Technical analysis at its core depends on the identification of trends by using past performance to grasp how prices are changing over time. Apart from understanding trends is the need to recognize important horizontal levels that can represent pockets of buying and selling.

Resistance acts as a price ceiling, preventing upward momentum and potentially representing a level where investors are more comfortable selling

These levels are correspondingly referred to as support and resistance. Typically these horizontal lines signify areas an asset’s price has difficulty falling below (support) or rising above (resistance).

The importance of these levels cannot go understated as they serve as the cornerstone for any successful trading strategy. These natural levels are crucial to evaluating potential entry points for trades and also the exit strategy depending on how conditions evolve after the trade is placed.

How to identify Support and Resistance

When watching the way that asset prices behave over time, it will become clearer by reviewing the charts that assets occasionally have difficulty crossing certain thresholds to the upside and downside.

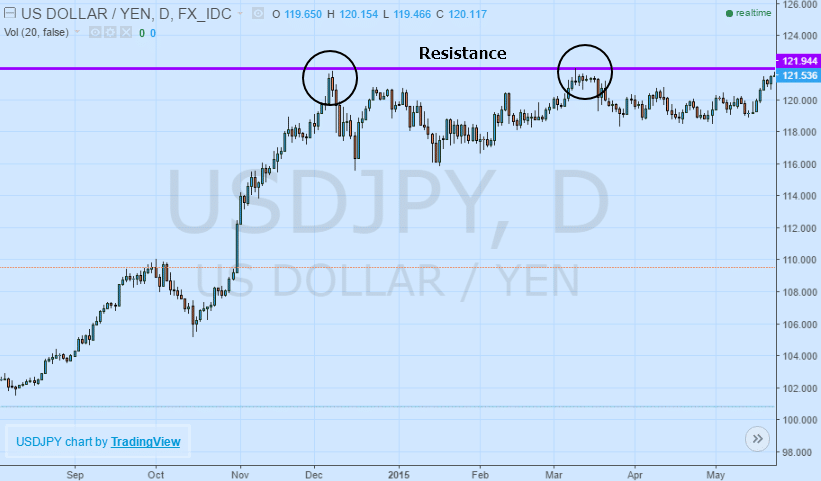

Sometimes an asset will test the level several times without breaking while in other circumstances the level will be broken. In the event that a particular level is difficult to overcome after being tested multiple times, this would traditionally be referred to as “resistance.” In effect, it acts as a price ceiling, preventing upward momentum and potentially representing a level where investors are more comfortable selling the asset.

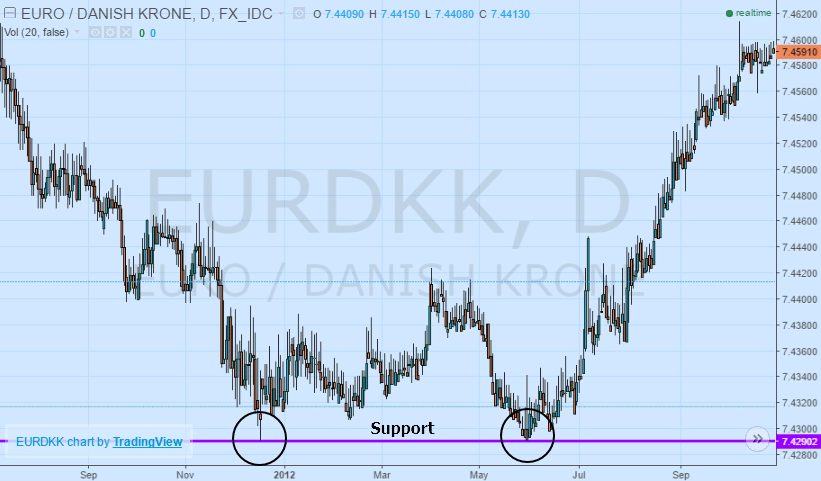

On the other hand, in the event that a level is particularly stubborn on the downside, preventing an asset’s price from traveling below a certain horizontal level, this would be referred to as “support.” Equivalent to a price floor, it represents a level the asset’s price has difficulty falling through. This could be due to demand for an asset at that value, potentially because investors feel the asset is undervalued and it presents a good buying opportunity.

Drawing Support and Resistance Lines

It is imperative to determine the correct time horizon depending on the trading strategy

When looking to define support and resistance levels, it is imperative to first determine the correct time horizon depending on the trading strategy. A short-term intraday trader might prefer to analysis 1-minute, 15-minute, or 1-hour candlestick charts. By comparison, a medium-term trader might prefer 4-hour and 1-day candlesticks.

Once the trade time horizon has been chosen, the next step is to look for highs and lows over the time period. While the simplest way is to pick out the peaks and valleys on a chart, it is generally best to go one step further by identifying levels that have been tested two or three times. Support lines would be drawn underneath the price action while resistance would be signified by a horizontal line connecting points above the price action.

Setting Up a Simple Support and Resistance Strategy

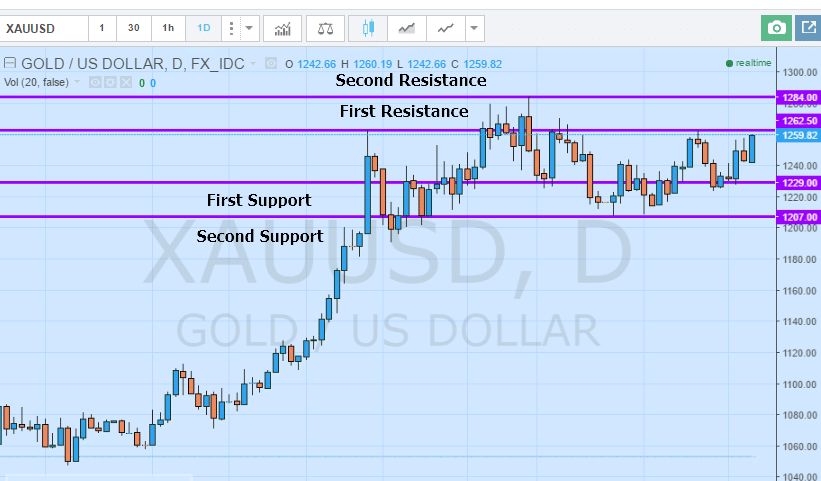

Once support and resistance levels are identified, a strategy can be formed around these pockets of buying and selling. Most notably, support and resistance is helpful in determining where to enter or potentially exit when establishing positions.

From an entry standpoint, once a level has been identified as difficult for an asset to fall below, it might potentially be a great opportunity to establish a Call position at those levels.

However, if the asset falls below the level, it means buying support might have disappeared and its time to look for new opportunities. On the opposite side, once a resistance level has been identified as difficult for an asset to rise above, it might be viewed as a promising level to establish Put positions with the expectation that asset prices will fall back towards support.

It is important that once a support or resistance line is broken, it is not deleted. When crossed to the upside, resistance turns into support. When crossed to the downside, support turns into resistance. Even when broken, these horizontal levels can have significance in the future and are likely to remain important levels down the road. However, waiting for multiple tests of these levels will help add to confirmation that the levels are valuable to monitor for establishing positions down the road.

Important Notes

Although supported in large part by numerous mathematical attributes, technical analysis is not an exact science. The beauty of support and resistance is that they do not necessarily predict the direction of prices, but rather assist us in defining important levels to incorporate in a trading strategy and timing the entrance for Call or Put positions.

From identifying a potential entry point for a Call position near a pocket of support or helping to determine a target for exiting a trade based on resistance, these crucial levels are exceptionally useful for determining the risk and reward of a potential trade.

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An expert in the binary options hedging field - Idan provides insights, guidance and coordination in business planning, Risk Management and technology strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.