As the cryptocurrency market matures there’s been an explosion of new retail and institutional traders entering the market.

In 2020 alone the spot trading volume of Cryptocurrencies was up 53%, while the number of advisors adding cryptocurrencies to their client’s portfolios increased by 49%.

Unfortunately because the cryptocurrency markets are so new it’s been difficult to find the proper tools for analyzing the broader market for altcoins.

That’s changing however as the brand-new analysis platform altFINS launched from beta to tens of thousands of users.

In the first three months of 2021 the platform saw a 300% increase in its user base, with traders from over 50 different countries joining to improve their analysis of the altcoin markets.

altFINS spent six months in beta testing, adding new elements and enhancements to its platform, and fine-tuning every aspect of its official web app.

The full version launched on March 30, 2021 and has been successful in helping cryptocurrency traders find what altcoins are best to buy and sell at all times.

The tool is simply incredible, with coverage of over 5,000 individual digital assets across dozens of exchanges.

Taking in the hundreds of millions of price and volume data points the platform performs over 1 billion daily calculations to ensure the most detailed and precise analysis.

That analysis is then translated into actual trading signals and actionable market advice that leads to trading opportunities for the tens of thousands of active crypto traders using the service.

What is altFINS?

The altFINS tool is a cloud-based cryptocurrency analysis platform that allows active traders and investors to screen through thousands of digital assets, performing detailed technical analysis and identifying the best trading opportunities in real-time as the markets evolve.

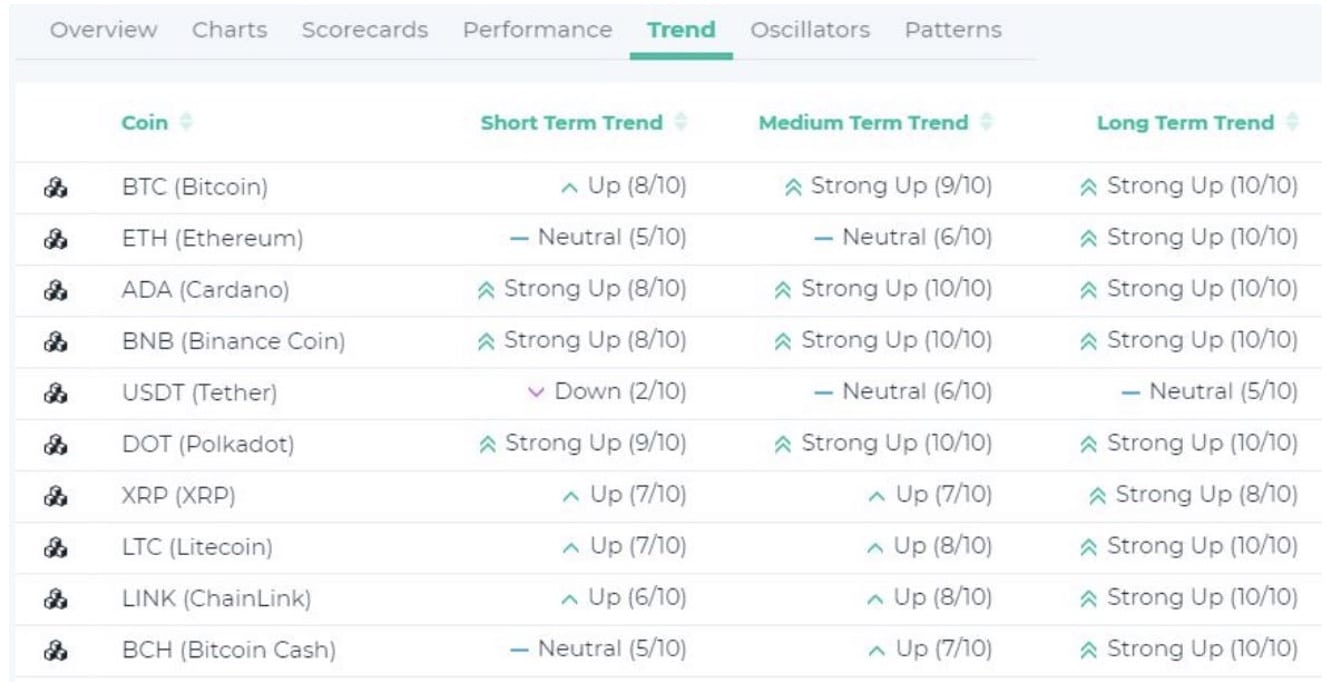

The platform takes real-time tick-by-tick data from dozens of crypto exchanges and uses that to calculate 60 technical indicators (SMA, EMA, MACD, RSI, and many more) across five different time frames.

All of this complex time series data and analysis are managed by a proprietary data management system developed specifically for the altFINS platform.

This allows for the screening of thousands of altcoins via technical indicators, and enables automated chart pattern recognition systems, thus giving traders an edge in the markets. altFINS also enables trade execution, portfolio tracking and performance monitoring.

altFINS is the only cryptocurrency analysis platform that offers a combination of the all the following features:

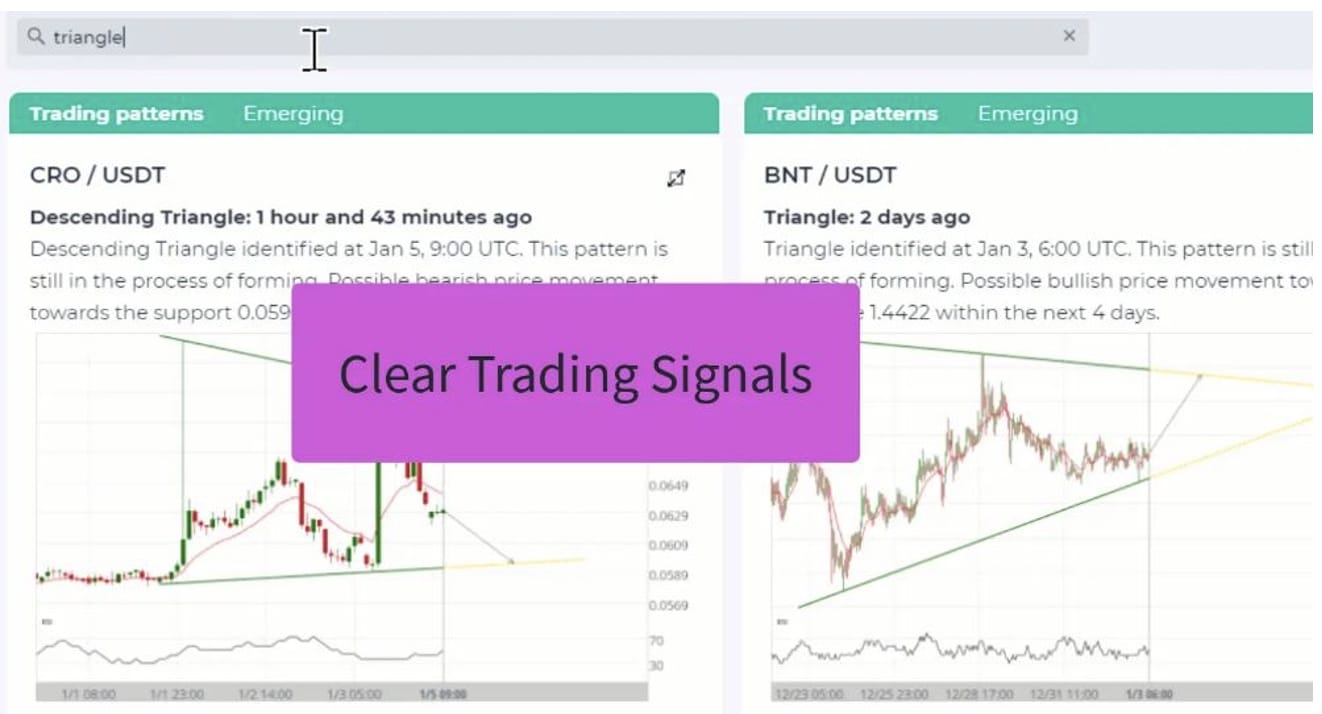

- Automated chart pattern recognition

- Curated charts – technical analysis on top 30 altcoins

- Signal summary with over 50 pre-set trading signals

- Coin screener using technical indicators (> 60 analytics)

- Alerts for price, price change, signals, news and events

- Twitter news feed and events calendar from hundreds of crypto projects

- Portfolio tracking

- Trading across multiple exchanges with unified order management

- Clean, ad-free user interface

Richard Fetyko, the founder and CEO of AltFINS had this to say about the launch of the platform:

“We were particularly pleased to see how global our impact could be. During the last three months, our user base quadrupled and included users from over 50 countries including the US, UK, Germany, Iran, India, Turkey and Nigeria.”

Why Choose altFINS?

The altFINS platform is coming at a very good time, as cryptocurrency markets in 2021 have reached a tipping point in its trading volumes and number of active investors.

The year has seen increased adoption for the emerging asset class, and the number of retail and institutional investors involved in the cryptocurrency markets continues expanding rapidly.

And the one thing they all need are reliable tools for analyzing their potential opportunities in the crypto markets.

While the increased trading volumes were a good sign of traders increasingly participating in the crypto markets, there have been other signs of increased adoption of cryptocurrencies in 2021.

One very public indication was the Coinbase IPO, which unveiled new data regarding the growing number of cryptocurrency traders. According to data from the U.S. based exchange, their user base grew from 32 million in 2019 to 43 million by the end of 2020.

Transactions increased as well, with the number of actively transacting users growing from 1 million in 2019 to 2.8 million in 2020.

It’s not just retail traders that have been expanding into cryptocurrencies either. Coinbase also caters to institutional users, and fourth quarter 2020 data shows that institutional trading volumes grew by 110% on a year-over-year basis, while retail trading volumes expanded by 80%.

In addition, the number of institutional accounts jumped from 1,000 at the end of 2017 to over 7,000 in 2021.

In the first decade of cryptocurrencies the trading ecosystem was dominated by the rise of exchanges. First the centralized exchanges, and more recently the decentralized exchanges have emerged, giving us hundreds of places to trade, but very few support services.

Now we are seeing the support ecosystem growing, including custodians, KYC/AML, smart order routing and management, arbitrage, derivatives, market makers, tax reporting and Risk Management , among others.

altFINS is a part of this growing support ecosystem, and it will join the others as a means to facilitate the additional adoption of cryptocurrency investing and trading by traditional investors and investing professionals.

That shift is already occurring, with financial advisors increasingly recommending their clients allocate a portion of their investing portfolio to cryptocurrencies.

altFINS is unique within the cryptocurrency ecosystem since its focus is on pre-trade analysis, and post-trade analysis rather than trade execution.

altFINS was a needed addition in cryptocurrencies since it provides trading ideas through a variety of means (screeners, signals, chart patterns, and news), and helps traders to understand their trading performance. It also helps to educate traders with an extensive online knowledge base, and active blog, and video trading tutorials.

According to Richard Fetyko:

“We’re excited to officially unveil altFINS to the broad crypto investment community. We have worked tirelessly to create the most advanced crypto analytical platform where users can find profitable trading ideas. We think altFINS’ platform is incredibly unique and helpful to active traders and investors.”

Conclusion

The cryptocurrency ecosystem is just beginning to move into a more evolved and mature phase. The period of growth in exchanges is leveling off, and now support services are seeing amazing growth.

altFINS is a unique part of this new and growing ecosystem, providing traders with the technical analysis tools that have been missing in the early years of cryptocurrency growth.

With a growing portfolio of trading tools, signals, and analysis altFINS is a platform that every cryptocurrency trader should consider adding to their tool chest.

In trading every edge can help, and altFINS provides traders with a unique edge that is likely to improve trading results dramatically.