Of all the disruptive technologies in the financial sector over recent years, perhaps none have garnered as much attention as data, especially so-called “big data.” Data has long been a valuable asset for companies of all shapes and sizes, but with advancements in Analytics , large financial institutions are starting to understand the real-world implications for it.

“Big data” specifically refers to vast data sets too large for individuals to analyze on their own but that can be computationally analyzed to reveal trends, patterns, and other important insights on a variety of topics, but particularly human behavior.

Today, banks are leveraging the advancements in not only data collection, but in the different methods of analytics to learn and understand more about clients and customers than ever before; here are some examples.

Risk Management

Determining the credit worthiness of potential borrowers can be a tricky task, but quality data makes things significantly less difficult for banks. One of the ways big data has made its way into the banking industry is by helping provide more insight on potential borrowers for lenders.

Besides a traditional credit score, there are other factors that can be used to paint a picture about one’s credit worthiness. For example, demographic and geographic details, the makeup of an applicant’s social media friends list, and even the time of day an applicant fills out a form are all valuable details that can be leveraged to make more informed lending decisions.

With the help of big data, banks are able to enhance the accuracy of their risk assessments and improve lending practices.

Though big data is still just beginning to make its way onto the scene, there are already plenty of companies starting to utilize it. For example, the German company Kreditechhas been compiling and analyzing large data sets to assess the credit worthiness of individuals as early as 2013 — and even making loans with their assessments.

On a larger scale, UOB bank in Singapore launched a big data-driven risk management system of their own. By utilizing big data and leveraging advanced technologic analysis, the bank was able to severely cut down the calculation time of value at risk.

Rather than taking what the bank estimated to be 18 hours, their new system took only minutes, meaning that they’re looking forward to potentially being able to implement real-time risk analysis in the not so distant future.

Marketing and Selling Products

Another area that big data analytics helps banks is with their marketing and sales efforts. Much in the same way that big data is used to mitigate the risks banks take in their lending practices, that same data is valuable for determining when and whom to market products to.

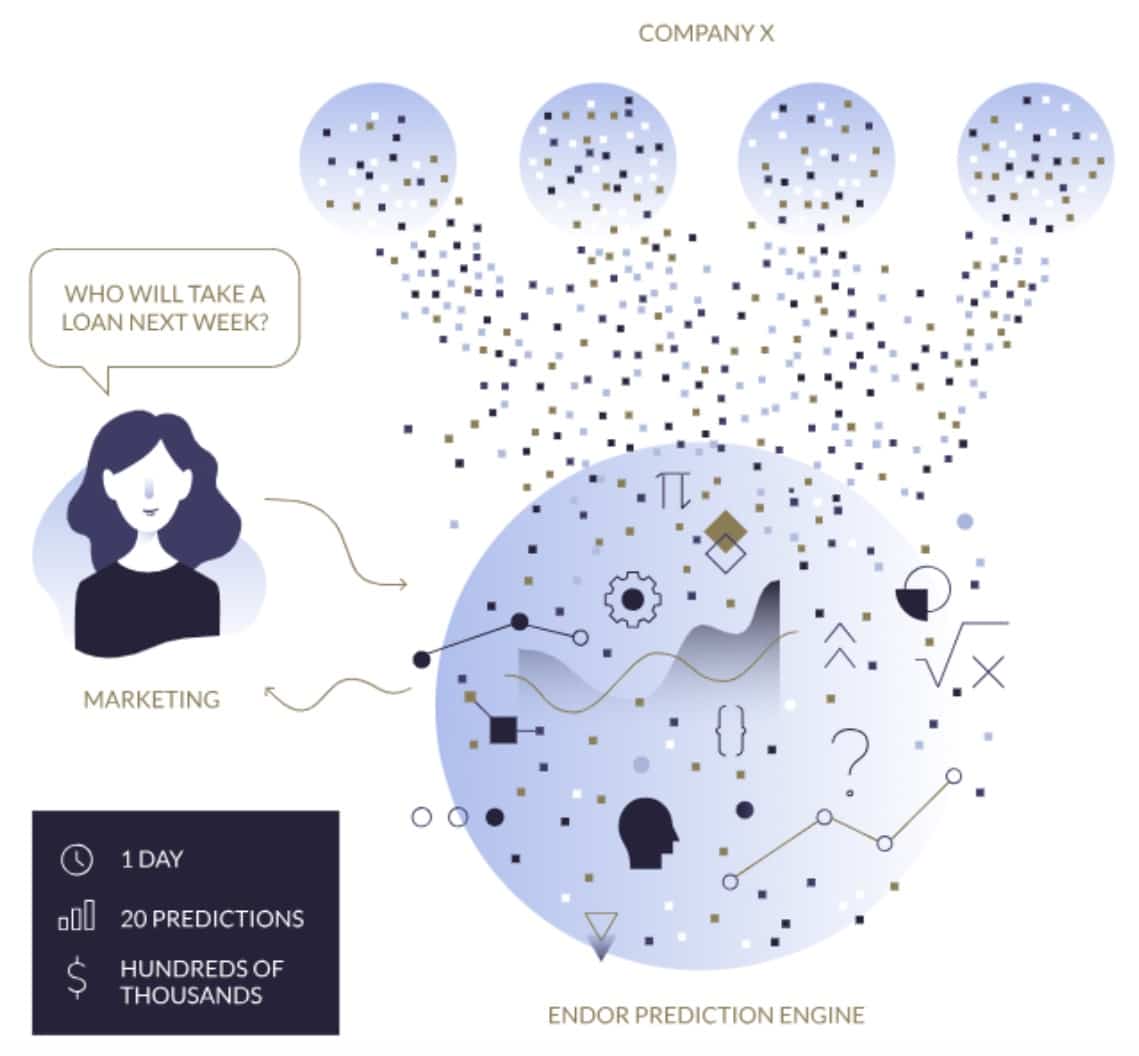

Examples of this practice in action can already be seen by companies analyzing big data to learn more about their customers and their buying habits. For example, Endor is a young fintech company specializing in predictive analytics that’s combining AI and big data to improve results for sales teams.

Getting high quality results from big data requires massive and complex computational analysis which is critical for handling an immense volume of different data sets. To improve the process, Endor uses AI to build a encrypted data prediction system based on human behavior called “social physics.” This platform enables automated predictions, inexpensively and efficiently, rather than building individual predictive models for each question.

The analysis can all be completed using entirely encrypted data and yields valuable insights for companies and businesses looking to boost their sales.

Rather than asking “who should we try to market loans to?” businesses can instead look at real-world scenarios like “who is the most likely to take a loan next week?”

A more personal example of other companies achieving the same outcome outside of the financial industry can be seen with Netflix as well. The company has incredible amounts of data from its 100+ million users and uses that data to build customer loyalty and drive retention.

The media streaming powerhouse utilizes big data it’s collected to create a recommendation system that influences an estimated 80%of the content we watch on the platform.

By using big data effectively, banks and other businesses aren’t just improving the quality of their sales and marketing efforts, but they’re also increasing the quality of their engagement with consumers.

Irrelevant marketing and sales attempts can be alienating for consumers and can come off as “spammy.” By increasing relevance in marketing efforts, brands are able to improve their relationship with potential buyers, not distance themselves.

Fraud Prevention

Last, but certainly not least, big data is important for fraud prevention, especially in the financial industry. Fraudulent transactions cost financial institutions billions in losses every year, and the faster a bank can catch fraud, the faster they’re able to put an end to it and protect both the security of their accounts as well as their bottom line.

Like with sales, a large component of fraud is human behavior. Individual spending and deposit patterns, along with seasonal fraudulent behavior are both valuable for catching, preventing, and even predicting potential fraud in the future.

A pioneer in enterprise technology solutions, IBM, is already putting big data to work in the real world by helping companies fight fraud via data. By analyzing large data sets, card issuers, banks, and other companies can quickly detect anomalies that stand out from typical consumer habits.

At the same time, IBM data analysts say there are some distinct signs from would-be bad actors. According to IBM’s Big Data & Analytics hub:

“Fraudsters tend to have telltale attack patterns, as do the events themselves. For example, fraudsters often tie scams to seasonal events; tax-related scams are common during tax season. Banks can be liable if the schemes include bank wire transfers on behalf of customers, according to American Banker, so it is in their best interest to track and anticipate these attacks using predictive analytics.”

The Takeaway

Data is one of the most valuable assets for any business; it can be used to derive important insights about customers, potential customers, and even improving overall business efficiency. But as businesses look to leverage vast amounts of data, it’s important to find the most efficient and accurate means of doing so.

By incorporating AI and enhanced analytics methods, the banking industry is uniquely positioned to benefit from big data. Now, it looks like they’re taking that advantage to reduce risk, improve their selling abilities, reduce fraud, and gain an edge on the competition.

Disclaimer: This is a contributed article and should not be taken as investment advice