In 2023, Tradeweb Markets (Nasdaq: TW) achieved record revenue for the 24th consecutive year. The company published financial results for the fourth quarter and full year, highlighting double-digit revenue growth driven by high trading volumes across several key products.

Tradeweb's Quarterly Revenues Jump 26%, Adjusted Net Income Rises 30%

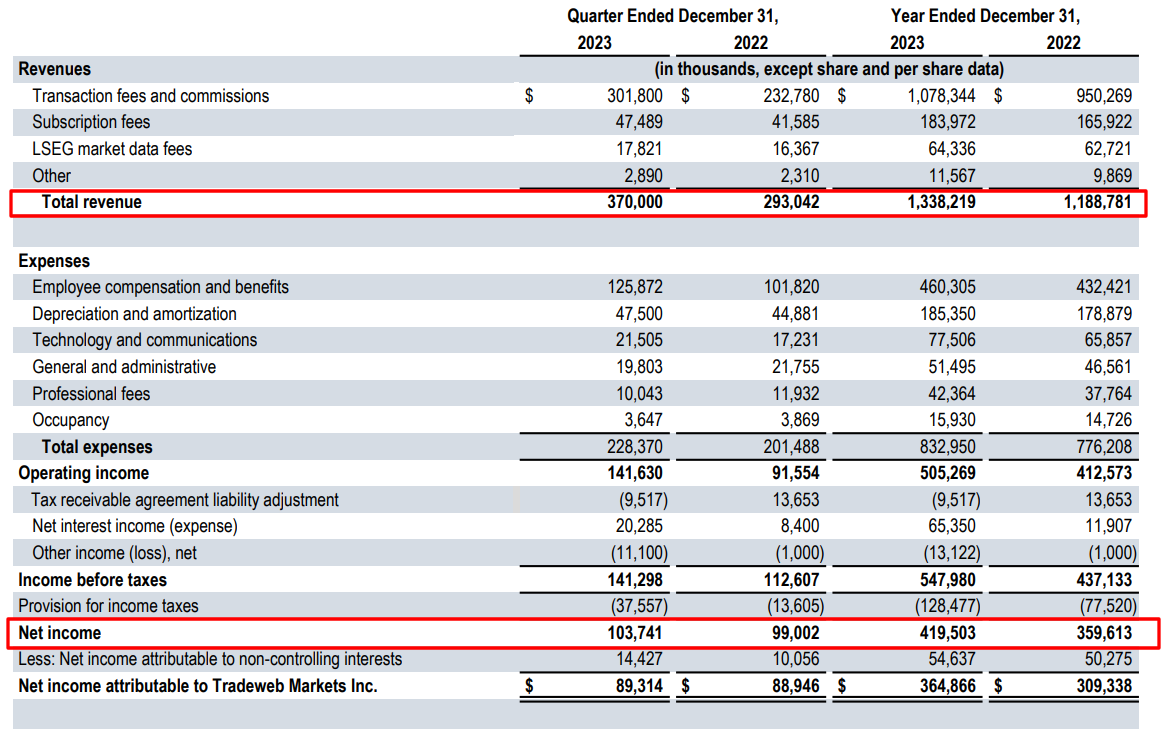

Total revenues for the fourth quarter climbed 26.3% year-over-year (YoY) to $370 million. On a constant currency basis, revenues increased 24.6%. The company achieved a record average daily trading volume (ADV) of $1.7 trillion for the quarter, a jump of 57%.

Several areas posted all-time high ADV numbers, including fully electronic US High Grade credit, US Treasuries, equity derivatives, global repos and long-dated swaps . Tradeweb's share of fully electronic TRACE trading in US High Grade hit 17.2%, up 284 basis points.

The adjusted net income expanded 30% to $151.9 million. Adjusted EBITDA rose 27% to $195.9 million, while the adjusted EBITDA margin reached 53%.

"We invested in growing our international footprint across new geographies and expanded our product offerings through two strategic acquisitions, r8fin and Yieldbroker," Billy Hult, the CEO of Tradeweb, commented.

According to the latest data published for January 2024, the total monthly trading volume reached $42.6 trillion. The ADV saw a record $2 trillion, marking a YoY increase of 74.6%.

Trading Volume Soars across Asset Classes

Returning to Q4 and 2023 reports, ADV Rates surged nearly 73% to $1.1 trillion. Swaps and swaptions with tenors of 1-year or greater more than doubled amid higher rate volatility. Mortgages ADV increased 21% and European government bonds grew 22%.

In Credit, ADV advanced 12% to $24 billion. Record electronic US High Grade ADV rose 41%. Session-based trading, request-for-quote and portfolio trading all saw higher adoption. European Credit ADV jumped 28% from a year ago.

Equities ADV increased 37% year-over-year, driven by substantial increases in US and European ETF volumes. Money Markets ADV was up 35%, led by all-time high repo trading.

2023 Revenues Hit Record $1.3 Billion

For the full year 2023, Tradeweb generated record revenues for the 24th straight year. Revenues grew 12.6% to $1.3 billion, or 12.2% excluding currency effects. The latest results continue Tradeweb's track record of consistent growth since its founding in 1996.

"Our successes over the past year have led to our 24th consecutive year of revenue growth and profitability, positioning us well for future opportunities," Hult added.

Net income rose nearly 17% to $419.5 million in 2023. Adjusted EBITDA margin improved to 52.4% from 51.9% last year. Tradeweb posted double-digit growth in diluted EPS and adjusted diluted EPS.

Outlook and Growth Initiatives

Tradeweb issued full-year 2024 adjusted expense guidance of $755-805 million. The company completed two acquisitions in 2023 that expanded its global footprint and product capabilities.

The company's CEO pointed out Tradeweb's strong performance in the face of macroeconomic uncertainties last year. He emphasized the company's favorable position as it enters 2024 to capitalize on improving market volatility and other opportunities.