Real-time financial news analysis company RavenPack has formed a partnership with software provider Deltix Incorporated for the development and deployment of advanced quantitative alpha generation and Execution strategies.

Analyzing market data in a timely manner is a challenging business when considering the speed at which orders are being executed in the world of algorithmic trading. Just this week alone, strategic partnerships between executing venues, market participants and technology providers, all of which are aimed at providing very high order execution speeds and ultra-low latency with electronic trading in mind.

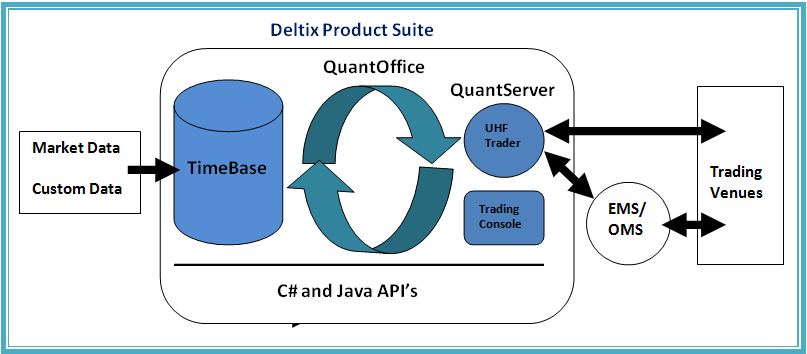

The alliance has been formed in order to make RavenPack’s Regional Macro Sentiment Indexes which analyzies unstructured market news and to make it available in the Deltix Cloud Services (DCS) platform, allowing quantitative financial firms interested in using news Analytics to enhance alpha generation can conduct their research and back testing, without the overhead of data aggregation and integration in Deltix’s research software QuantOffice.

DCS also contains a library of pre-built algorithms that users can back test and enhance. Increasing reliance on speed and performance are driving many tools away from legacy physical server farms to cloud hosted systems and Deltix's system is no execption.

Armando Gonzalez, CEO of RavenPack made a public statement concerning the strategic alliance: “We are delighted to partner with Deltix in pursuit of our goal to make news analytics available to a broader audience in the financial markets.”

“With our own quantitative research we have scratched the surface of what can be done with news analytics data. We are sure the Deltix community can take our sample models and enhance them to extract more value from our data” he concluded.

Data Required – Fast!

With order book maintenance down to 1 microsecond in the case of Celoxica’s new Generic Book Accelerator having being launched this week, and alliances taking place between other participants in order to reduce execution latency, the performance of ancillary components required by algorithmic traders such data analytics and financial news service is paramount.

In addition, the actual order execution speed has been a subject of news for many companies this week in North America, aiming their ultra-low latency solutions at major executing venues and proprietary trading firms despite possible restrictions being implemented by regulators. Given such a deluge of undeterred companies going down this route recently, it appears that the need for high speed data and analytic tools is there.

“As an ongoing exercise at Deltix, we seek out new sources of data, raw or derived, which may be useful in quantitative research and trading,” explained Ilya Gorelik, Deltix Founder & CEO in a statement issued by the company.

“RavenPack is such a source. We believe our clients can develop profitable strategies by enhancing their models with news analytics.”