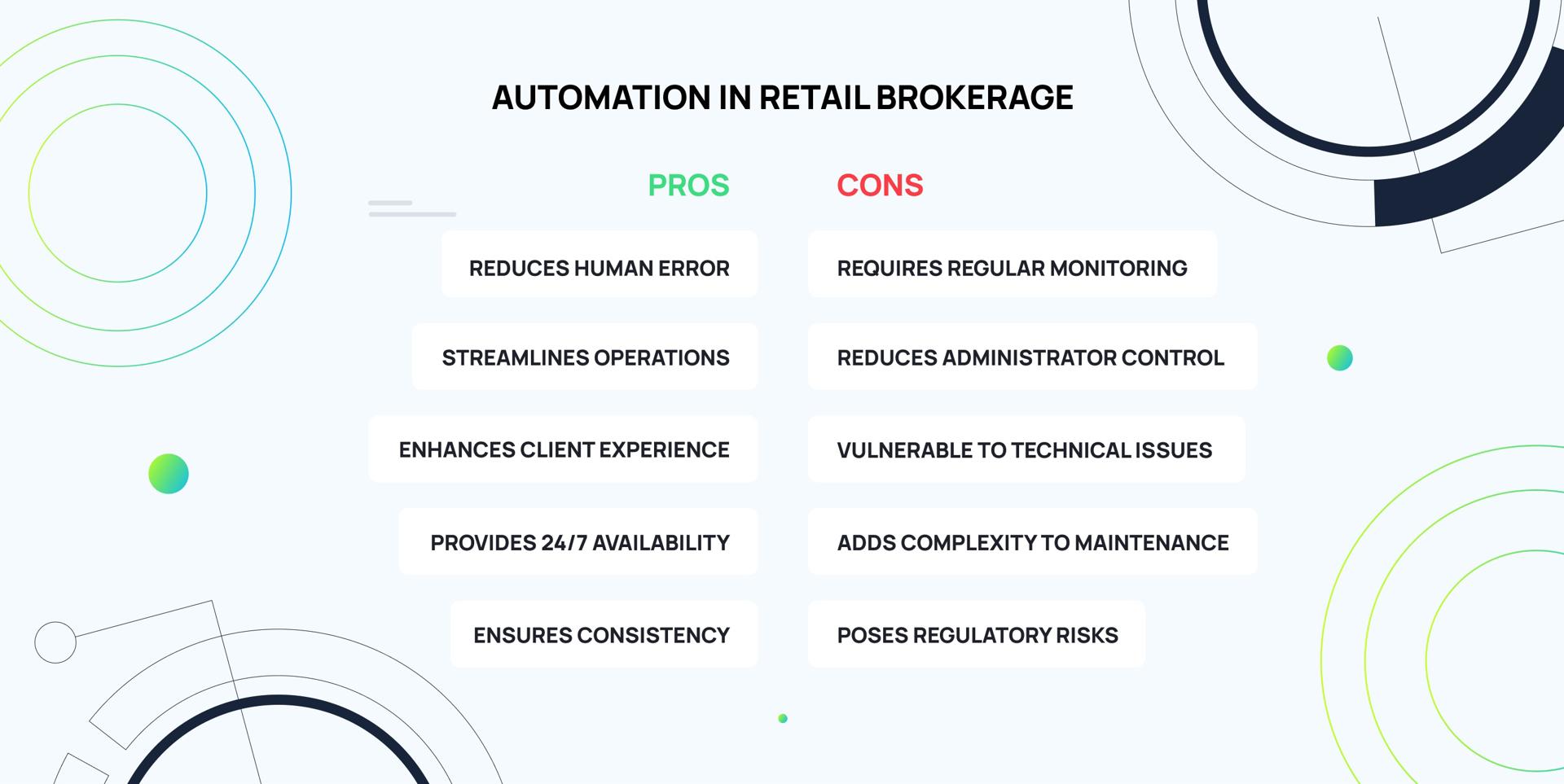

In the retail brokerage sector, the pursuit of high-level automation in technological solutions is becoming increasingly paramount. Automation alleviates the administrative burden on managers, streamlines platform operations, and mitigates the risk of human error. For large-scale solutions with thousands of active client accounts—such as social trading, PAMM, or prop trading platforms—automated features are not just desirable but essential. The exponential growth of trading operations makes manual monitoring and management impractical, driving brokers to seek "smart" turnkey technologies that promise enhanced manageability and operational efficiency.

However, automation does not come without its challenges. The delegation of routine tasks to automated systems can reduce a broker's control over operational processes, introducing a new set of risks.

While automation is a critical component of third-party solutions for retail brokerages, an over-reliance on machines can be detrimental, especially in the context of complex account management technologies. In some cases, initiating processes manually remains the optimal choice. To balance automation with human oversight, brokers can adopt a hybrid strategy. This approach might involve: automated processes with manual approval or partial automation, where certain processes are done manually.

“I understand a desire to automate every part of your business, but each automation process implies a certain level of access to sensitive information. Even if a broker hosts everything on proprietary infrastructure and trusts their tech provider, there is still a chance that something goes sideways. Brands should have a comprehensive emergency plan as well as a continuous review system to detect any discrepancies with clients’ data”, commented Anton Sokolov, Marketing Manager in Brokeree Solutions. “While true that automation reduces human errors, you should not rely on fully automated systems without an emergency brake or a rollback process in place.”

Kinds of automatization: expert discussion

There are different aspects in account management systems, where automation may be applied: risk management, client attraction, customer relationships, etc. We have asked industry experts what threats and perspectives they see in the automation of specified areas when discussing third-party solutions.

● Automation is very important when brokers want to scale. We like to help our clients find the balance between automation and identifying where it may be safer to have manual processes in place. This depends on the scale, budget, and capabilities of the personnel each broker has. We like to think of our dealers being 'bionic.' By this, we mean using automation more and more to handle monotonous tasks, thereby allowing human intellect to shine through where it is most needed. Certainly, this brings value as automation amplifies human effort rather than minimizing it. With the right tools, brokers can scale more effectively; for example, three dealers can accomplish the job that once required five.

Alexander Geralis, Director at Finthentic

● Automation of brokerage processes offers significant value, particularly in a risk management. It allows brokers to respond instantly to market volatility spikes or "black swans", manage the trade flow and account leverages, minimize risks in extreme market conditions.

Automation is also important in countering cheaters, who have long been using robots for their own purposes. For example, comparing quote flows from different brokers to find delays and trade on arbitrage. It is impossible to effectively counter toxic clients without auto detection of such an activity.

However, automation alone does not solve these tasks. It is essential to have a clear understanding of which actions to take and when, and then automate those actions according to prepared risk management rules. Balancing automation with human expertise is crucial in maintaining a high level of brokerage services.

Valerii Dolgov, CEO of Indigosoft (developer of Brokerpilot).

● The question of whether automation is applicable to all brokerage processes or if some should remain manual hinges on the maturity of the solution or technology. At DGM Tech Solutions, we take a cautious approach and advise the same to our brokerage clients. However, we also understand that technological progress is driven by those willing to venture into uncharted territory. Achieving a point where AI or scripted automation can be fully trusted for even the most sensitive tasks requires pushing boundaries and strategically embracing high risks to reap high rewards.

I advocate for segregating sensitive aspects of the business, especially those involving real-time trading and client funds, by adopting a hybrid approach: automate tasks where AI or any automation script is certain to be accurate and reliable and keep manual control over areas where the solution's consistency and precision cannot be guaranteed. Meanwhile, less sensitive functions like marketing or CRM procedures, where immediate mistakes are not critical or have minimal impact, can be fully automated and improved as flaws are identified."

Constantinos Michaelides, Director at DGM Tech Solutions

● Content engagement is critical to the success of any broker because content is the thing that gets traders to take action. However, content production is a very expensive task involving analysts, compliance, and translators. The problem is compounded when needing to produce content across different topics, trading styles and multiple jurisdictions and languages.

Automatic production and distribution of content can be achieved by companies such as Autochartist at a fraction of the cost of hiring all the staff necessary to perform this task in-house. And over-and-above the massive cost savings, there is the added advantage of consistent branding across all channels, and consistent messaging across all communication channels. Despite all the advantages of automated content production and distribution, it is still necessary to have a basic level of human involvement to add some spice to the content feed. Let's put it this way, automation can deliver the plate of pasta, but you still need a human to add some salt and pepper.

Ilan Azbel, CEO of Autochartist

How do developers ensure the automation in account management systems are safe for brokers?

The key principles for the sustainable use of automation in trading is proper planning and preparation for its introduction into the ecosystem. Brokers should analyze various performance processes in terms of its significance. There are some operations that can be fully automated, but at the same time, others, more important, like transferring accounts to the funded phase, require complete manual execution. There is also a third category of processes, hybrid in its nature. It necessitates partial manual control or a manual start-up phase, yet their overall automatic execution does not typically elevate the broker's risk levels.

If a broker decided to automate a part of account management process, disregarding the technical aspect of the matter, a robust and secure solution can be defined by three criteria:

- There are flexible rules to configure automation processes;

Brokers may choose which processes should be automated and may define specific conditions for automated actions.

- There are inbuilt risk management tools to ensure correct automation;

These tools can be integrated as system protocols for periodic self-audits or as manual monitoring tools for brokers’ staff members to use.

- There is an responsive tech support team by a technology provider;

“Based on an analysis of the client experience, the recent major update of Prop Pulse was focusing on providing more flexibility for the broker to manage the participants in the challenge. While the automated progression of traders through challenges offers convenience, manual screening may be preferable in certain scenarios. Prop Pulse now supports both methods, offering flexible risk management and new automation features” Yana Kitaeva, Product Owner at Brokeree Solutions.

New features in Brokeree’s Prop Pulse

In January 2024, Brokeree Solution, an international provider of turnkey technologies for brokers and prop firms, released the first account management systems for prop trading. Since the release Prop Pulse has got several integrations with CRM providers and payment systems. Now developers announced the first major update for the system. New features focused on the automatization functionality of the solution.

● Automation

A notable feature of the latest update is the broker's ability to automate more processes within the Prop Pulse. For instance, traders' accounts can automatically advance to the next challenge step if a broker removes manual administrator control. The trader must flawlessly meet trading objectives and initiate the transfer through the client's portal. If this stage is completed without violating any constraints set by the broker, the system will permit the trader to advance to the next stage.

Alternatively, if a broker prefers to retain manual control over account transfers, the solution provides a list of accounts that have satisfied the conditions for moving to the next phase. The transfer will only occur upon administrator approval.

● Interface

To easily monitor traders' progress in challenges, brokers have a dedicated tab with intuitive dashboards. The latest update has enhanced this feature with an improved interface. Interactive graphs, based on clients trading data, highlight successful and unsuccessful accounts with colors. In addition to the charts, administrators can access detailed tables showing traders' progress through each step of the challenge. This enables managers to quickly obtain the necessary information and respond effectively if any issues arise.

About Brokeree Solutions

For more than a decade Brokeree Solutions has consistently enhanced the technology that multi-asset brokers around the world rely on. Brokeree’s flagship products include cross-server Social Trading, PAMM, and multi-platform Liquidity Bridge, available for brokers operating on MT4, MT5, cTrader, and DXtrade CFD trading platforms. In addition, the company offers more than 50 solutions and tools that help brokers elevate their businesses in various areas, including client attraction, risk management, liquidity management, and more.