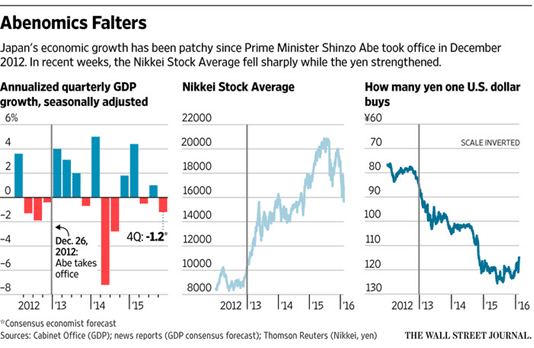

When Shinzo Abe Started his second turn as Japan’s prime minister in 2012, Japan was faced with decades of deflation, stagnant GDP growth, and an aging population.

Abe was elected on the platform of restoring Japan’s economy to the period of robust growth from 1980 to the mid 1990’s. The economy minded prime minister created the term “Abenomics,” which was a plan to combat deflation with the “three arrows.”

The arrows are bold monetary easing, flexible fiscal stimulus spending, and policies designed to spur growth and private investment.

Three years of Abenomics has proved largely ineffective. Abe planned to raise value added taxes (VAT) from 8.0% to 10.0%, a move which he recently delayed until 2019 due to lingering deflationary concerns.

Abe’s administration plans to stay the course despite clear signals that the current strategy is not effective. After weakening about -6.5% against the US dollar over the past three years, the Yen appears to be heading down an even bumpier road.

The Announcement

I think investors and corporate managers have already given up on the success of Abenomics

Prime Minister Abe has repeatedly said that only an economic shock on the scale of the Lehman Brothers collapse or a major earthquake would prompt a delay in the proposed tax rate hike. On Wednesday, as the G7 economic forum looms, Abe went back on his word and delayed the proposed 2017 VAT hike until October of 2019 on renewed fears of deflation.

At a press conference in Tokyo Abe said “I decided that I should delay the sales tax increase because it might damage domestic demand.” He then proceeded to blame his neighbors, saying “China and other countries are slow to deal with excess capacity and structural problems and it may take time for emerging economies to recover. In that context, there are concerns about long-term stagnation in global demand, so I thought I should delay it as long as possible.”

Putting off the sales tax increase may improve Abe’s prospects in the July 2016 upper house election, but the decision will also create doubt about the government’s ability to decrease a debt burden nearing two and a half times GDP. Some analysts argue the delay is political and means Japan may be less likely to engage in more quantitative easing. Other analysts said the length of the delay underscores concerns about weakness in the economy.

Either way, the events that are unfolding seem like bad news for Abenomics and Japan.

If At First You Don’t Succeed, Try, Try Again

Instead of pivoting, the Abe administration is doubling down on Abenomics as the answer for stimulating Japanese growth. “To shake off such risks, we need to rev up the engine of Abenomics,” according to the Prime Minister.

Despite implementing negative interest rates, the government’s core index shows that prices are still declining.

While maintaining a pledge to get Japan’s balance sheet back into the black by 2020, Abe plans to continue his fiscal plans, having announced a stimulus package of as much as 10 trillion Yen ($90 billion) last week.

Nikkei reported Saturday that Abe will seek a second supplementary budget worth 5-10 trillion Yen after July’s election. Abe is sticking to his plan despite few signs of positive economic activity in the country.

Still Falling Short

The gold standard for Abenomics is achieving an inflation rate of 2.0%. Despite implementing negative interest rates, the government’s core index shows that prices are still declining.

Japanese consumer figures have remained anemic, mainly on the presumption of prices to fall further in the coming months. Consumer spending fell for a second straight month in April, sliding -0.4% year-over-year, after dropping -5.3% in May according to data from the Ministry of Internal Affairs and Communications. Consumption accounts for roughly 60.0% of Japan’s GDP, which would be significant if it were the only bad numbers coming out of Japan. Exports shrank by -10.0% in April as consumer prices slipped -0.3%.

Additionally, corporate earnings have been losing momentum, painting an unseemly portrait of forward-looking Japanese economic activity.

What it Means

The outlook for Japan is grim from both outside the country and inside. Chief economist at Japan Macro Advisers, Takuji Okubo, stated he does not believe Abenomics will be successful in coming years.

“I think investors and corporate managers have already given up on the success of Abenomics,” he said. “The problem is the lack of an alternative.” Surprisingly, despite a weak outlook, the dollar dropped as much as -1.5% to a two-week low against the Yen on Wednesday.

In theory Abe’s announcement points to a monetary stimulus plan that will weaken the Yen. “The fact that we’ve had this opposite move tells you there’s something going on in the market,” said Doug Borthwick, head of currency trading at Chapdelaine & Co. This may in fact suggest a larger player, possibly at the People’s Bank of China, is rebalancing its reserves.

This indicates that the next couple of sessions may see the dollar course correct and strengthen against the Yen heading into the G7 summit next week. However, the main upcoming risk factor remains employment data from the US which could be a major driving force behind the US dollar near-term.

Idan Levitov is the VP trading of anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An expert in the binary options hedging field – Idan provides insights, guidance and coordination in business planning, Risk Management and technology strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.