New tokens and projects are launching every day, though many of these have seemingly left core crypto investors out of the loop. AX1 has charted a different course, which has looked to disrupt the crypto industry with the recent kick off of its capital appreciation token.

AX1’s overall project has helped target ordinary investors and holders, benefiting from the large-scale mining of various leading Cryptocurrencies . The UK-based startup is benefiting from tailwinds garnered from its pre-sale initiative. This funding will be instrumental in the next phase of the project, including the purchase of data rigs and associated core operations of AX1.

What does a capital appreciation token mean?

ICOs and other coins are all designed to gain value over time – many of these ultimately come up short. The concept behind AX1’s project is to give token holders the chance to profit from the mining of various cryptocurrencies without the need for any technical knowledge. The project has been described in more detail by AX1’s CEO, who outlined the basis of the overall mining operation.

In essence, AX1 token holders are effectively buying a stake in a centralised mining pool, which is in turn managed from a state-of-the-art data centre. The rewards from the mining activity will be accumulated within the pool which, over time, will increase the value of the AX1 mining tokens.

In parallel, the value of the AX1 tokens will be further elevated through multiple growth opportunities as well. This includes POW vs POS, forward selling opportunities, secondary markets, mined coin portfolios, as well as growth of the crypto market cap.

Room for growth

While it’s easy for normal individuals to imagine rows of computers mining cryptocurrencies, the actual reality behind this endeavor is somewhat different. It is quite difficult, if not impossible, to mine cryptos profitably using standard equipment. In this respect, AX1 has access to two floors of a state-of-the-art data centre in Manchester, UK, dedicated solely to this function.

For operations using the right equipment there is a great deal of profit that can be made. Moving forward, there will be a greater emphasis across the industry on a centralised mining pool. AX1 is providing a unique opportunity for investors to become a part of this process via its AX1 capital appreciation tokens.

Token holders will have the chance to participate in a managed mining operation, while enjoying capital appreciation through contractually guaranteed economic rights within the portfolio of mined coins. In particular, fifty per cent of the value of the mined coins will be placed in a segregated account, helping to ensure and provide backing for the value of AX1 tokens.

The effort is a departure from many other coins currently on offer across the industry, which are seemingly devoid of such guarantees or backing. For AX1’s part, the availability of a segregated account is the key driver and strength of its offering.

Project timeline and regulatory backing

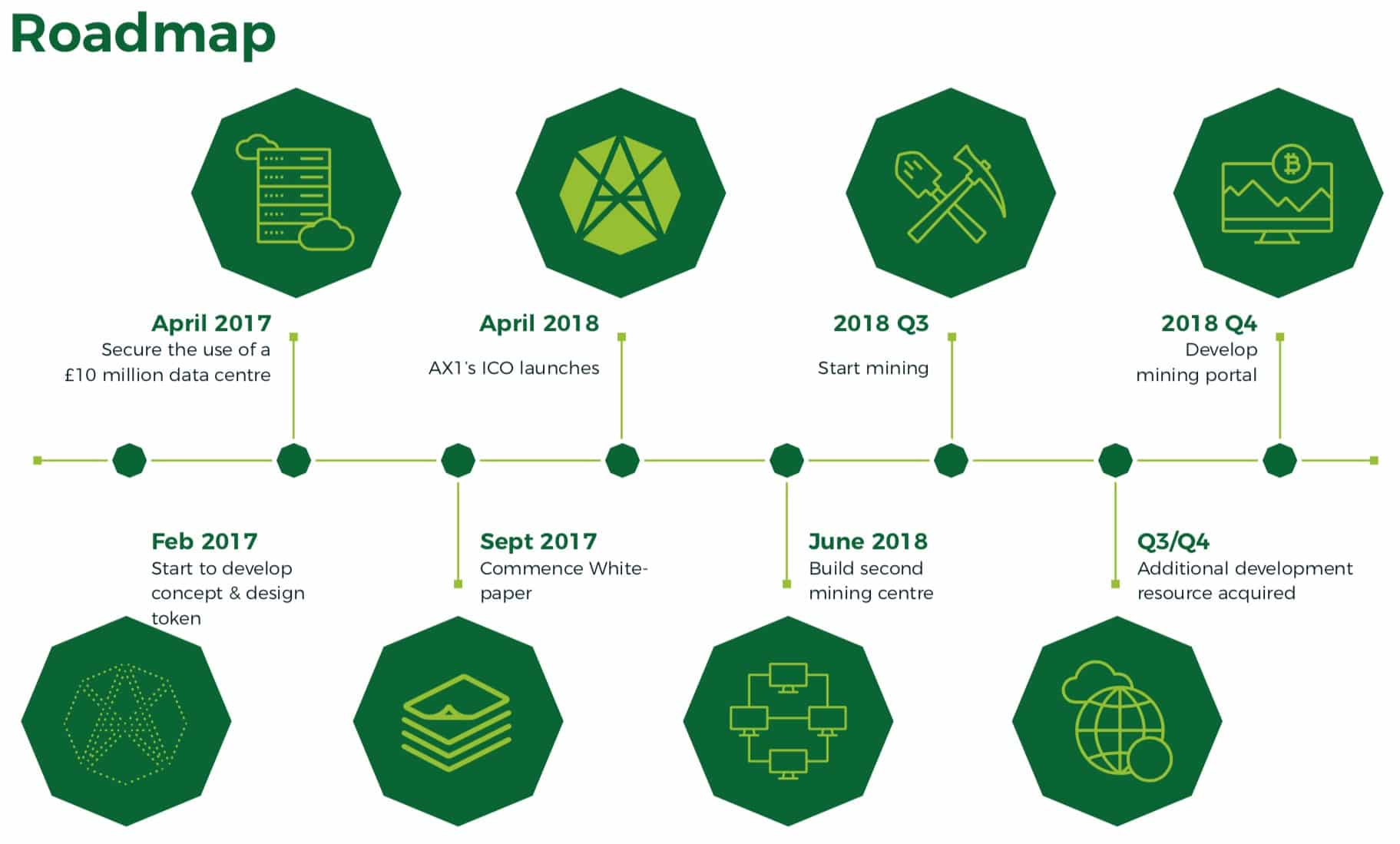

AX1 is in the midst of its project development, having already benefitted from a pre-sale option as well as the launch of its Initial Coin Offering (ICO) ). Founded by an experienced team of professionals spanning multiple sectors, AX1 is not just another startup.

AX1 has worked to give prospective ICO investors a degree of protection and comfort that may not be available in many other jurisdictions, resulting in its launch in Jersey. In doing so, AX1 has obtained a consent under the Control of Borrowing (Jersey) Order for its project via the Jersey Companies Registry, part of the Jersey Financial Services Commission (JFSC).

By choosing this route, AX1 is taking all the requisite regulatory precautions to help safeguard investors. Consequently, AX1 has worked diligently to appoint and maintain a Jersey resident director on its board as well as appointing a Jersey administrator licensed by the JFSC under the Financial Services Law of 1998.

Operating in Jersey also means that AX1 will be required to maintain and adopt several different systems requirements to help ensure the highest transparency. This includes risk controls, policies and procedures for the customer take-on, as well as profiling and transaction monitoring. The level of detail is certainly a step above other ICOs seen in other jurisdictions.