth historic data captured and time stamped in Colocation , with the initial phase covering the most recent three months’ worth of historic data. Data will be provided for the markets where MarketPrizm currently offers data services and will cover equities, commodities and derivatives.

Tanuja Randery, Chief Executive Officer of MarketPrizm

According to a spokesperson at MarketPrizm, the service will capture the most recent three months’ worth of historic data. In addition, the Technology Provider will offer users the ability to take advantage of MarketPrizm’s infrastructure for data storage and delivery, thus eliminating the need for them to set up and maintain their own data storage solution. Instead, clients will be given a log-in to access the data in which they are most interested and for which they are approved. The European infrastructure will be based in London while the Asia infrastructure will be based in Tokyo.

MarketPrizm recently announced the launch of its Hong Kong office, thus signifying the firms growing nature and the wider use of low latency solutions in Asia.

The new service will initially be rolled out in Europe in Q4 2013, after which it will be available in Asia.

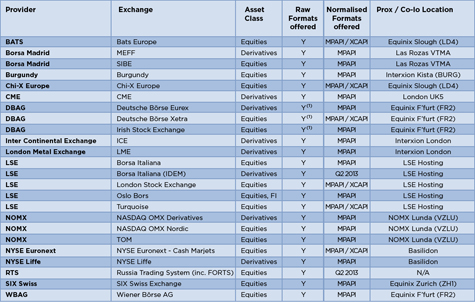

List of exchanges that are currently available with MarkePrizm, the firm intends to launch its new service on these