As Finance Magnates recently reported, the new competition for Forex brokers especially in the institutional space could be coming from nowhere else but big banks. While Nordea Markets is not the biggest bank in Europe and is certainly focused on a rather specific geographical region and client mix, its customers have recently gained access an interesting trading product.

Nordea Markets has recently tapped into the niche of providing its clients with a comprehensive and easy to use foreign exchange Trading Platform . The name of the product is e-Markets Nexus and it is offering news, research, financial forecasts, and last but not least FX trading to the clients of Nordea Markets.

The firm is aiming to retain its clients within its trading environment with a multi-device solution, an approach that is very unorthodox for a big bank such as Nordea. The company has also built in a set of tools for managing post-trade activities such as settlement instructions.

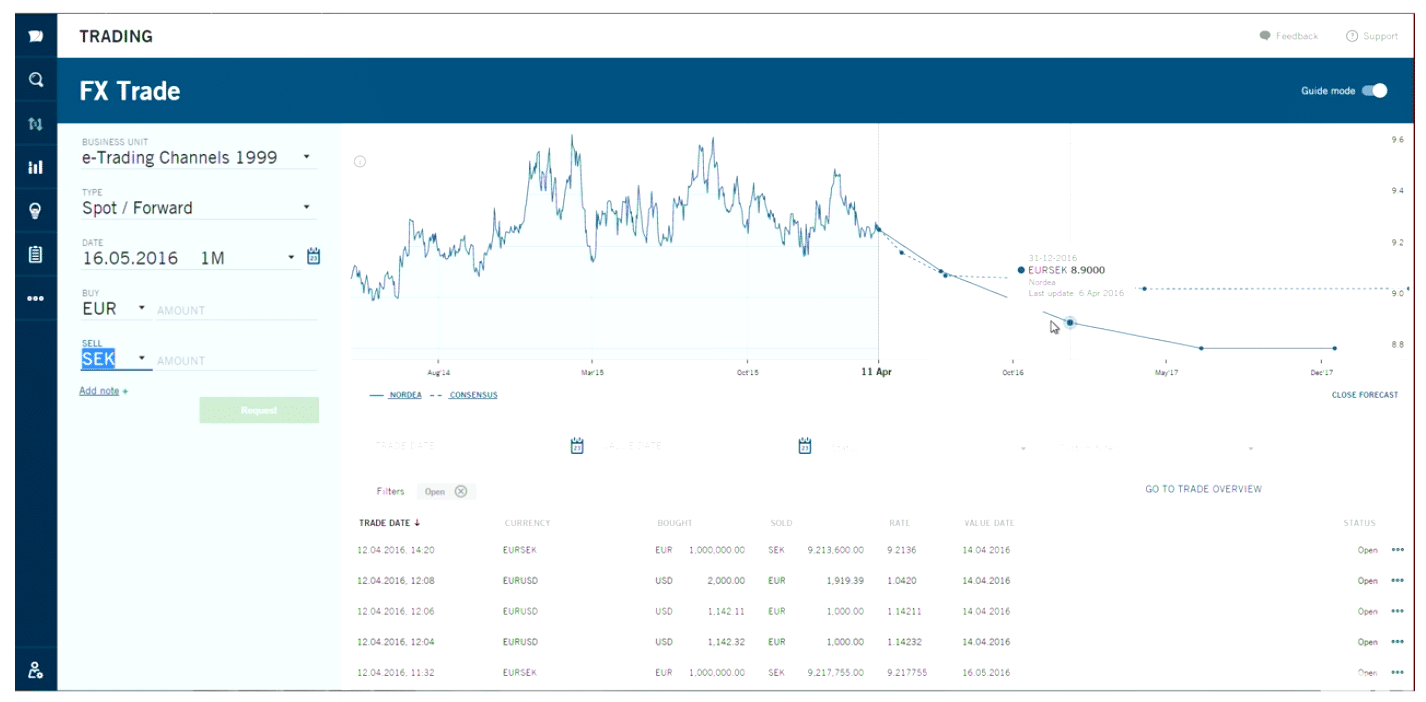

Looking within the platform solution, one feature stands out - the clients not only see the current rates on the chart, but are also presented with a forecast of future moves in a given currency pair.

e-Markets Nexus at a Glance

The e-Markets Nexus platform is web based and is compatible with most modern browsers - Google Chrome, Firefox, Safari and Internet Explorer. The mobile solution is available for all major segments of the market - iPhone, iPad and Android devices are all supported.

Nordea Markets is the subsidiary of Nodea Bank that is focused on international markets. Clients of the firm have access to trading a broad range of financial instruments including fixed income, currencies, commodities, equities, and others.

The chart on the platform not only shows current rates but future projections

The firm’s headquarters are in Copenhagen, however Nordea Markets also has operations in Helsinki, Oslo and Stockholm, and regional offices across the Baltics and in Poland, Russia, Singapore and the USA.

Nordea Bank has been created after a set of mergers between a number of Scandinavian banks. Aside from Denmark, Sweden, Norway and Finland, the firm is now also growing strong in Estonia, Latvia, Lithuania and Poland.

According to Nordea the e-Markets Nexus FX trading platform has been crafted by the bank in conjunction with the needs of its clients. With the multi-device support, the firm is opening access for customers to more active trading.

Clients of Nordea Markets not only can trade FX spot rates but also forwards and swaps. The solution is free for clients of the company.

In addition to FX, the trading platform also provides information and research on other assets, however for the time being those are not tradable.