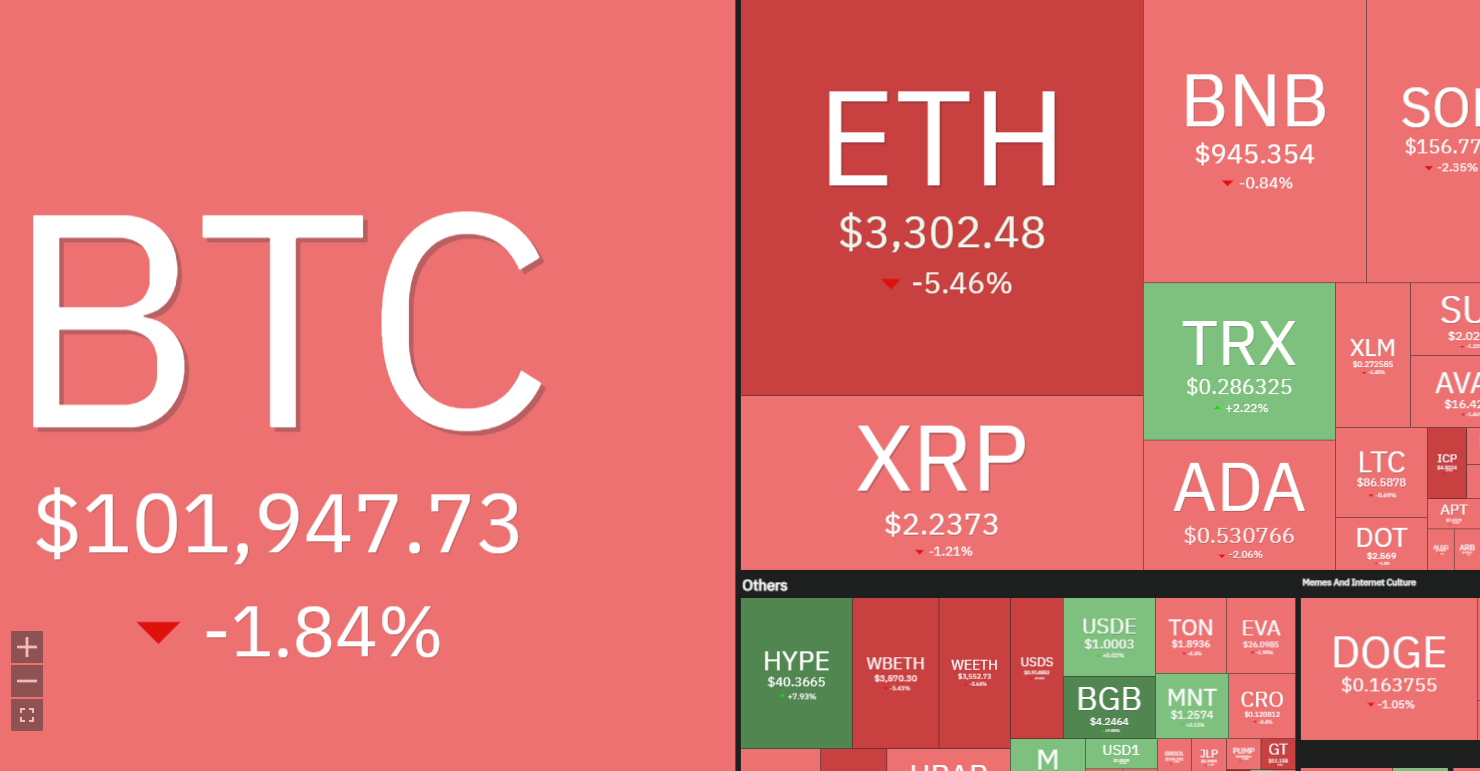

The cryptocurrency market crashed for a second consecutive day today (Wednesday), 5 November 2025, losing over $1 trillion in market capitalization since early October as Bitcoin, Ethereum, XRP and Dogecoin prices led a broad-based selloff.

The entire crypto ecosystem is experiencing dynamic declines with Ethereum at $3,303 (after -16% two-day crash), Bitcoin testing $100,000 psychological support, and major altcoins extending losses as institutional investors rotate out of digital assets.

In this article, I examine why crypto is going down and conduct a technical analysis of the BTC/USDT, XRP/USDT, ETH/USDT and DOGE/USDT charts, based on more than 10 years of experience as a cryptocurrency investor and analyst.

Why Crypto Is Going Down Today? Fed, AI Bubble, and Whale Selling

Federal Reserve Chairman Jerome Powell's hawkish remarks downplaying December rate cuts created the initial catalyst for crypto's collapse. The probability of a December cut collapsed from 96% before Powell's press conference to just 69.3% afterward, dampening expectations for looser financial conditions that typically support cryptocurrency prices.

Paul Howard from Wincent explained the market dynamics: "Cryptocurrency prices continued to slide and were pushed lower by a lack of positive macro news. There appears to be a big skew of selling on a major exchange which would back up the on-chain analysis indicating this is old BTC whale selling pressure. Dumping billions gradually into the ecosystem over the course of the last few days is not panic selling."

The cryptocurrency collapse coincides with a broader tech selloff. Palantir dropped 8% despite beating earnings on valuation concerns, while Nvidia shed 4% losing $200 billion in market capitalization. The Nasdaq fell 2% and the S&P 500 declined 1.2%, reflecting growing worries about AI-driven stock valuations.

Institutional investors pulled $1.15 billion from Bitcoin ETFs last week, led by BlackRock, ARK Invest, and Fidelity. This exodus signals a significant shift in sentiment as traditional financial institutions that drove Bitcoin's rally to $126,000 in early October are now reducing exposure amid Federal Reserve uncertainty and AI bubble concerns.

Ethereum 16% Two-Day Crash Breaks 200-Day EMA

According to my technical analysis, the price of Ethereum (ETH) has experienced two days of dynamic declines in a row, losing approximately 16% within 48 hours. For the chart situation, this is a very large change, and from my technical analysis, these declines from the first part of the week fully hand power to the bears, changing the trend currently to downward.

Most significantly, we went below the 200-day exponential moving average (200 EMA), simultaneously breaking out of the consolidation range drawn since July, and also went below the zone of August lows, leaving behind a series of very important supports which are now resistance.

ETH prices stopped at this moment at the last line of bullish defense, the 50% Fibonacci retracement drawn from April lows to the highs. This level falls around $3,175. If it is broken, Ethereum will continue its decline toward the 61.8% Fibonacci retracement and the range of local May and June highs between $2,760 and $2,650.

At this moment, bears have the advantage in the market, so further depreciation cannot be ruled out either, and the target level or range, according to my forecasts, is the April minimums at the $2,380 level. This means ETH could fall from current levels by as much as 60%.

Bitcoin Price Tests $100K After 8% Two-Day Plunge

The price of Bitcoin (BTC), like other major cryptocurrencies discussed by me in this analysis, has two days of dynamic declines behind it, during which it lost a total of 8% in value, and prices stopped only at the height of the psychological $100,000 level last tested in June. Today Bitcoin is trying to violate this level for the second day in a row.

Bulls are trying to defend for now. If it is broken, however, it opens the road to a much stronger downward correction. We will officially exit the consolidation range drawn from May, and moving below the 200-day exponential moving average (200 EMA) only confirms that now bears are in the lead.

I identify the first zone of declines around the levels of $92,000 and $94,000, where Fibonacci extension and retracement levels coincide, with the target zone of declines around $74,000 and $76,000, the April lows where the 161.8% Fibonacci extension also falls.

You can read more about the potential range of Bitcoin declines in my separate BTC/USDT chart analysis which I wrote this week.

Joel Kruger, strategist at LMAX, also provided important context: "A sustained move under the 50-week could extend the pullback toward the top of the cloud near $95,000, where we would expect strong support and the formation of a higher low before the next leg higher to fresh record highs. The key takeaway: this remains a healthy correction within an ongoing bull market, not a bearish shift."

XRP’s Death Cross Looms at $2.30 Support

The XRP is managing best for now compared to other leading cryptocurrencies, maintaining local support levels and trading still in the $2.20-$2.30 zone coinciding with July lows.

This doesn't change the fact, however, that prices broke out at the beginning of October from a wedge or triangle formation and are currently consolidating at lower levels below the 50 and 200 EMA which are very close to drawing a death cross, a crossover which, according to technical analysis enthusiasts like me, is a strong sell signal.

If the current support doesn't hold, we face a decline below the round $2.00 level, including toward $1.90, June lows. The next target decline level is $1.61 at April minimums, and the ultimate level is $1.25, the level last observed in November 2024 coinciding with intraday lows from October 10 when the market briefly collapsed, as well as my XRP price decline forecast based on Fibonacci extensions.

You can read more on this topic in this article I wrote earlier.

Dogecoin Also Sees Death Cross, Forms at Channel Bottom

Although Dogecoin (DOGE) chart clearly shows it has lost and cut itself off from its September highs by several cents, in broader terms we actually remain in the same consolidation drawn since February. Its lower limit, which we are currently witnessing, falls just above the 14-cent level, while the top is at just under 29 cents.

The last hours of declines caused some local supports to turn into resistance, and at this moment, only the lower limit of the sideways channel last tested in June stands before us. What's more significant, however, is we're moving below the 50 and 200 MA which have already formed a death cross formation, the very strong sell signal mentioned earlier by me.

If the current support doesn't hold and we exit this consolidation, Dogecoin could pave the road to stronger declines and a retest of levels last observed in August 2024 below the 8-cent level.

Crypto Price Analysis, FAQ

Why is crypto crashing today?

Cryptocurrency market lost over $1 trillion since October 6 peak with Bitcoin breaking $100,000 for first time since June (-5% daily to $100,893), Ethereum crashing -16% over 48 hours to $3,303, triggered by Federal Reserve Powell walking back December cuts (probability 96% to 69.3%), AI bubble concerns spreading from tech selloff (Nasdaq -2%, Nvidia -4%), institutional exodus (Bitcoin ETF outflows $1.15B) and. leverage cascade ($1.78B liquidations affecting 441,867 traders).

Will Bitcoin go below $90,000?

Yes, it may. According to my technical analysis, Bitcoin breaking $100,000 opens path to first target $92,000-$94,000 (Fibonacci extension/retracement zone coinciding with April-May lows), ultimate target $74,000-$76,000 (April minimums + 161.8% Fibonacci extension).

Why are Ethereum and altcoins falling harder than Bitcoin?

According to my analysis, Ethereum down -16% over 48 hours breaking below 200-day EMA and consolidation range from July, bears now in control with potential 60% decline to $2,380 April lows if 50% Fibonacci support $3,175 breaks, XRP death cross forming between 50/200 MA at $2.30 support, Dogecoin death cross completed testing channel bottom 14 cents, altcoins exhibiting 1.5-2x Bitcoin beta amplification typical during market weakness.

Is this a crypto bear market?

In my opnion, yes. Bears warning Peter Schiff "losses staggering surpassing dot-com bubble," CredibleCrypto "most severe bear market in Bitcoin's history," $1 trillion market cap loss, institutional exodus $1.15B ETF outflows, 2018 parallel (October weak, November brutal preceded -37% crash).

Before you go, please also check my previous (and more bullish) crypto price predictions: