The fluid conditions across the Euro Area continue to spotlight the uneven recovery of economic fundamentals despite the extreme amount of accommodation already in place.

Germany in particular has benefited from the conditions as a result of increased competitiveness. However, despite the bullishness on the economy relative to other European peers, certain metrics remain in troubling territory.

This is widely reflected by the overwhelmingly negative performance of the DAX 30 components over the last 52-weeks and since the outset of 2016.

Even with a growing emphasis on fighting deflation and improving trade, the German economy remains unbalanced, contributing to an uncertain outlook for the DAX 30. Although the index is still in the process of rebounding from February lows, without a positive backdrop to support further gains, the longer-term downtrend may resume.

Macro support

On the whole, Germany has been a strong performer from a purely fundamental perspective over the years.

Severe underperformance of the German banking sector has been dragging on the index, specifically Deutsche Bank's -33.36% tumble

Falling unemployment and fiscal discipline have been hallmarks of the policies driving sustained growth in the region in spite of troubling external conditions. Helping the positive momentum has been a supportive monetary policy environment, especially with the nation on the cusp of deflation with headline annualized inflation last printing at 0.10%.

The uptick in factory orders recorded during the month of March has also renewed expectations that the economy is still performing well, climbing 1.90% during the month after rebounding from a -0.80% contraction in the previous month. Fanning this optimism is the record current account surplus which reportedly climbed to EUR 30.40 billion in March. Trade within the Euro Area and European Union continues to climb on an annualized basis, but the external picture remains fraught with risks.

While a number of data points that have lent themselves towards optimism in German stocks, namely better trade, there still is substantial cause for concern.

For one, slumping industrial production in March continues to underscore the challenges after declining -1.30%, the fastest pace of contraction since 2014. Focusing more on local Equities , DAX 30 component performance has not been positive on the whole. Aside from the benchmark falling -14.77% over the last year, only four constituents out of the 30 that comprise the index are showing positive returns year-to-date.

Dragging on the index has been the severe underperformance of the German banking sector, specifically Deutsche Bank which has tumbled -33.36% since the outset of the year, followed by Commerzbank which is trading -26.35% lower over the same period. This is an especially concerning development considering the supportive policy backdrop.

Technically speaking

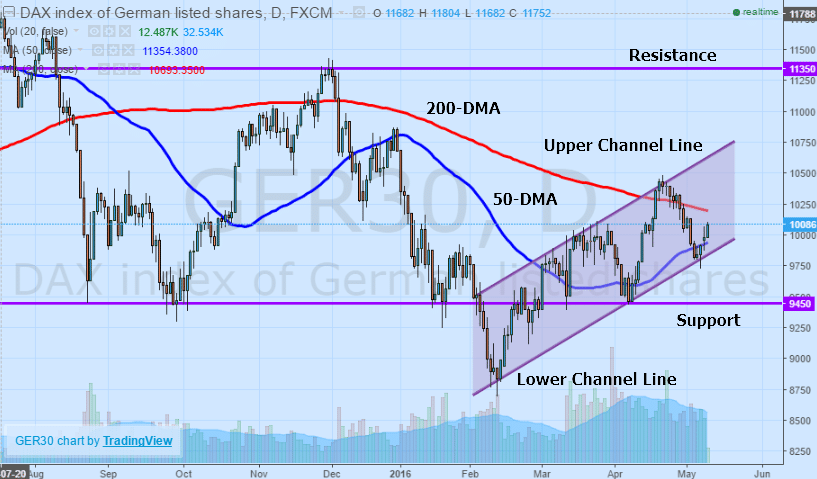

From purely a charting perspective the German DAX remains in an uptrend in the medium-term despite remaining in a longer-term downtrend that has been intact for the better part of the last year.

Even after climbing above the 10000 psychological level, a reversal will not be confirmed until the index is able to overcome resistance sitting firmly at 11350. There are several factors contributing to the near-term bullish bias that might enable the DAX 30 to reach these levels, namely the 50-day moving average which is acting as support at the moment.

Although the 200-day moving average remains in a downward trend, acting as resistance against any upside momentum, should this level be broken to the upside by the 50-day moving average and DAX 30 price action, it could signal another leg higher in the index.

Outside of the moving averages, the other bullish indication is the upward trending equidistant channel that has been forming since February.

The channel has three points of contact touching both the upper and lower channel lines, suggesting that ideal positions initiated at the lower channel line should target the upper channel line for an exit. However, if the DAX 30 should fall below the lower channel line, a candlestick close below this level would indicate a channel-based breakout to the downside to be confirmed by higher than average trading volumes and heightened directional momentum.

Upcoming factors that could shift DAX momentum

Looking forward for the DAX 30, there are several factors that could help or harm the ongoing climb in the index. The main items to watch over the coming sessions is the inflation and GDP data coming out on Friday.

Should the annualized CPI print in deflationary territory at -0.10% as is currently forecast by consensus, it could be a sign of worsening domestic conditions.

Additionally, preliminary GDP is anticipated to decelerate to 1.50% expansion on an annualized basis, adding to potential factors stacking up against the DAX.

However, despite tapering in growth, the preliminary first quarter GDP projection is for 0.60% growth, a nice improvement from the 0.30% reported in the fourth quarter.

Furthermore, the tailwinds from monetary policy which remain widely supportive of the index climbing further from current levels. Thanks to the balance sheet expansion undertaken by the European Central Bank, excess cash is likely to find its way towards risk assets especially with interest rates in negative territory.

The expansionary efforts will also continue to pressure the Euro lower, helping to drive relative value plays in the DAX that see component valuations rise over time. Added monetary stimulus will also contribute to momentum higher in the index, but that depends largely on how conditions evolve across the Euro Area over the medium-term. While technical indicators may be back bullishness going forward, attention must be paid to the evolving fundamental conditions which are also reflected by the DAX 30.

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An expert in the binary options hedging field - Idan provides insights, guidance and coordination in business planning, Risk Management and technology strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.