US-based Kinetix Trading Solutions, which offers compliance solutions to banks and brokerages across both sell-side and Buy-Side facing spectra, speaks with Finance Magnates during an exclusive interview where the company revealed its new office set to open on April 1st in London.

At nearly six years old, the firm has emerged from startup mode, after it was founded by Amit Karande, the firm's CEO and former Lehman Brother's SVP, who recently held positions with Citibank as Director of Capital Markets Technology for the bank, before starting Kinetix. During the call, Mr. Karande explained how the company evolved after a gradual major pivot in its business.

the real crux of regulatory compliance is your ability to prove at any given time - if you have to - that the rules were followed, and these rules keep evolving periodically.

From trade-management to compliance

Based in Princeton, New Jersey, the company was initially set up to provide trade management solutions, where the pivot to compliance evolved as ongoing regulatory changes became the driving force behind subsequent product iterations. This led to a compliance solution that had the merit of catering to the needs of trade management, including pre-trade compliance-related checks, and post-trade aspects, as the product focus shifted.

The asset classes the firm focuses on mainly include fixed income and derivatives, such as the FICC divisions that exist across investment dealers, including foreign exchange trading. Mr. Karande explained how in Europe there appears to be a renewed focus for senior management to engage in cost-cutting initiatives, where he believed that Kinetix solutions could deliver.

During the call with Finance Magnates, Mr. Karande said: "the real crux of regulatory compliance is your ability to prove at any given time - if you have to - that the rules were followed, and these rules keep evolving periodically."

Legacy systems lag market

Amit Karande, Founder,

Kinetix Trading Solutions

With regard to fragmentation for Liquidity routes and the many 3rd party technology providers that firms may use concurrently, Mr. Karande opined how before 2008 trading swaps required complex systems and trading technology. Yet, as the market has since become more simplified and volumes grew significantly higher - there are still complex legacy systems in place at many providers. Therefore, the legacy platforms have potentially lagged behind the market's adaptation and this offers firms a chance to optimize their technology stacks.

He added how rather than revamp an entire trading infrastructure, it's possible for firms to swap components and potentially realize significant cost savings.

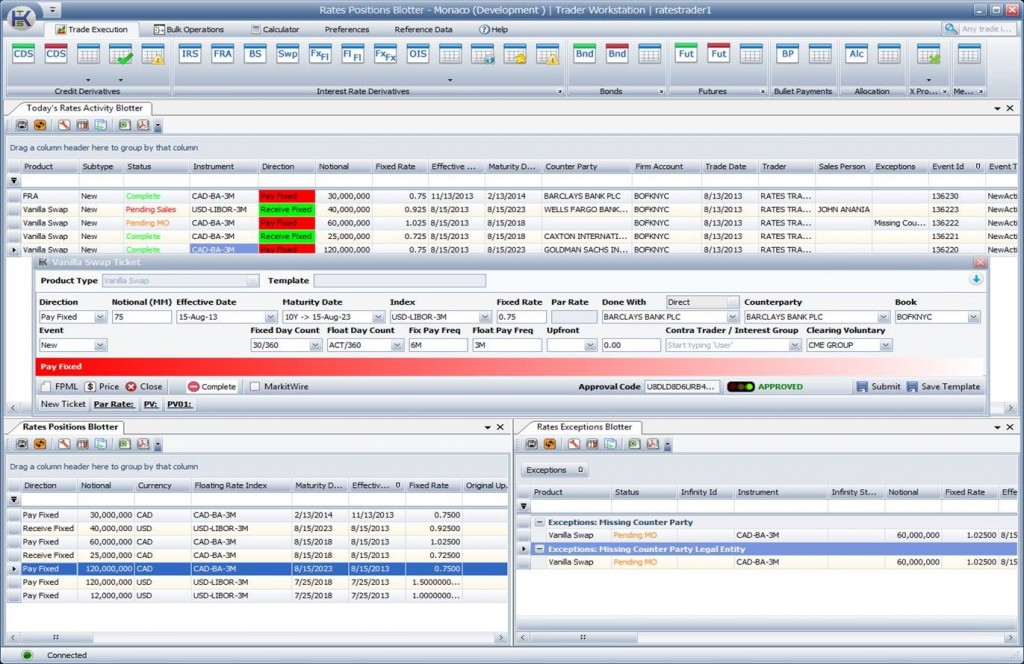

A screenshot of some of the company's product interfaces shows a fair amount of detailed reporting features, bearing in mind that the initial product was geared more towards trade-management. Mr. Karande believes that this is its edge, as the solution could appeal from a sales perspective, rather than just from a regulatory compliance view.

Recent legal validation

Earlier this month the company announced that it had received legal validation from Katten Muchin Rosenman, a leading law firm in the U.S. that specialises in capital markets related matters including CFTC and SEC cases. “We are delighted to play a principal role in ensuring trade certainty for the derivatives industry,” said Guy Dempsey, Attorney at Katten Muchin Rosenman. “With such a complex regulatory landscape, industry participants reach significant benefits from the confidence of legal validation.”

Basically, the law firm had reviewed the Kinetix rules-based engine applicable for US and EU regulatory compliance across the markets that it serves and was able to add its validation, in an effort to help clients feel that trades are meeting regulatory requirements through the Kinetix solution.

The news follows Mr. Karande's former colleague Paul Puskuldjian joining him from Citibank where he held the position of Global Head of Capital Markets middle office technology, and now serves as Kinetix's COO, as covered by Finance Magnates. The below screenshot of the company's Monaco platform shows trades in quick-ticket format.

Source: Kinetix