Blockchain -based NFTs are becoming widely adopted across an extensive range of industry segments.

Non-fungible tokens are unique and useful because they allow us to prove, with the power of distributed ledger technology (DLT), that each NFT is truly unique or one-of-a-kind and there aren’t any other digital collectibles that are just like a particular NFT an investor is planning to own or already owns.

Many new and innovative projects have been launched in order to provide various use-cases or applications that leverage NFT technology. Minting, buying, selling, trading, and even investing in NFTs has become a global phenomenon.

It’s not just a fad or some crazy bubble without any fundamentals. NFTs will become ubiquitous because they are truly useful.

They can be described or thought of as a type licensing technology that can reliably prove that a particular digital item is truly one-of-a-kind and who its owner(s) are.

In much the same way that rare cards or unique works of art in the real world are considered classics and become extremely valuable, NFTs seamlessly introduce the very same concept in the digital world.

Large tech firms such as Visa, Mastercard, and even Microsoft (among others) are now focused on supporting NFTs in some manner and also the fast-evolving Metaverse.

In addition to giant companies, there are a number of high-potential initiatives that are also developing new use-cases for the booming NFT market.

Converting Bets into NFTs

Azuro is an innovative project that aims to provide a decentralized betting protocol that is governed by a distributed autonomous organization (DAO). The platform addresses a number of issues or problems that are found in the existing online betting sector.

For example, the current online betting has unclear or incorrect odds and bet settlement for bettors. There are also late or declined payouts, which negatively impacts the user experience.

In addition to these issues, there are account limitations for successful bettors, as well as certain Liquidity limitations for bookmakers and relatively high payment (10%) costs.

The Azuro team aims to address all these issues, and also plans to resolve other problems like low conversions because of internal KYC.

Currently, there are also high entry barriers for investors and entrepreneurs so this is another area that Azuro has identified and will try to address it as well.

Additional issues Azuro plans to solve are enhancing the UX for bettors and bookmakers, further expanding markets, and “stabilizing all sides with decentralization.”

The company is being led by a team with considerable experience in the betting sector. Azuro brings a crypto solution to online betting that provides a much better experience for bettors, and a solid investment for entrepreneurs.

Azuro’s working MVP has already been deployed on the Rinkeby Network. The project’s developers have also created the mechanism to convert each bet to an NFT.

They have also implemented the architecture of the future Oracle’s solution with a Chainlink node in operation.

By turning each bet into an NFT, there should be an opportunity for additional trading cases for users and the NFT could be sold via the Bet Marketplace, the developers explained.

As noted by its development team, NFTs of each bet may enter the Azuro marketplace for secondary sales and even P2P trading. Gamification should incentivize participation via leaderboards, badges/achievements, and various challenges.

Diamond NFTs Earned by SynFutures Traders

In addition to this platform, there are many more promising NFT use-cases that have emerged this year.

For example, SynFutures claims to be the first futures trading platform that leverages the Single Token Model: Users are able to trade and easily list crypto majors, altcoins, NFTs, indices, and real-world assets with a single token through their sAMM model.

The SynFutures team recently revealed that they have a new and improved website. The aim of their project is to create a platform that’s more open, decentralized, and leveraged. As of November 10, 2021, the SynFutures Beta version recorded a 24-hour trading volume of $29.7 million. Their total users also grew throughout October, reaching over 44,000 on November 10.

The team also notes that their trading competition started on October 15 and has since rewarded 7 traders with Diamond NFTs for their $1M+ total trading volume since the beginning of the competition. SynFutures’ products include NFTures and their Decentralized Oracles.

With NFTures, traders can easily short or long a popular NFT directly, the developers explained.

A New NFT Marketplace Aims to Be an OpenSea Competitor

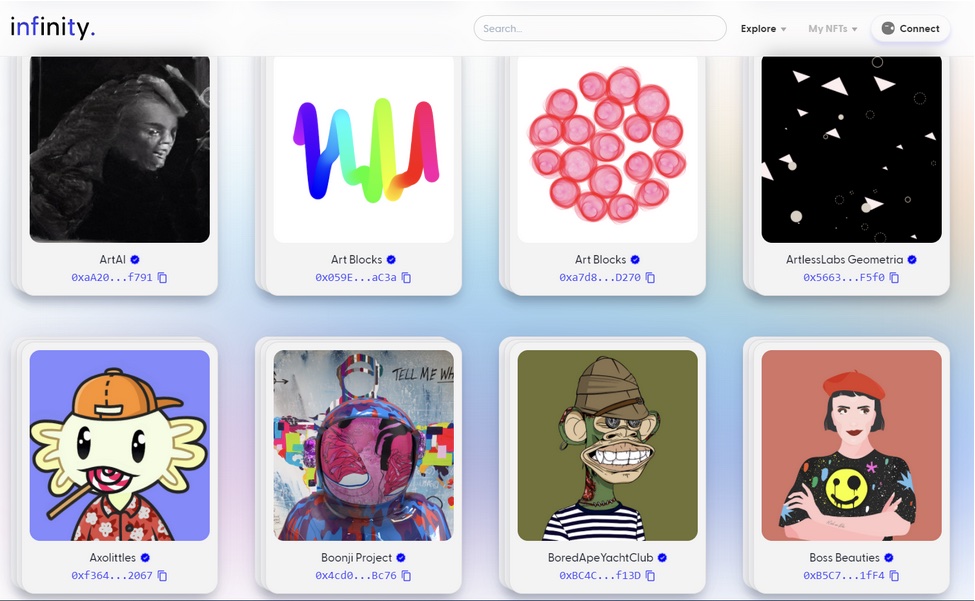

Another high-potential project called Infinity is offering a brand new NFT marketplace that will try to compete with OpenSea. Infinity claims that it has already given away 600M tokens.

Consumers who have performed transactions on one of the largest marketplaces for digital collectibles or NFTs should receive free tokens, however, only if they use the services of this competitor.

Infinity says it’s like the “FTX for NFTs.” The company also noted that Infinity is a community-led, decentralized NFT marketplace created specifically for the future of discovering, developing, and owning digital collectibles.

As a legitimate alternative to OpenSea, the platform intends to better represent, as well as cater to the special requirements of the NFT community. Dune Analytics data shows that traders have been using Infinity, however, the volumes have not been too high.

As noted by its creators, Infinity has been established by Garrett Allen and Adi Kancherla. Allen is a ConsenSys alum, the Ethereum-focused company that recently acquired $200 million in capital to expand its line of products. Kancherla has experience working at Google and Amazon and also runs an NFT minting firm known as Mavrik.

According to Kancherla and the team, the crypto and DeFi industry really need a Web 3.0 version of OpenSea. They claim that not having such a solution is like not having access to decentralized or non-custodial exchanges and only being able to trade crypto-assets via Coinbase.

It’s worth noting that a company worker used certain information to trade NFTs, which had a negative impact on OpenSea’s reputation. These types of incidents also indicate that the market needs more platforms so they can offer better services.

Notably, Infinity’s initial version has been created by forking OpenSea’s source-code, however, it has significantly lower transaction costs at around 1.5%, compared to 2.5% for OpenSea. All the transaction fees reportedly go to the community-managed DAO.

These projects are among many other high-potential initiatives that have been launched to support the dynamic NFT industry. In the years to come, we should see a much more robust and mature market for NFTs, which will be supported by many different blockchains and a wide range of crypto-assets.

As we head into 2022, we can expect many more creative use-cases for NFTs to emerge that should focus on gaming, gambling, sports, entertainment, and just about any other industry that would benefit from proving the authenticity of digital items and products.