When it comes to trading, everyone is looking for an edge. Whether that edge is low latency networks, seasoned quants, arbitrage situations, or new ways to predict economic data, it really doesn’t matter, as long as it Leads to consistent profits, that advantage will be in demand. Due to this demand, it’s no surprise that interpreting real time social media is becoming a hot commodity. Using real time social data, traders are searching for spikes of interest in different asset classes that could be indicative of breaking news taking place. In addition, firms have been creating tools to gauge market sentiment to use in their trading decisions.

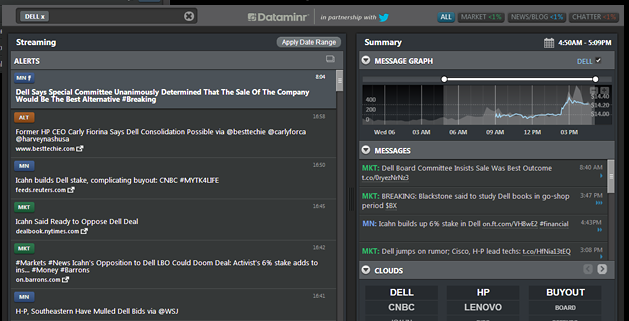

Following on that trend of analyzing real time data, real time data discovery platform, Dataminr, announced yesterday that they raised $30 million in Series C funding. Leading the round were Venrock and late-stage venture fund Institutional Venture Partners who contributed $25 million, with the remaining $5 million provided from existing investors. The funding occurs nearly nine months after Dataminr had secured $13 million in a Series B deal last year. Dataminr counts both sell-side and Buy-Side financial firms as clients. Customers use their products to produce what the company calls ‘actionable signals’ to trade upon. In an example of their product that was featured on GigaOM, Dataminr was able to report about last months’ trail derailment in Baltimore to its customers well in advance of major news organizations, which provided traders the ability to short shares of CSX before the event was widely broadcast.

In regards to their investment, Nick Beim, Partner of Venrock, said, "Dataminr has emerged as the clear leader in the new and valuable category of real-time information discovery, helping identify significant events before they become news. The company has a tremendous opportunity to create systemic disruption in industries that rely on real-time information. I am very excited to be joining the Dataminr board and look forward to helping the company build on its impressive growth."