Chasing after momentum moves higher or lower can be a challenging trading strategy, especially during volatile market conditions after big news events. However, helpful tools like Bollinger bands can be particularly useful as they help to understand how Volatility is changing and furthermore when momentum is overextended to one direction or another.

Bollinger bands are extremely beneficial when it comes to trading pullbacks in momentum.

Bollinger bands are extremely beneficial when it comes to trading pullbacks in momentum or even trend reversals by helping spot a trading asset that is either overbought or oversold.

Setting Bollinger Bands

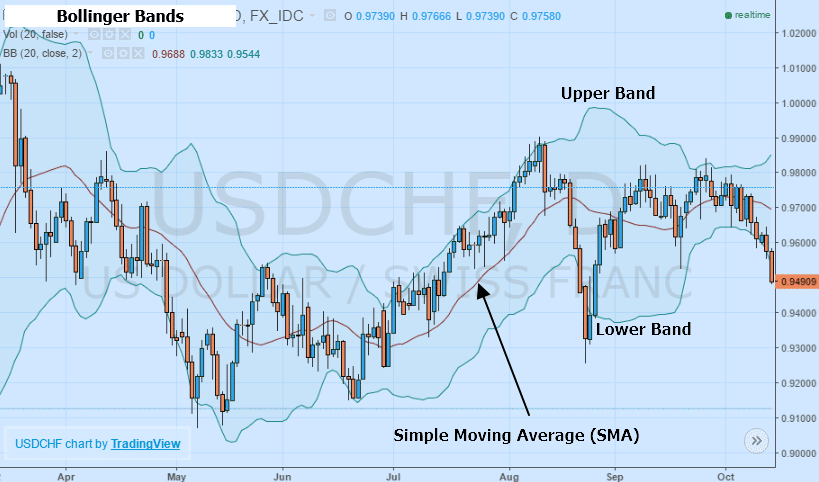

Named after inventor and famed technical trader, Jon Bollinger, this technical indicator calculates the distance of price from a simple moving average that closely tracks the price action in the trading asset.

Using a simple moving average which can be set to any number of periods, Bollinger bands are set both above and below the moving average to a distance that depends on the volatility based on earlier changes in prices.

Mathematically, the distance of each Bollinger band from the simple moving average is typically set at two standard deviations of an average of earlier price volatility.

The math there tells us that low volatility conditions will be indicated by narrower Bollinger bands while highly volatile conditions will result in wider bands. This means that when prices of an asset to either touch or cross a Bollinger band, it must be an extreme directional move that based on the higher or lower band could indicate conditions in which said asset is overbought or oversold.

The simple moving average is typically designed to measure 21 periods when used classically alongside bands set at two standard deviations. However, depending on your trading time horizon, these inputs might want to be adjusted to fit a certain trading style and strategy.

Bollinger bands can be instrumental in correctly setting the potential risk and reward parameters for a trade.

Bollinger bands are more than just helpful for identifying conditions in which an asset is overbought or oversold, they can be instrumental in correctly setting the potential risk and reward parameters for a trade.

Some traders wait for volatility to narrow sharply, indicated by Bollinger bands that are closely hugging the simple moving average to help spot out breakouts in momentum. These breakouts usually result after an instrument has been trending in a narrow range for an extended period of time.

Popular Bollinger Band Patterns To Trade

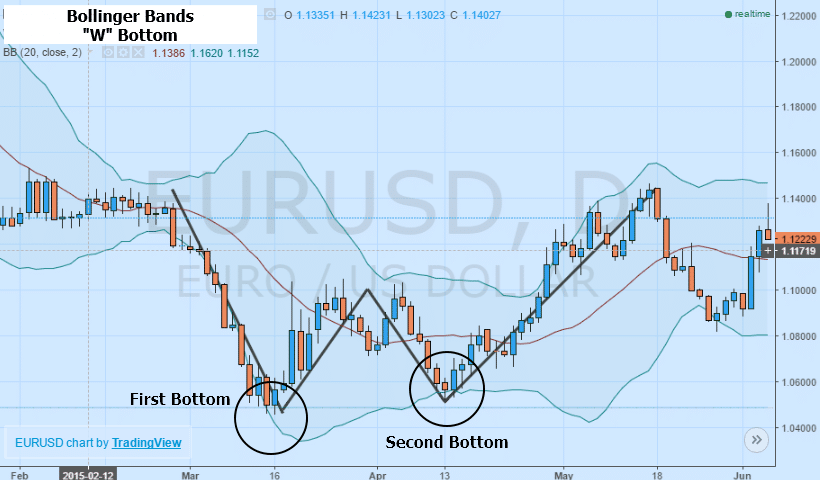

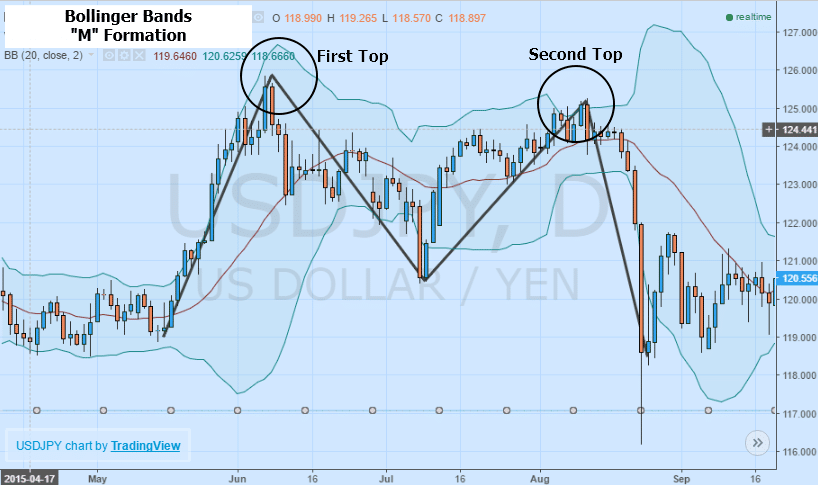

One of the most popular patterns that traders like to use with Bollinger bands is the identification of “M” tops and “W” bottoms in the price action. Typically viewed as a strong reversal signal similar to double bottoms and tops, the Bollinger bands can be useful in identifying potential entry points for trades and even breakout opportunities.

A bullish bottom pattern is formed by two successive bottoms in price action which typically resembles a “W”, although at first it will resemble an upside down “N”. The key lies in establishing bullish positions near the lower Bollinger band with a target set on the upper Bollinger bands. However, if prices continue to fall, it may be a strong sign to exit and search for a new opportunity.

A bearish top pattern is formed by two successive tops in price which opposite to the “W” form a “M”. Before forming the entire “M” an “N” will emerge in the price action and this is the point at which traders should want to get involved.

When at the second peak and the “N” has been formed by the asset price action, it is time to establish a bearish position in the trading asset. Should prices continue to rise after the fact and move higher above the second top it is a signal to exit and wait for new opportunities to arise.

To wrap it up, let's take a look at this summary:

Some Notes

First, While Bollinger bands are exceptionally helpful in determining when an asset has overshot to the upside or downside, it is important to use the bands to also set risk conditions, not just entry points.

Additionally, risk and reward should be set based on the width of the bands, or volatility, with narrower risk-reward during low volatility and wider risk-reward during higher volatility.

Idan Levitov

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An expert in the binary options hedging field – Idan provides insights, guidance and coordination in business planning, Risk Management and technology strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.