In recent years, both artificial intelligence (AI) and decentralised finance (DeFi) have undergone significant technological advancements. However, each industry has faced its own set of challenges. AI has grappled with the high cost of hardware and lack of open investment access, making it difficult for smaller startups to compete against large corporations such as Microsoft, which benefit from access to cheap GPU power and early investments into generational assets such as OpenAI.

DeFi, on the other hand, has faced its own set of obstacles, including regulatory challenges and unsustainable yield, resulting in the failure of various exchanges and the breakdown of multi-million-dollar ventures. These difficulties have driven the development of innovative and disruptive solutions that are now redefining the DeFi and AI landscape.

One such solution that holds tremendous promise is the convergence of AI and onchain financial systems–Artificial Intelligence Finance, or AI-Fi for short. Where DeFi meets AI, a powerful alliance emerges, one that offers the potential to transform both industries, improve their resilience and adaptability and lay the foundations for long-term financial sustainability.

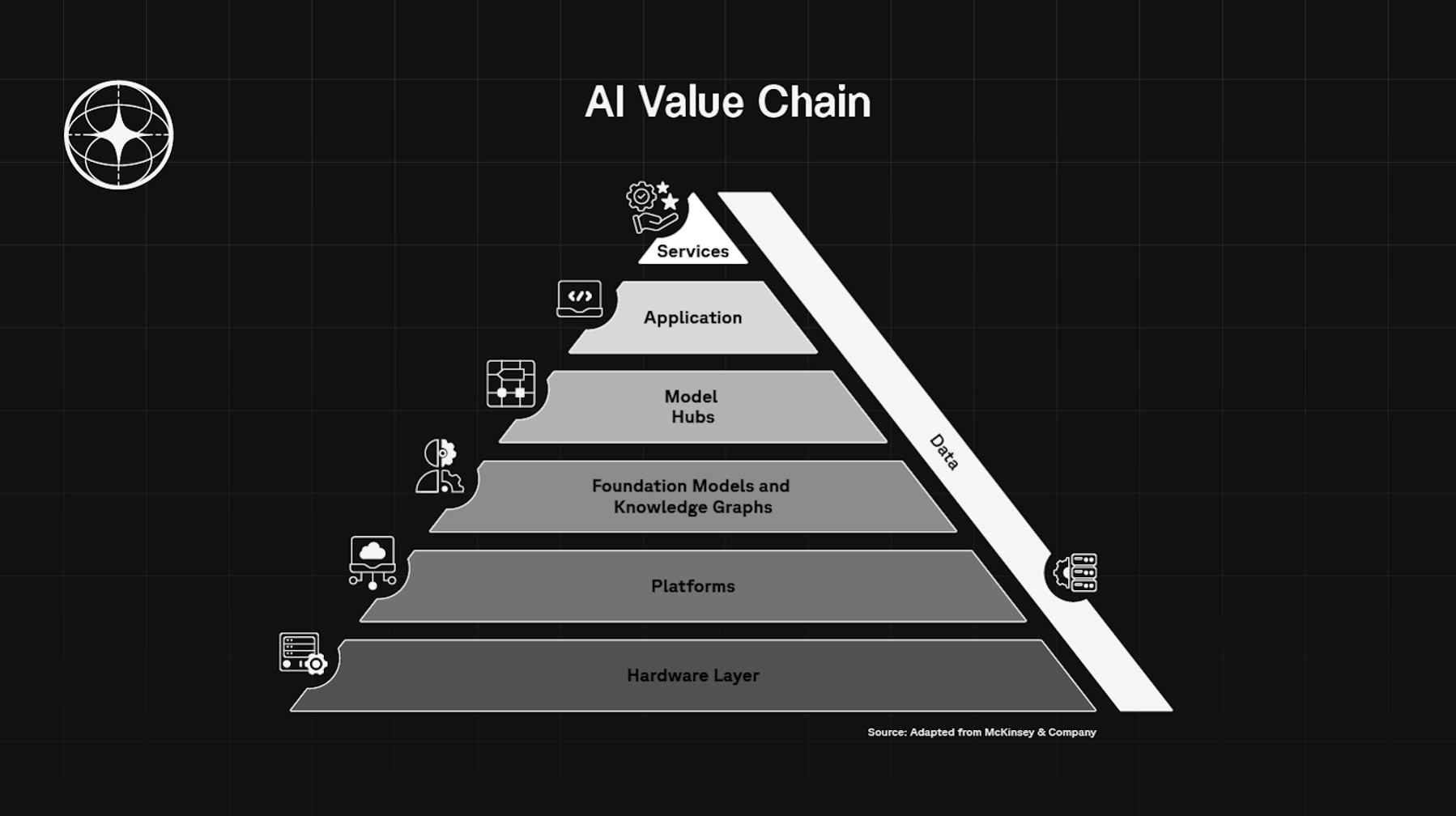

As these industries evolve, tokenising AI assets across the entire AI Value Chain will become a crucial strategy to democratise access to essential resources, support liquidity, and foster innovation in the ecosystem. This Value Chain–which comprises hardware, platforms, models, apps and services–can be effectively capitalised on through tokenisation, allowing AI-Fi to empower both retail investors and smaller startups to compete more effectively against larger corporations, and in turn shape the future of the AI economy.

The Advantages of AI-Driven DeFi

As AI-Fi continues to evolve, it becomes clear that the partnership of DeFi and AI will offer a multitude of advantages that will transform the financial landscape.

DeFi's peer-to-peer transactions and automated smart contracts effectively remove the need for centralised intermediaries, streamlining interactions between users and financial services, making it the perfect partner for AI, which is mostly online and networked. When applied across the AI value chain, DeFi can significantly transform both industries and lead to new economic opportunities.

For example, onchain trading can benefit from AI's rapid examination of blockchain transactions, identifying potentially lucrative opportunities across multiple networks simultaneously. AI could find an opportunity, such as an arbitrage, execute it using DeFi protocols, and return the funds with added interest to a user's wallet, all without any effort on the user's part. Different AI-powered strategies can run behind the scenes in DeFi vaults, offering automated trading to anyone with internet access and modest on-chain funds.

AI-driven DeFi also benefits individual users through faster decision-making, enhanced risk assessment, better returns due to the elimination of intermediaries, and improved user experiences with robo-advisors and on-chain portfolio managers. Additionally, investors can take advantage of the tokenisation of AI-related assets, which enhances the overall ecosystem through automated trading and settlement mechanisms. This includes the tokenisation of previously illiquid markets, such as GPU power. The 24/7 operation of these markets, combined with reduced counterparty risk provided by blockchain technology, creates a much more efficient marketplace for AI resources.

Data Supporting AI-Fi & the Tokenisation of AI-related Assets

- According to Accenture, 74% of organisations have adopted AI technologies in 2024, further driving the demand for innovative AI-FI frameworks that can facilitate transparent and efficient markets for AI assets, while ensuring automated compliance. McKinsey analysis indicates that tokenised market capitalisation could reach around $2 trillion by 2030, highlighting the growing influence of tokenisation across various asset classes.

This trend reflects an increasing institutional interest in tokenisation, with leaders like BlackRock’s CEO, Larry Fink, recognising its potential as the next evolution in markets. These data points underscore the urgency and opportunity for integrating AI-Fi solutions to enhance market transparency and accessibility.

Case Study: AI-Fi & Cloud Computing

The convergence of AI-Fi and cloud computing represents a transformative shift in how both industries operate. As AI technologies continue to evolve, they demand substantial computational resources for model training and inference, which cloud computing can provide.

According to Franklin Templeton's research, the current landscape is dominated by a few major players—commonly referred to as the "Big 3" (Azure, AWS, Google Cloud)—alongside telecom giants like AT&T and T-Mobile. These entities have historically benefited from low capital costs and government subsidies, creating an imbalance in access to essential computing resources.

AI-Fi addresses this imbalance by enabling fractional ownership of computing resources, such as GPU credits. This democratisation of access ensures that value flows directly to a broader range of participants, rather than being concentrated among a few large corporations. By allowing smaller startups and individual investors to participate in the AI economy, AI-Fi fosters innovation and competition.

Currently, the trading and accumulation of these computing resources are largely controlled by centralised players like NVIDIA. However, through AI-Fi, new investment opportunities can now emerge in the hardware layer. Tokenised hardware pools can be established, allowing investors to collectively own and trade shares in computing resources. This not only opens up attractive revenue streams but also enhances liquidity in a market that has traditionally been illiquid.

Singularity Finance: Bridging DeFi and AI

Singularity Finance (SFI) brings together DeFi and AI experts to develop a comprehensive tokenisation framework spanning the entire AI value chain. At the hardware layer, SFI enables the tokenisation of GPU infrastructure and data centers, creating a more inclusive and efficient AI economy. Decentralised computing services are introduced at the platform layer, providing cost-effective alternatives to traditional cloud providers. At the model layer, SFI facilitates the tokenisation of foundation models and knowledge graphs, fostering collaborative development. Finally, at the application layer, SFI deploys AI-powered DeFi solutions and professional services, creating a complete ecosystem for AI asset monetisation and utilisation.

By working across the entire AI value chain, SFI's tokenisation approach redefines value creation and exchange in the AI economy, unlocking new asset classes and opportunities for participation. Additionally, with the support of the ASI ecosystem, SFI is well-positioned to drive the future of AI-Fi and shape the decentralised AI landscape.

The convergence of AI and DeFi, (aka AI-Fi), is poised to reshape both industries profoundly. As organisations increasingly adopt AI technologies and the tokenised asset market continues to grow exponentially, the demand for innovative AI-Fi frameworks will only intensify. By bridging AI development with DeFi, platforms like SFI create new markets for previously illiquid assets, in turn transforming how AI resources are valued and traded in the digital economy.

Author Bio:

Cloris Chen, CFA, is a leading expert in decentralized finance (DeFi) with a focus on tokenization and the AI economy. As CEO of Singularity Finance, a SingularityNET ecosystem partner, she bridges AI economy and decentralized finance. Cloris’s background includes six years as a vice-president at HSBC, followed by a role as treasury director at a unicorn startup. Cloris holds master’s degrees in computer science from the University of Pennsylvania and economics from the Hong Kong University of Science and Technology. Cloris leverages her diverse experience to advocate for innovative financial solutions. Her insights on the intersection of AI, tokenization, and DeFi are reshaping perspectives on the future of finance. Follow Cloris for cutting-edge analysis on these rapidly evolving fields.