ATFX Connect intro

Back in 2019, ATFX stepped into the Institutional arena with the launch of their Multi Access platform ATFX Connect.

The vision from management was to expand and promote the company’s global presence and continue to provide award-winning Liquidity and customer service to clients within the Institutional community.

With the focus on a more diverse Investor, the ATFX Connect platform has been designed to provide an efficient automated trading venue that delivers a tailored liquidity service to Hedge Funds, Asset Managers, Brokers, Private Banks and other financial institutions.

Adding a new Prime Broker

Fast forward to 2021 and ATFX’s reputation as a go to broker for Institutional clients continues to flourish. Already FCA regulated, management took the key decision to elevate the profile of ATFX by partnering with a leading tier 1 Prime Broker to establish their presence within the Institutional community.

With the introduction of an Agency model ATFX can now accommodate Institutional clients that wish to trade FX and Precious metals without having to post margin and have already successfully partnered with several new clients who are able to enjoy direct market access to multiple Tier 1 providers and trade on their aggregated pricing feeds.

Wei Qiang Zhang, Managing Director at ATFX, - “The key to the future of ATFX’s success will be driven by the strategic thinking and planning of the management team. With our innovative technology department and the application and dedication from our experienced UK staff, ATFX are well positioned to establish themselves as a long-term business partner to clients in the Institutional community. The launch of the new product further demonstrates our commitment, work ethic and the constant innovation to develop our technology, research and tailored solutions for our clients.”

ATFX Connect enhanced product and technology

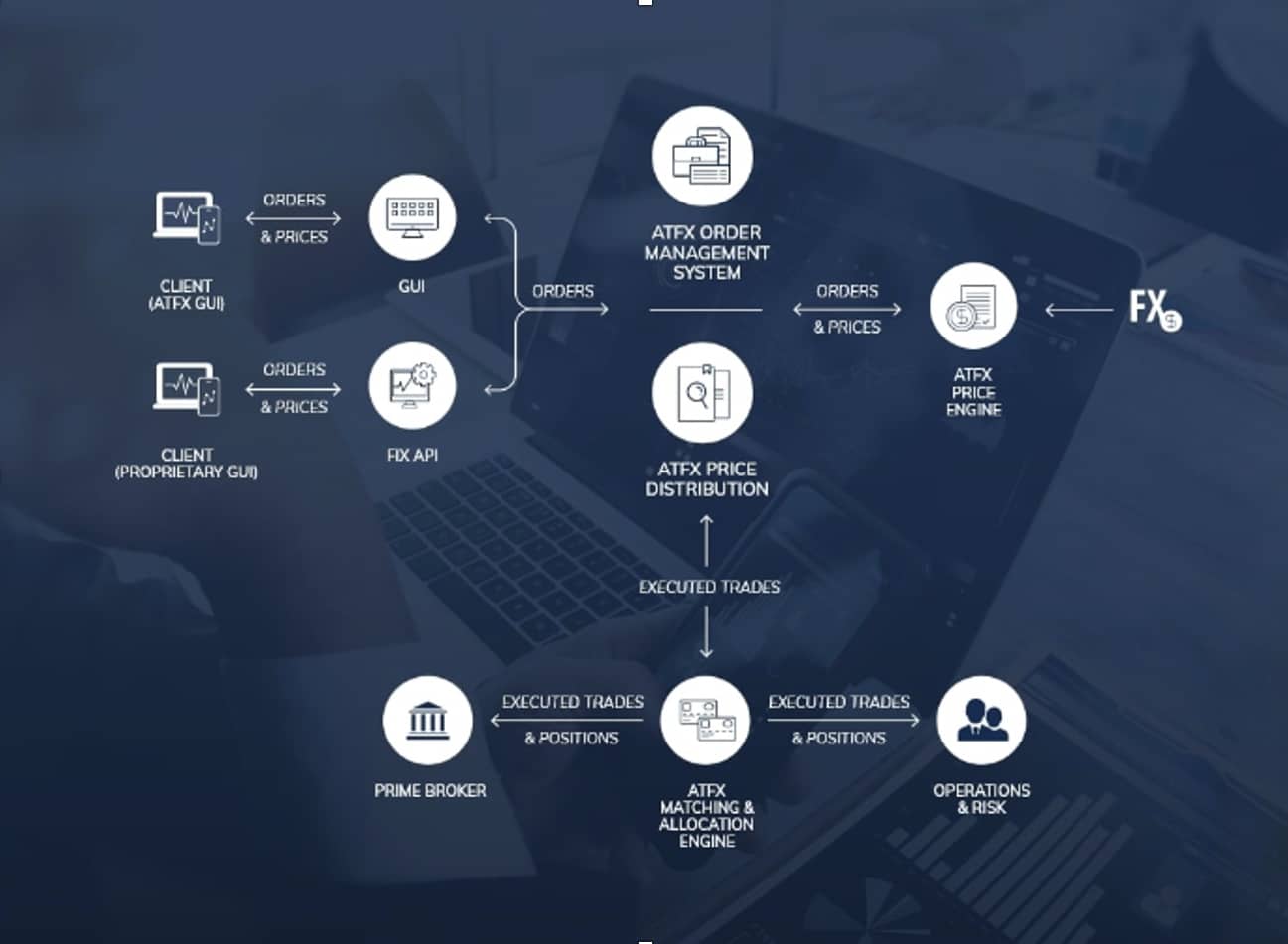

Over the last 18 months ATFX have invested heavily in their technology and product offering. We have continued to develop our Multi Access Platform “ATFX CONNECT” and have added a number of new order functions designed to give our clients more options and flexibility when trading. The platform offers low latency, quick order entry and competitive pricing in a stable environment with a choice of either Agency or Margin configuration. ATFX Connect provides clients with direct market access to a number of Tier 1 bank and Non Bank liquidity providers allowing them to leverage our aggregated pricing feeds via FIX API or Gui. The platform’s technology also allows ATFX Connect to provide our clients with tailored liquidity streams designed to meet their needs on a sweep or full amount basis.

ATFX Connect Platform Framework

For margin clients, ATFX Connect also continues to provide a bridge solution via OZ giving them access to institutional liquidity and CFDs. During the past year ATFX have worked closely with their business partners to expand the product offering and will look to build on this throughout 2021.

What can we expect to see from ATFX Connect going forward into 2021?

2020 proved to be a difficult year for many in the Financial markets with the impact of a global pandemic, a controversial US Election and Brexit negotiations going down to the wire.

With these uncertainties now resolved and a hope that the COVID-19 threat will recede in 2021 ATFX UK will look to build on the company's success turning their attention to the Institutional market with a focus on Europe and other global financial centres.

As a growing fintech company, ATFX will continue to invest in their staff and technology.

The development of the in-house aggregator and bridge remains a key focus for the year ahead. At a global level, the ATFX management team is committed to expanding the company and increasing market share across established jurisdictions in Europe, UK, Middle East, SE Asia and Latin America.

By working closely with business partners and understanding their needs, ATFX Connect provides clients with a reliable tailor-made service designed to build long term relationships.

Marc Taylor, Institutional Sales at ATFX Connect, -” The Agency model has further enhanced the reputation of ATFX within the Institutional market and we have already partnered with a number of new customers. With the addition of a Tier 1 Prime Broker clients can now leverage our direct market access allowing them to trade on more competitive prices without having to post margin.”

ATFX intro

ATFX is an award winning FX/CFD broker with an established global presence. Globally, the company has offices around the world including London, Dubai, Mexico, Hong Kong, Taiwan, Thailand, Malaysia, Vietnam, and the Philippines offering support to its clients in more than 15 different languages.

ATFX is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Financial Services Commission (FSC) in Mauritius, and the Financial Services Authority (FSA) in Saint Vincent and the Grenadines.

ATFX offers a variety of products, including over 200 financial assets from forex, cryptocurrency, precious metals, energy, indices, and shares via CFDs.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.