An equity deal that values Markit at roughly $5.9 billion has been reached where business research provider IHS Inc, listed under ticker IHS.N, will acquire nearly 57% of the newly combined company, bringing the Merger value to just over $13 billion between the newly combined businesses. The remaining pro-forma ownership will be 43% held by Markit, with 5 of the 11 combined board positions.

This is according to a definitive agreement signed by the companies and announced jointly today, whereby the combined companies will be rebranded as IHS Markit. IHS has nearly $2.2 billion in revenue and 9,000 employees, whereas Markit has $1.1 billion and 4,200 staff, for comparison. The news follows after Markit announced an acquisition earlier this month, as covered by Finance Magnates after the company introduced its MarkitSERV FX broker affirmation service on March 15th.

The deal will be accretive to combined adjusted earnings and expected to bring combined free cash flow to $900 million during 2017. Shares of Markit under ticker MRKT.O last traded at just under $30.00 per share, reflecting that the deal implied market price of $31.13 per share and a premium above last Friday's closing price on the NYSE.

"The combination will enhance cash flow and enable stronger returns of capital to shareholders.”

Renaming as IHS Markit

Commenting in the joint press release, IHS Chairman and CEO Jerre Stead said: “This transformational merger brings together two information-rich companies to create a powerful provider of unique business intelligence, data and Analytics to a broad and complementary customer base. IHS Markit and its shareholders will benefit from enhanced product innovation to deliver strong returns across economic cycles. Importantly, the two companies are values-based organizations that have a strong cultural fit which focuses on customer satisfaction and colleague success.”

Markit Chairman and CEO Lance Uggla added in the announcement: "This is an exciting transaction for customers, employees and shareholders of IHS and Markit. Together, we will create a global information powerhouse and a platform for innovation that drives future revenue. At the heart of our shared vision is the opportunity to offer our customers a broader and richer content set through both existing and new products that will support their critical decision making and manage regulatory change. The combination will enhance cash flow and enable stronger returns of capital to shareholders.”

Mr. Uggla is expected to assume the role of president and a member of the board for the new merger of equals, whereas Mr. Stead will become chairman and CEO until his planned retirement on December 31st 2017, whereupon he will be succeeded by Mr. Uggla who will take the helm as both CEO and Chairman after Mr. Stead retires.

IHS Earnings Call Today

The transaction is expected to close by the second half of 2016, based on regulatory and shareholder approval, and will be a fully taxable transaction for IHS U.S. shareholders to enable the offsetting of capital losses against capital gains. A conference call will be held today at 8am EST to discuss the news, and coinciding with the IHS Q1 earnings call.

Shortly after publication, during the above-mentioned conference call, one of the repeated highlights made was how Markit and IHS have many common customer relationships, yet, without product overlap, and thus creates an opportunity to cross-sell existing client's without conflict.

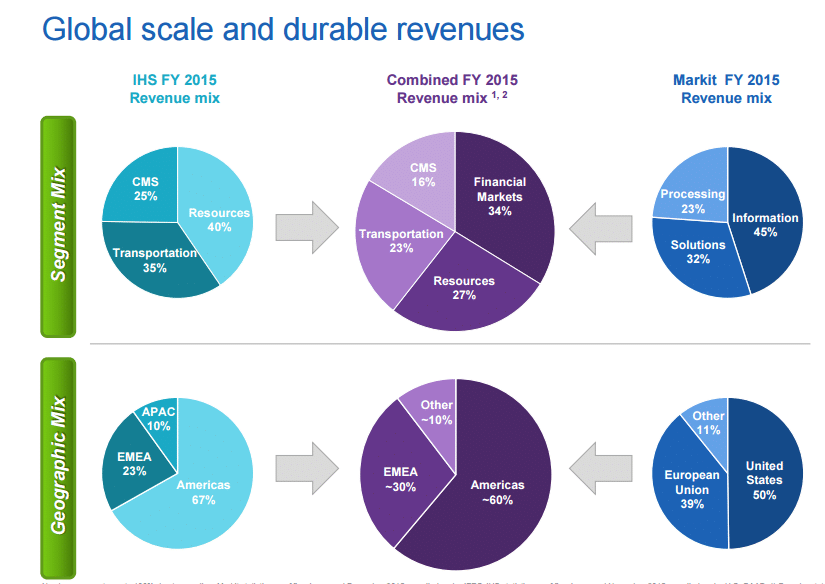

An excerpt from the IHS Markit presentation that accompanied the press release can be seen below, and highlights how Markit brings financial markets exposure to IHS's existing industry holdings, in addition to geographic distribution:

Source: IHS Markit press release