When it comes to understanding how or why financial markets and assets are behaving in a particular way, there are numerous methods of analysis. However, in certain cases, there is a strong relationship between how one asset moves relative to another, commonly referred to as correlation.

While those who are familiar with statistics will be quick to point out that that correlation does not equal causation, meaning that a moving in one asset’s price is not necessarily the cause of a movement in another asset’s price, price action is interconnected to a degree.

Utilizing correlations can be helpful in identifying how two assets might move relative to one another, providing pair trade opportunities and secondary trades.

Direct and Inverse Relationships

A correlation coefficient is used to measure the strength of a relationship between price movements in one asset and how closely they are related to price momentum in another asset. Correlations break down into two classifications, direct correlations and inverse correlations.

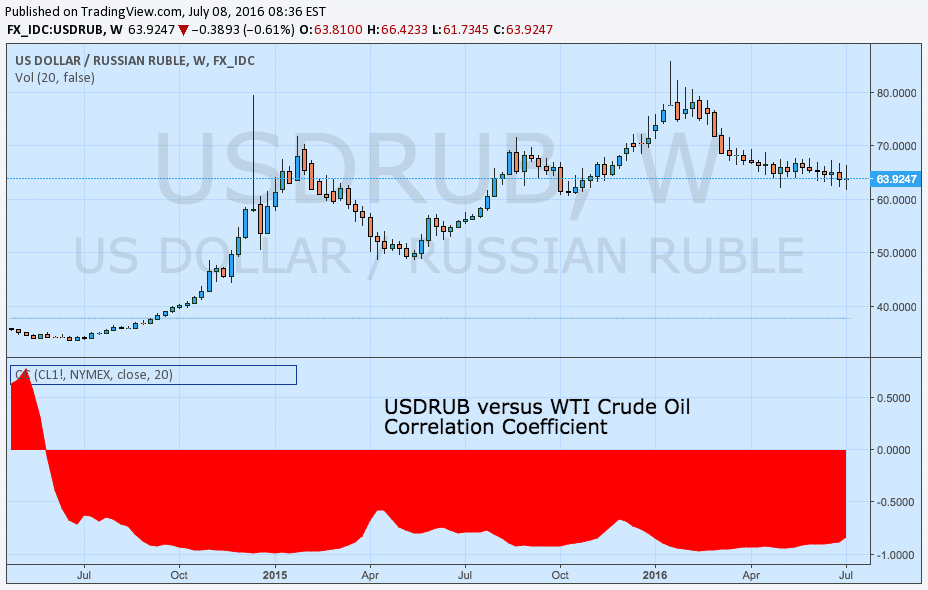

In the case of a direct correlation, a movement higher in one assets price would conceivably happen in tandem with the asset that is being compared with the correlation also echoing the momentum upward. Inverse correlations differ in that as one asset’s price moves higher, the asset being compared that exhibits an inverse correlation would normally be in decline, making the opposite move.

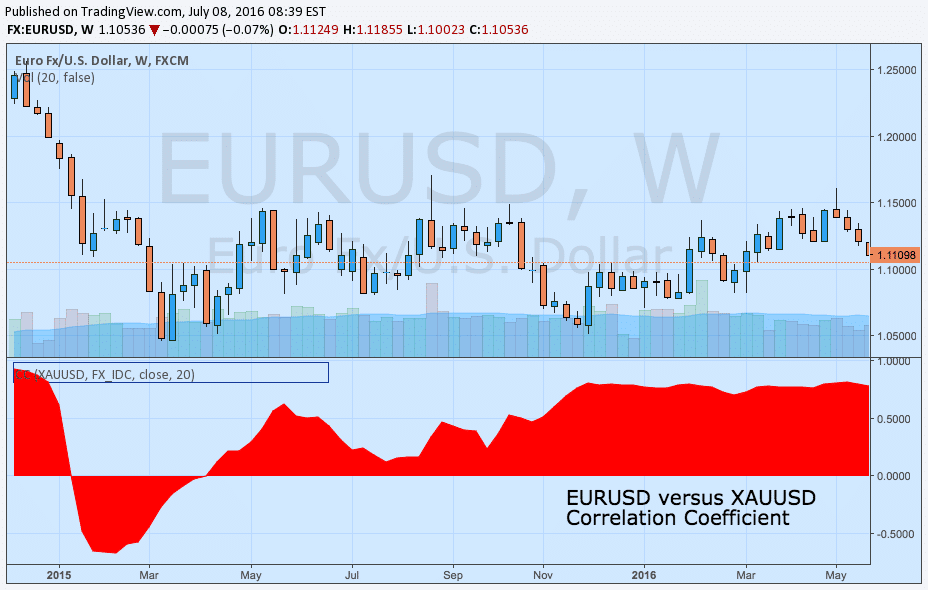

How closely the two assets track the movements of the other depends on the actual correlation coefficient itself. Correlation coefficients are typically plotted as a histogram, or bars, on a chart with a zero line and range of -1.0000 to 1.0000. The closer the bars are to the extremes of the range, the stronger the relationship that is being measured.

When it comes to a direct correlation, the closer the correlation is to 1.0000, the stronger the relationship between the two assets being compared. If positive but closer to 0.0000, it indicates that the direct relationship is very weak, potentially not relevant depending on the level.

Conversely, an inverse relationship is in the range of -1.0000 to 0.0000. A coefficient closer to -1.0000 indicates a very strong inverse relationship whereas the closer the approach to 0.0000 on the negative scale, it suggests a weak relationship between the two assets being compared.

Pair Trading and Secondary Trades

When it comes to using correlations as a trading strategy, there are several different common applications that investors can find useful. The two major strategies include pair trading and secondary trading.

Pair trading refers to a pair of assets that are traded at the same time based on the relation. It some cases this could mean establishing a bullish position in one asset and a bearish position in another asset in the case of an inverse correlation. In the case of a direct correlation, it could mean taking two equivalently sized bullish or bearish positions.

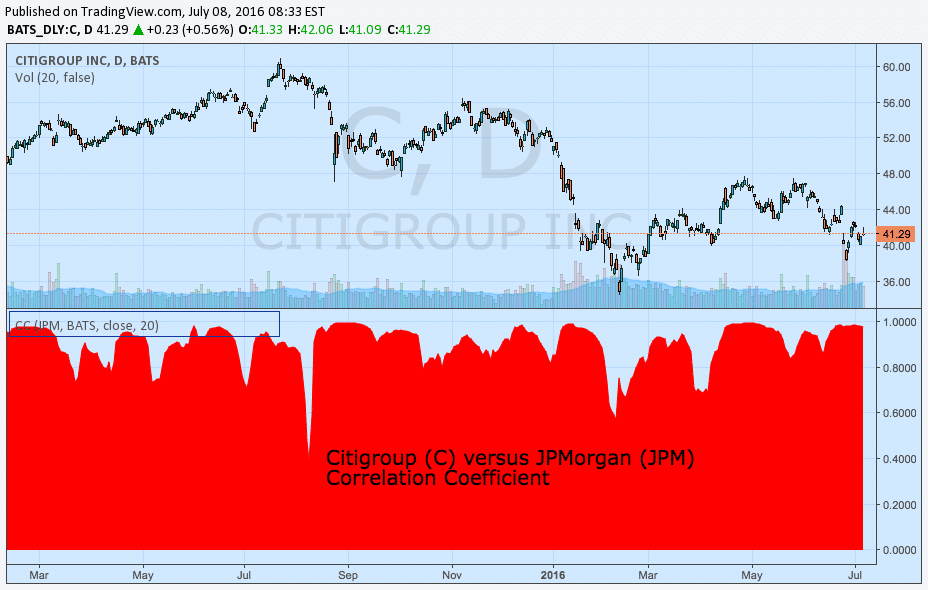

Secondary trading relies on finding two assets that are similar, typically stocks that share the same industry or sector. The main idea behind a secondary trade or play, is trading one asset off the movement of the primary asset.

An example would be trading JPMorgan after the earnings report from Citigroup if a strong direct relationship exists. Should Citigroup experience positive price momentum following the earnings release, the strategy would be to establish a bullish position in JPMorgan while watching the momentum in Citigroup for signs that momentum is ending to exit the position properly.

Final Notes

It is important to note that correlations change and adjust over time. Sometimes historical relationships can diverge and break down, only to eventually revert to their original form.

However, bearing in mind the notion that the relationship can ebb and flow, it is important to always monitor the strength of the relationship between two assets to gain the best insights for the trading strategy that accompanies correlation coefficients.

Idan Levitov is the VP trading of anyoption.com. He is a seasoned professional with years of experience in trading and expertise in the binary options hedging field.