Moving averages are an extremely popular way for traders to build a greater understanding of an asset’s trend as prices change over time.

Depending on the length of time be measured and type of moving average, whether simple or exponential, we can learn valuable information about the strength and direction of a trend. One way to incorporate moving averages with a swing trading strategy is by employing commonly recurring patterns including the “golden cross” and “death cross.”

Too complex? start with our beginners guide

Getting down to business? Check out the DAX

Having a clear time frame in mind before getting involved in swing trading is essential

Formed by the crossover of moving averages, the emergence of these formations is often an early indication of a reversal in an assets price direction and the beginning of heightened momentum. Correct identification of these patterns can be a great tool for improving returns and identifying setups with a large degree of potential.

The Golden Cross

In keeping with its name, the golden cross pattern is generally viewed as a strong indication of unfolding bullish price action in an instrument.

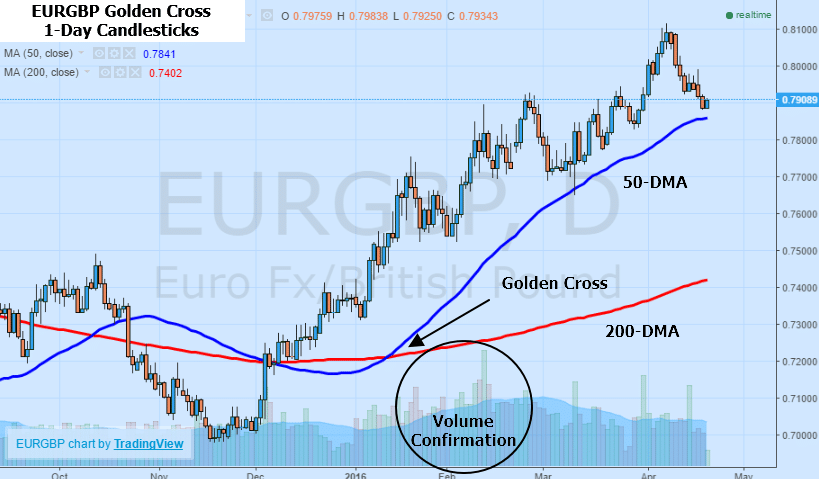

Formed by a 50-day simple moving average crossing over a corresponding 200-day moving average, this is traditionally a precursor to sustained upside in an asset’s price over a period of time that can range from a few months to months depending on the trading time horizon.

Besides the fact that moving averages trending below price action act as support levels for an asset, the shorter-term moving average crossing the longer-term moving average to the upside is viewed as a robust signal of accelerating upward momentum.

The Death Cross

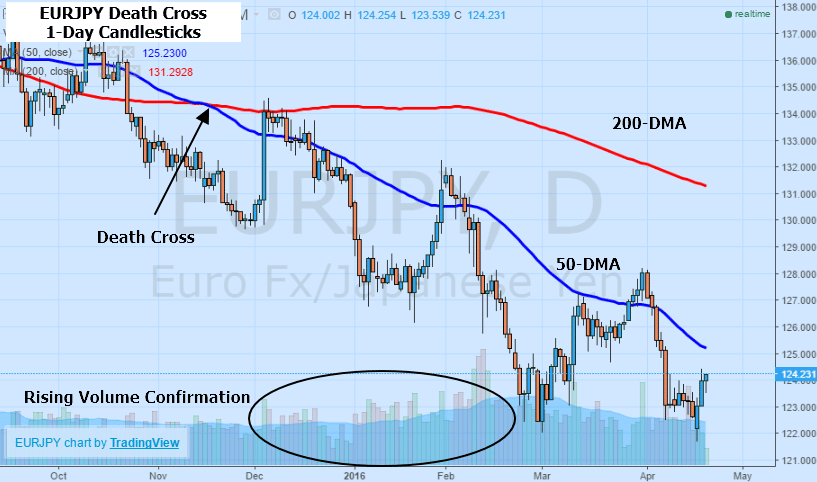

Contrary to the golden cross, the death cross pattern has a predominantly bearish bias when it is identified.

Similar to the golden cross, the pattern depends on the emergence of a moving average crossover. When the 50-day simple moving average crosses the 200-day moving average to the downside, this is an early sign of a reversal in price momentum and direction for an asset.

The bearish bias is due to the fact that the downward indications come from both moving averages trending above the price action, acting as resistance against any sustained upside movement in the trading asset and adding to downward pressure.

Confirmation

One of the key elements to determine if the golden cross or death cross patterns are in play is getting confirmation, namely from volume.

When either of the formations are accompanied by rising or higher than average trading volumes it is typically a strong signal that the pattern is genuine and not a fake move. Aside from volume, it is also important to ensure that both moving averages are trending in the same direction.

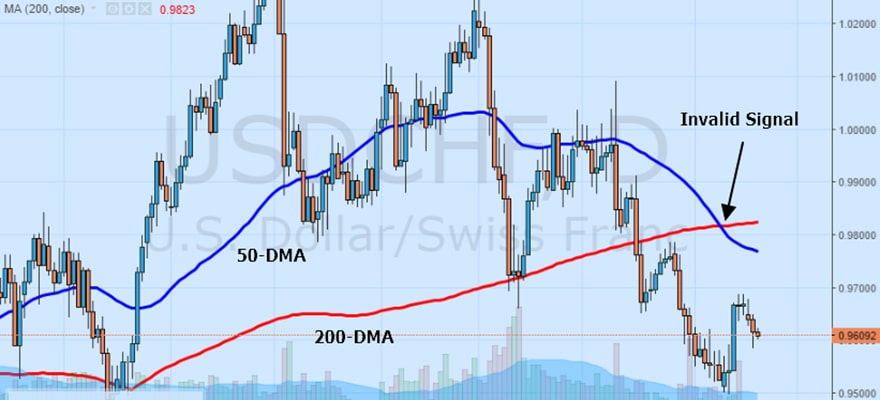

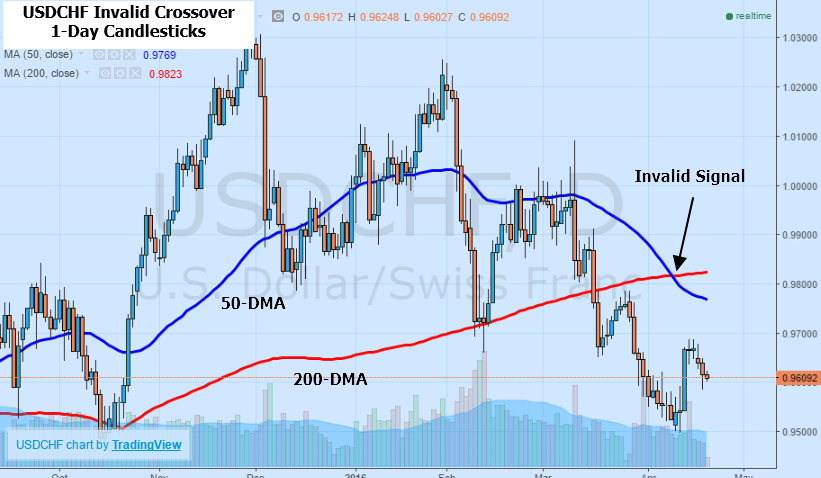

In the case of the golden cross, both moving averages should be trending higher while the opposite is true for the death cross. If the longer-term 200-day moving averages is trending in a direction opposite to the shorter 50-day moving average, the reversal signal is not suggestive of a golden cross or death cross.

Setting Up Trades

Once the golden cross has emerged and been confirmed by upward trending moving averages and higher volume, it is a good indication to begin establishing multi-day Call positions in anticipation of sustained upward momentum.

In the case of the death cross, confirmation from the volume and moving averages trending lower would be a good indication to begin establishing multi-day Put positions.

In both cases however, it is important not to chase after momentum. If an instrument has already moved substantially, it is worthwhile to wait for a pullback before getting involved in a momentum-based trade. Additionally, should an asset’s price fall below the moving averages in the case of a golden cross or above the moving averages in the death cross, this is a strong sign the pattern is breaking down.

The Limitations

Like any form of technical analysis there are certain drawbacks to applying the golden cross and death cross to a trading strategy.

Besides the obvious limitation of past performance not necessarily indicating future performance, these setups can occasionally produce false signals, especially if the moving averages are not in agreement about the prevailing trend of the underlying asset.

Results can vary as well. Historically these types of patterns have translated to substantial direction momentum for longer periods of time ranging from days to even years. Having a clear time frame in mind before getting involved in a swing trading opportunity is essential to successfully navigating potential setups.

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An expert in the binary options hedging field - Idan provides insights, guidance and coordination in business planning, Risk Management and technology strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.